(Kitco News) – Silver’s price surged to its highest level in more than a decade on Monday morning as the grey metal finally started to play catch up to gold, which continues to set new record highs amid a backdrop of deteriorating global financial conditions.

The question on the minds of precious metals investors now is how the gold/silver ratio will perform in the weeks and months ahead as the metals find newfound love from investors looking to maintain their wealth.

Since January 22, the gold/silver ratio has fallen from its yearly high above 92 to its current value of 75.75, and many expect it to continue to decline as silver finally gets the love it deserves, but according to Mike McGlone, senior commodity strategist at Bloomberg Intelligence, gold could continue to outshine its sister metal if the S&P continues to show strength.

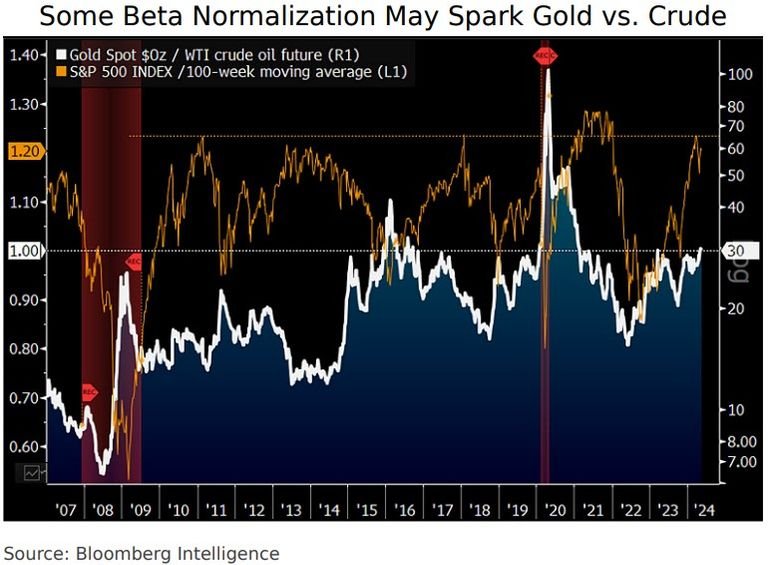

“The consistency of gold beating silver when the S&P 500 stretches about 20% above its 100-week moving average may add fuel to the benchmark precious metal’s propensity to outperform most commodities,” McGlone said in his latest update. “A top risk of 2024 could come from gold widening its outperformance vs. AI-driven beta.”

Focusing on the gold/silver cross, McGlone said it “may gain support from stock-market resistance,” as their data “shows just below 80 ounces of silver per ounce of gold acting as an enduring pivot and support since the Federal Reserve started hiking in 1Q22.”

“What’s notable is the consistency of the S&P 500 reaching the 20% threshold above its 100-week moving average, and gold rising vs. silver,” he said. “With the S&P at a 22% premium to this mean on May 17 and gold/silver at 77, a key question may be what’s different this time?”

McGlone said Bloomberg’s bias “is leaning with some normalization, notably in the stretched stock market, which typically favors the top precious metal vs. increasingly industrial-based silver. Led by China, central banks are buying gold and adding buoyancy to most metals. Industrial metals are typically more highly correlated to equity prices than gold.”

Based on the recent strength shown by gold, McGlone said there is a strong likelihood it will continue to outperform stocks and other metals as investors rediscover the allure of holding the yellow metal in challenging markets.

“A top markets spread with macroeconomic implications is gold vs. the S&P 500 (SPX), and risks may be leaning toward the metal outperforming,” he said. “At about the same on May 17 as the end of 2019, the gold/SPX ratio and total ETF holdings of the metal appear to be ripe to move, awaiting a catalyst. It’s the potential for a shift to inflows in gold ETFs, following record-setting outflows despite the rising price since 2020, that may portend a win-win for the metal’s price.”

As for why investors should buy gold “with the stock market on a tear and T-bills above 5%,” McGlone noted that central banks have had a voracious appetite for gold in recent months, and that shows no signs of slowing.

“Central banks buying gold at a tremendous pace is more likely to accelerate than diminish, according to the World Gold Council,” he said. “To May 17, the metal is up about 17% in 2024 vs. the S&P 500 total return at around 12%.”

For this reason, McGlone suggested that “2024 may be about gold vs. everything else.”

“Record 2024 highs in gold and copper vs. crude oil and corn on May 17, at levels first traded in 2007 and 1996, may show the commodities performance tilt favoring metals,” he said. “Low supply elasticity, storage costs, and trends in de-dollarization and electrification are top metal-sector attributes, but autocorrelation forces leave behind a lone standout: gold. It has demonetized silver, and the graphic shows the propensity for gold to outperform the metal, energy, and agriculture sectors over time, notably on a total-return basis.”

“It’s a question of endurance and our bias is gold’s risk vs. reward is leaning toward outperformance acceleration, particularly if the elevated US stock market has a bit of normal reversion,” he added. “‘Unlimited friendship’ between the leaders of China and Russia may solidify gold’s geopolitical buoyancy.”

With the S&P 500 roughly 20% above its 100-week moving average, which McGlone said is “typically a stretched danger zone,” it could prove to be “a top tailwind for gold and headwind for crude oil.”

“A bit of reversion in beta could be what the gold/crude ratio bumping up against 30 resistance is anticipating,” he said. “That gold has been the only major commodity setting record highs in 2024, despite significant outflows in ETFs that track the metal, might suggest diminishing potential forces to pressure prices.”

McGlone said that a “reversal of the colossal buying by central banks could be a gold headwind, but the shift in the world order on the back of the ‘unlimited friendship’ between the leaders of China and Russia may portend early accumulation days for the metal. From a US standpoint, ‘why buy gold with stocks on a tear and T-bills above 5%’ could change with a bit of normalization.”

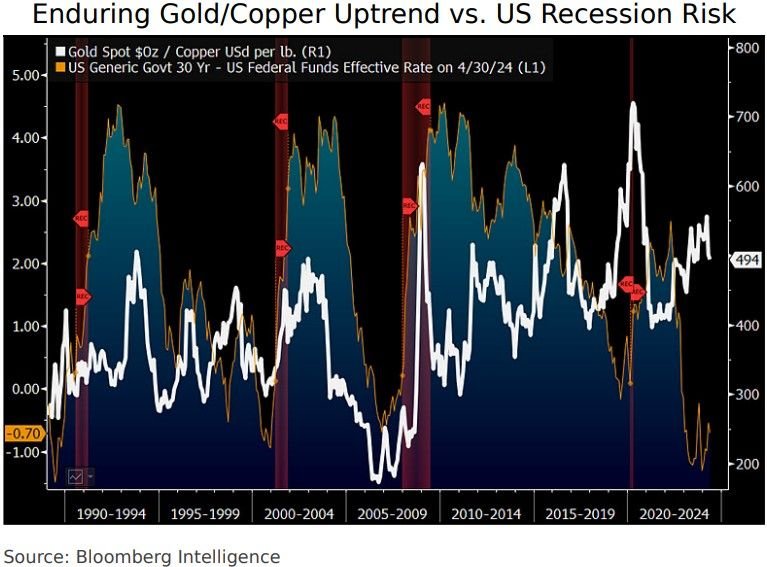

Looking at the performance of gold relative to copper, McGlone said, “The fact that delayed reactions in markets can be more extreme may refer to the propensity for gold to outshine copper, particularly when the yield curve normalizes from steep inversion.”

“At about 500 pounds of copper equal to an ounce of gold on May 13, our graphic shows the gold/copper ratio in an upward trajectory since bottoming at around 175 in 2006,” he noted. “That the nadir of the inverted yield spread between the US Treasury 30-year and fed funds rate that year was around 70 bps – about the same as it is now – may suggest similar upside for the precious metal vs. industrials.”

“It’s the distortions of the pandemic and shift in the world order, on the back of the ‘unlimited friendship’ between the leaders of China and Russia, that may be delaying a typical recessionary response to the inverted curve, and gold boost vs. copper,” he concluded.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.