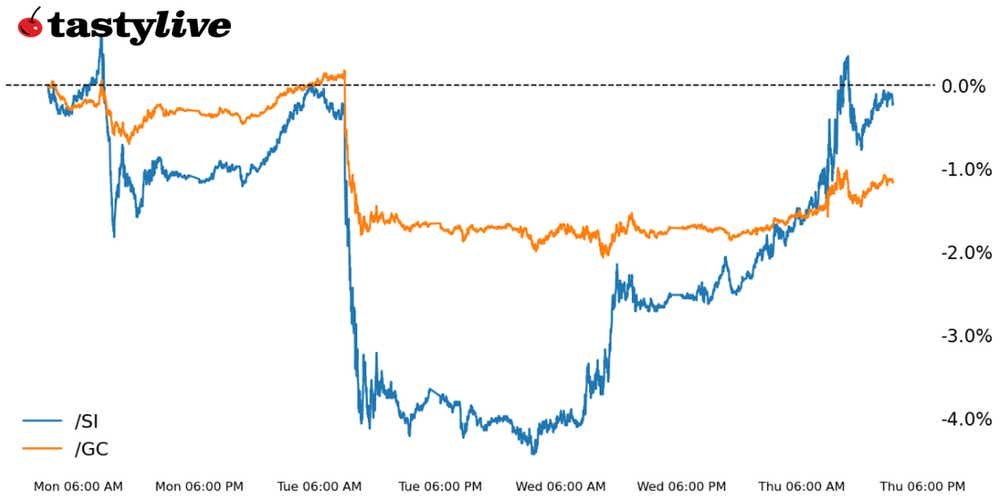

Gold prices are down 2.50% for the month so far

- Gold prices (/GCJ4) have moved out of a symmetrical triangle, finding support at multi-week range lows.

- Silver prices (/SIH4) have seen sharp swings this week, but now appear to be breaking out of the downtrend from the December 2023 and January 2024 highs.

- Precious metals may have weathered the storm in the bond market, which appears to be subsiding.

The January U.S. inflation report may be proving itself as a temporary setback for interest rate-sensitive assets, especially precious metals.

Fed rate-cut odds may have been decimated in recent days, but there’s a compelling case to be made that the worst is over–so long as markets remain confident that we’ll see at least one 25-basis-point (bps) rate cut in the first half of the year.

If this remains the case, then gold (/GCJ4) and silver prices (/SIH4) are proving resilient in a difficult environment. Recent developments keep the bigger picture range in /GCJ4 in focus, while /SIH4 may be offering a strong signal that rates-sensitive assets will have a tailwind in the short term.

/GC Gold price technical analysis: daily chart (August 2023 to February 2024)

Earlier this week, gold prices (/GCJ4) broke down out of a symmetrical triangle that’s been forming since November 2023.

Nevertheless, a shift outside of the triangle may not invalidate the view that a sideways consolidation may prevail. That view may have been vindicated in recent days, with /GCJ4 finding support in the area around $2,000, which is where traders carved out the Nov. 15 and Dec. 13 lows.

At these levels, with limited volatility (IV index: 11.1%; IV rank: 11.5), a long at-the-money (ATM) call spread would be a more appropriate expression of bullishness than a short ATM put spread. That said, a rally back into the daily 21-day EMA (one-month moving average) near 2039 may bring directionless, rangebound strategies (like short strangles or iron condors) back into focus.

/SI Silver price technical analysis: daily chart (August 2023 to February 2024)

Last week, we noted that “[silver prices] /SIH4 found support at the uptrend from the October 2023 and January 2024 lows. A bullish falling wedge may be coming together dating back to mid-October. A bullish daily key reversal yesterday suggests a near-term bottom may have been reached.”

Since then, /SIH4 probed the January 2024 low only to sharply reverse higher over the past two sessions. /SIH4 is now breaking the downtrend from the December 2023 and January 2024 highs (although not the downtrend from the December 2023 and February 2024 highs). Should a breakout gather pace, given the low volatility persisting (IV Index: 23.2%; IV rank: 15.1), a long directional bias may be best deployed via a long ATM call spread.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.