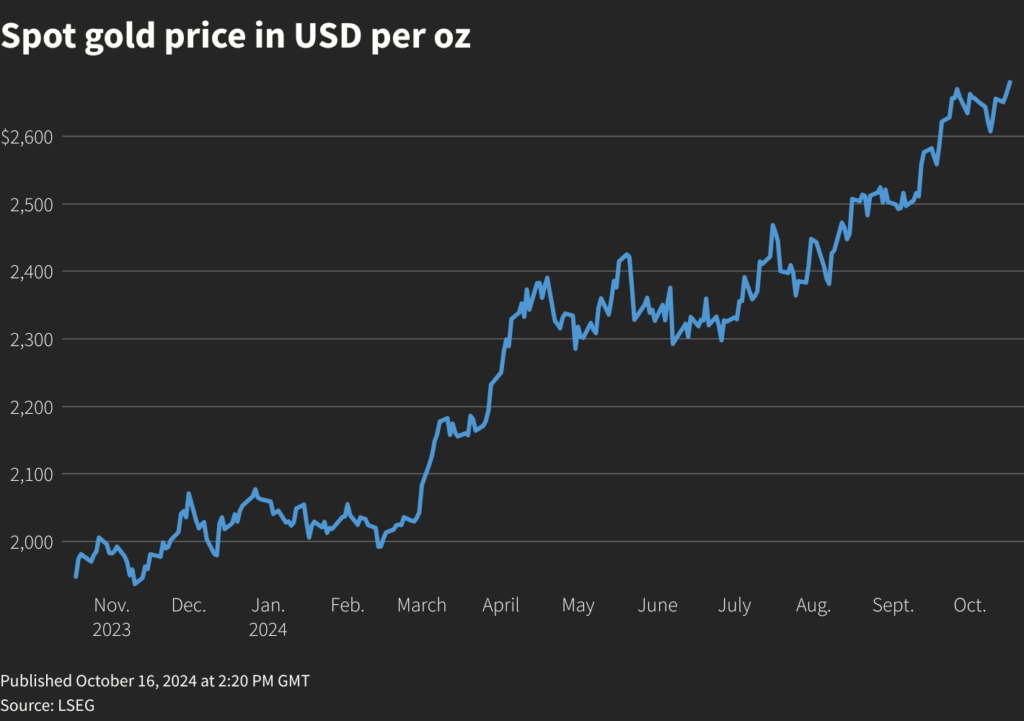

Gold’s strong momentum continued as US Treasury yields dropped to the lowest in a week, with the market anticipating another rate cut by the Federal Reserve. Traders currently see about a 96% chance of a 25-basis-point US rate cut in November, according to the CME FedWatch tool.

Over the past year, elevated interest rates have done little to slow gold’s ascent to consecutive record highs, and many investors are now betting that a pivot to looser monetary policy — accompanied by a slowdown in US economic growth — will fuel further gains.

In addition to rate cuts, the other main bullish drivers for gold include risk of fiscal instability, safe haven appeal and geopolitical tensions, all of which have contributed to its status as one of the best-performing commodities in 2024.

Now, bullion is gaining even more support as investors across financial markets reposition their portfolios in response to uncertainty over the outcome of the US presidential race.

“We anticipate uncertainty and volatility to rise until the next US administration is settled,” UBS analysts led by Mark Haefele said in an emailed note to Bloomberg, adding that “gold and oil can be effective portfolio hedges” in such environments.

Earlier, delegates to the London Bullion Market Association’s annual gathering predicted gold prices could even go higher and rise to $2,941 over the next 12 months, about 10% above current levels.

(With files from Bloomberg and Reuters)