US gold futures saw a larger gain of 1.2%, trading at $2,379.70 per ounce in New York.

“The fundamentals underpinning the current rally include growing geopolitical risk, steady central bank buying and resilient demand for jewelry and bars and coins,” the World Gold Council said in a recent note.

“With the prospect of lower interest rates ahead, the suggestion is that (gold exchange-traded-funds) ETFs have missed the rally and are now under-allocated,” the Council added.

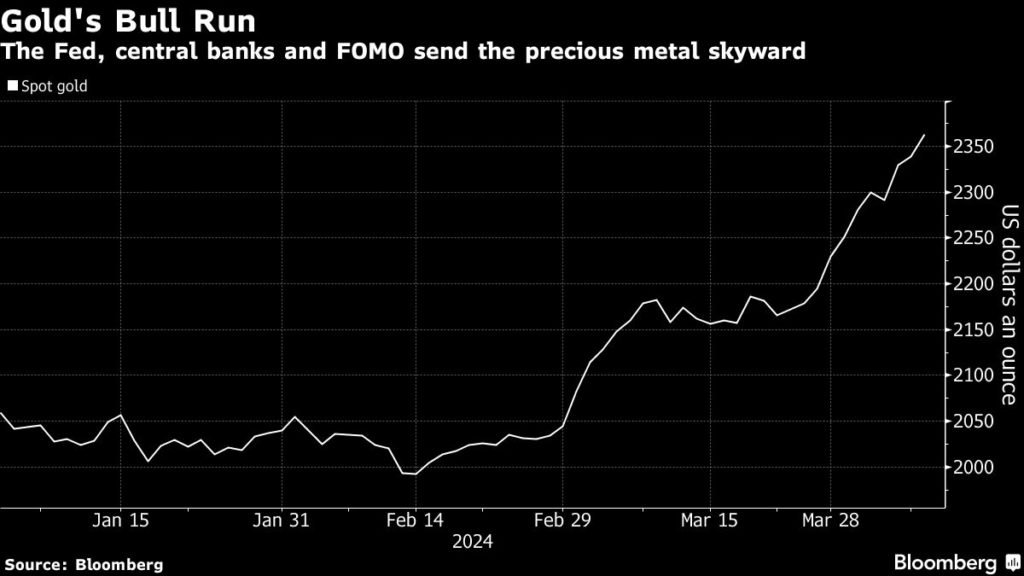

Bullion has gone up by more than 18% since mid-February, a move that has left some onlookers puzzled because of the lack of any obvious trigger, especially with the market now undecided on the Federal Reserve’s next move.

CME Group data showed that the market is pricing in a 53% chance of a rate cut in June, a Reuters poll showed.

The US central bank’s policy meeting minutes and Consumer Price Index (CPI) data are both due on Wednesday, which would shed more light on the exact timing of the Fed’s rate cuts.

“Technical buying momentum will continue in the gold market unless the CPI data comes out much hotter-than-expected. A cooler inflation report could take prices to $2,400,” said Phillip Streible, chief market strategist at Blue Line Futures in Chicago.

The metal is enjoying “strong underlying momentum with the buy-on-dip still the prevailing strategy among traders,” said Ole Hansen, commodity strategist at Saxo Bank A/S. With so many bullish tailwinds, gold “is in desperate need for consolidation, but FOMO is on clear display currently” he added.

This week, UBS Group said it sees gold rising to $2,500 an ounce by year-end, with a revival in exchange traded funds set to support another rally when the Fed eventually cuts rates.

(With files from Bloomberg and Reuters)