(Kitco News) – Wednesday’s 2 pm EST release of the minutes from the January FOMC meeting is the only significant economic news event on the docket this week, and it has captured the attention of precious metals markets, with traders and analysts weighing in on gold’s potential responses to the revelations they may contain.

“Gold prices rose in Asian trade on Wednesday, extending a recent rebound as the dollar retreated in anticipation of more cues on U.S. interest rates, most notably from the minutes of the Federal Reserve’s late-January meeting,” wrote Ambar Warrick for Investing.com. “Still, the yellow metal remained largely within a $2,000 to $2,050 an ounce trading range established over the past month, as the outlook for gold was clouded by the prospect of higher-for-longer U.S. interest rates.”

Warrick noted that the focus of investors was now squarely on the minutes from the FOMC meeting, where the U.S. central bank maintained rates unchanged while also attempting to rein in market expectations of imminent cuts.

“Since then, a string of hotter-than-expected U.S. inflation readings saw markets further price out the prospect of early rate cuts, which in turn weighed heavily on gold prices,” he said. “The yellow metal had briefly broken below the $2,000 an ounce level earlier in February, but saw a strong rebound from two-month lows.”

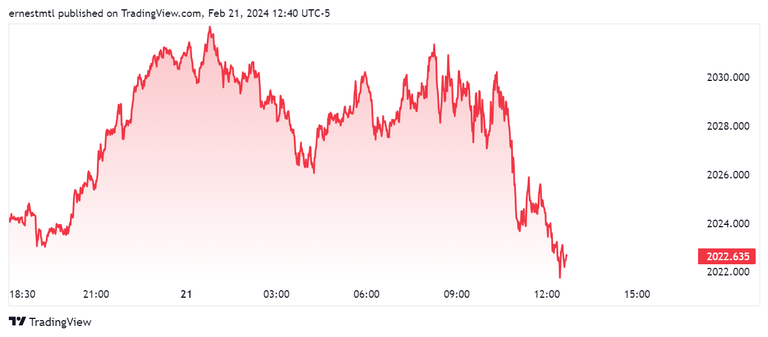

BTC.GCC.News shared the following chart on X, noting that gold’s strength during the session was hitting a ceiling ahead of the release. “Gold rose to the highest level since Feb. 9 at $2032 per ounce, but faces some resistance ahead of the release of Fed meeting minutes,” they wrote.

Forex Gold Trader was closely watching the U.S. dollar index for clues as to gold’s direction ahead of the Fed minutes. “MAKING STRONG SUPPORT AT 103.80-104,” they wrote in an X post. “NEXT WAVE WILL BE EXPECTED TILL 104.90 / 105.70.”

Dhwani Mehta, Senior Analyst and Asian Session Manager at FXStreet, wrote that gold prices are looking to extend their streak of gains to a fifth straight day on Wednesday on the back of the Fed minutes, but the precious metal was also benefiting from USD weakness driven by domestic politics.

“The latest leg down in the US Dollar could be attributed to renewed fears of a United States (US) government shutdown,” she wrote. “House Republicans have shifted from optimistically cautious to expecting a government shutdown unless a budget or spending stopgap is passed by March 1, according to a report carried by Axios. The government will go into a full shutdown by March 8.”

Mehta noted that gold prices are taking advantage of the greenback’s weakness, and any “hints on the timing of the first-rate cut this year” contained in the minutes could provide a catalyst for further dollar weakness, breaking gold out of its narrowing channel.

Mehta pointed out that on Tuesday gold prices finally managed a daily close above the 21-day Simple Moving Average (SMA), which is currently at $2,023 per ounce.

“The 14-day Relative Strength Index (RSI) extended its recovery above the midline, suggesting that the tide may have turned in favor of Gold buyers,” she said. “Therefore, the immediate resistance is now seen at the $2,033 level, where the 50-day SMA and the February 13 high coincide.”

She wrote that a sustained break above this level would suggest new buying opportunities “targeting the February 7 high of $2,044 and the $2,050 psychological barrier.” Conversely, if sellers seize control of the price action in the wake of the Fed minutes, “the 21-day SMA at $2,023 will need to hold the fort. A failure to defend the latter could fuel a fresh downswing toward the previous day low of $2,015, followed by the rising trendline support that aligns at $2,011.”

Mehta said the upward-trending 100-day SMA at the $2,002 per ounce level “will act as a tough nut to crack for Gold sellers.”

After breaking briefly above the $2,030 level in the overnight session and again shortly before the North American market open, spot gold continues to trade within a couple of dollars of $2,023. It last traded at $2,022.57, down 0.09% on the session.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.