Gold took another swing at record high levels during today’s Asian session, in a signal of persistence of the precious metal’s bulls. We highlight the upcoming period as particularly turbulent, given the financial releases ahead and fundamental issues tantalizing gold traders. We are to conclude the report with a technical analysis of the Gold’s daily chart.

Gold and the US stabilise in parallel

The negative correlation of the USD and gold’s price was obscured by the relative inactivity of the two trading instruments. It’s characteristic that the USD stabilised while gold’s price showed a slight upward movement after correcting lower last Wednesday. Overall we continue to see the case for the negative correlation of the shiny metal and the greenback to remain inactive. Similarly the negative correlation of gold’s price with US bond yields is also interrupted given that the 2, 5, 7 and 10 year US bond yields continued to rise over the past week, yet the appeal of the US bonds remained insignificant for gold traders to switch to US bonds as an alternative safe haven investment. For the time being the wide uncertainty in the markets seems to underpin gold’s bullish tendencies over the past few days. Yet we remain vigilant for a possible resurface of the USD-gold negative correlation, especially given the high impact financial releases expected from the US until the end of the week.

US financial releases expected

In the coming days we expect the release of some high impact financial data from the US that could create some mobility for gold’s price as well. We make a start by the release of the US PCE rates for September on Thursday. The rates are expected to slow down, showing an easing of inflationary pressures in the US economy and if so could add more pressure on the Fed to proceed with its rate cutting path maybe even with a faster pace. Thus such a release could support gold’s price. At the same time, we also get the preliminary release of the US GDP rate for Q3. The rate is expected to remain unchanged at 3.0% yoy if compared to the final rate of Q2 and such a result could enhance the Fed’s narrative for a possible soft landing of the US economy and thus weigh on gold’s price. Yet the crown of financial releases for the week is expected to be on Friday the release of the US October employment report. The Non-Farm Payrolls figure is expected to drop to 115k if compared to September’s 254k, the unemployment rate to remain unchanged at 4.1% and the average earnings report also to remain unchanged at 4.0% yoy. Overall such rates and figures, if the prognosis is realised, could support gold’s price as it could add pressure on the Fed to proceed with a faster easing of its monetary policy.

Earnings reports could steal Gold’s appeal

Besides US financial releases, we also note the possibility of mobility in US stockmarkets as we get the earnings reports of a number of high profile companies. We may see a market focus on the tech sector as we get the earnings reports of Alphabet (#GOOGL) today, Meta (#FB) and Microsoft (#MSFT) on Wednesday and Intel (#INTC), Amazon (#AMZN) and Apple (#AAPL) on Thursday. Overall should we see the earnings reports disappoint the market increasing uncertainty about the future, we may see gold’s price getting some safe haven inflows and vice versa, should the earnings reports be better than expected, we may see US stockmarkets stealing some of gold’s shine.

US elections provide wide uncertainty for the markets

Maybe the most tantalizing issue for the markets at the current stage are the US Presidential elections. The uncertainty factor about the outcome is high given that Trump and Harris are very close to call and the stakes are understandably high as well. The situation is further complicated as besides the Presidential elections on Tuesday, all the seats of the House of Representatives as well as about 1/3 of the Senate seats are to be contested. Should we break down the possible result scenarios, four emerge. The first would be a red sweep, where Trump is elected President and at the same time Republicans enjoy control over Congress, the second Trump gets elected, yet democrats control Congress, the third Harris gets elected President yet Republicans control Congress and the final scenario would be a blue sweep, where Harris is elected President of the US and Congress is to be controlled by the Democrats. There may be different market reactions to each one, yet we would also lie to mention the possibility that Harris marginally wins the election but Trump contests the result. Such a scenario could create wide uncertainty among market participants, which in turn could result in increased market uncertainty, thus safe haven inflows for the precious metal.

Technical analysis

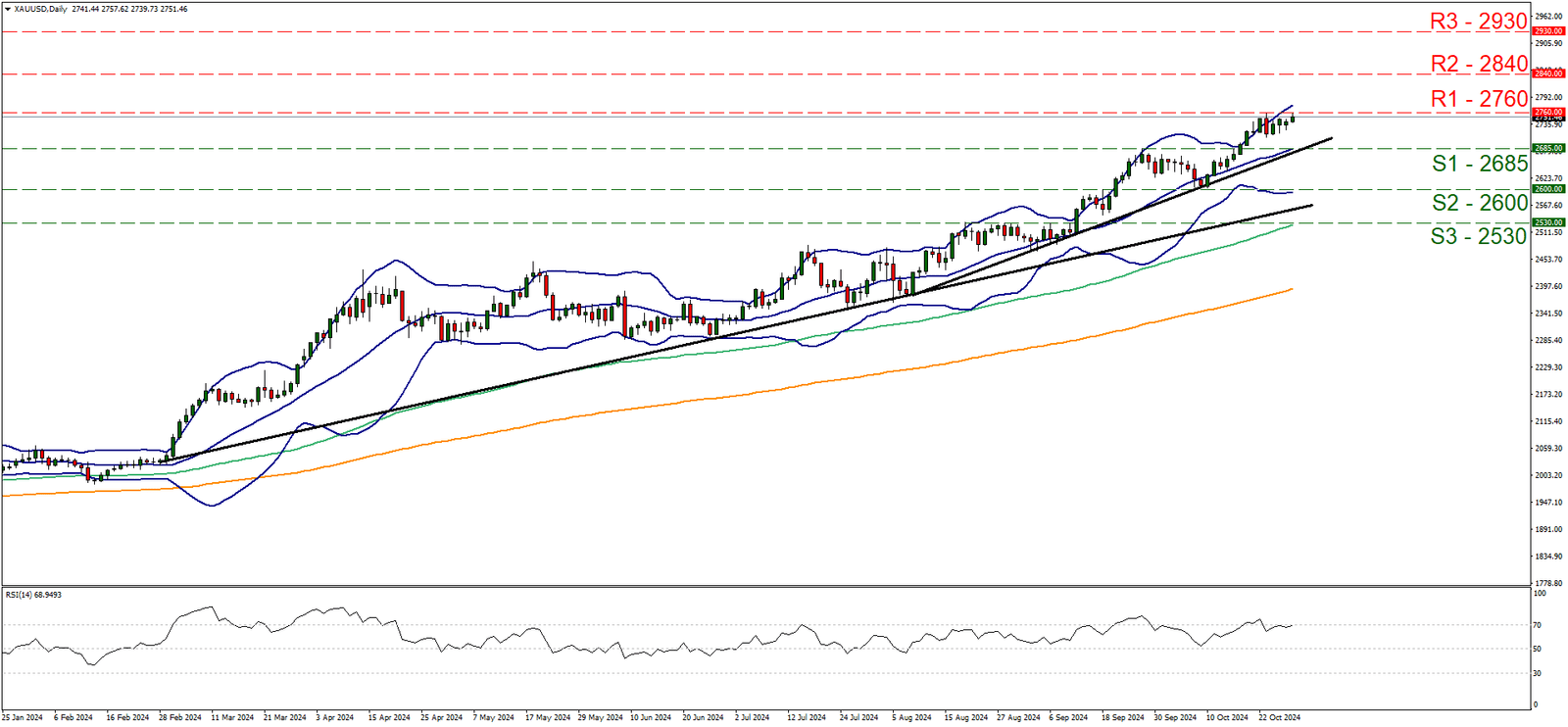

XAU/USD four-hour chart

Support: 2685 (S1), 2600 (S2), 2530 (S3).

Resistance: 2760 (R1), 2840 (R2), 2930 (R3).

Gold’s price is edging higher over the past few days and during today’s Asian session, took another swing at the 2760 (R1) resistance line, which is also a record high level for Gold’s price. We maintain our bullish outlook for the precious metal as long as the upward trendline incepted since the 7th of October remains intact. The RSI indicator continues to run along the reading of 70, implying that the market sentiment for gold remains strongly bullish, yet at the same time issues a warning that the precious metal may be at overbought levels and ripe for a correction lower. Similar signals are being sent as the price action of gold has hit the upper Bollinger band on the 23rd of October and stabilised. Should the bulls remain in charge as expected, we may see gold’s price breaking to new record high levels, by surpassing the 2760 (R1) resistance line and we set as the next possible target for the bulls, the 2840 (R2) resistance base. A bearish outlook in our opinion is currently remote, yet for such a scenario we would require gold’s price to drop, break the prementioned upward trendline, signaling the interruption of the upward movement of the precious metal, break the 2685 (S1) support line clearly, continue lower to break the 2600 (S2) support level and start aiming for the 2530 (S3) support barrier.