What is Goldmoney all about?

In the dynamic landscape of financial investments, Goldmoney Inc. (TSX:XAU, Financial) stands as a beacon for those seeking the enduring allure of precious metals. As a prominent player listed on the Toronto Stock Exchange, Goldmoney specializes in providing a comprehensive suite of services related to precious metal investments.

The company facilitates the seamless acquisition, storage and delivery of precious metals for its clients. With a staggering $2.5 nillion worth of precious metals safeguarded, the company has earned a reputation as a trusted custodian, serving individuals and businesses in over 100 countries.

Diversified business segments

Among its principal operating subsidiaries, Goldmoney.com serves as the flagship platform, offering a user-friendly interface for clients to explore and engage in precious metal trading and custody. SchiffGold.com, another key arm of Goldmoney Inc., caters to the intricate world of gold trading, providing valuable insights and resources to assist investors in navigating the complexities of the market.

Further amplifying its reach, Goldmoney Inc. holds a substantial 36% interest in Menē Inc., a strategic partnership that expands the company’s footprint in the precious metals sector.

Goldmoney has also recently formed Goldmoney Properties Ltd to pursue the acquisition of institutional grade real assets for real returns in an inflationary environment. In June 2023, they completed the acquisition of a landmark 219,258 (GIA) square foot Class A building near the Port of Southampton from Aviva Investors Lime Property Fund.

The acquisition was funded exclusively with balance sheet cash, and from the additional precious metal gains and operating cash flows realized after the year end. Goldmoney Founder and CEO Roy Sebag said, “With this acquisition, Goldmoney establishes a new inflation-protected income stream for shareholders.”

Leadership

Roy Sebag, CEO, with his strategic acumen and extensive knowledge of the precious metals market have propelled Goldmoney to the forefront of the business.

Previously, Mr. Sebag established BitGold, which debuted in 2014 and quickly became the most popular digital gold payments and savings platform ever. BitGold ultimately amalgamated with Goldmoney in 2015, forming Goldmoney Inc.

Under his leadership, Goldmoney has not only given individuals a secure and efficient platform for purchasing, storing, and selling precious metals, but it has also pioneered the use of blockchain technology to improve the accessibility and security of such assets.

Extensive competitors

When it comes to the precious metals industry, GoldMoney Inc.(TSX:XAU, Financial) is a trailblazer in a time when digital advances are constantly transforming conventional businesses. The company has been running Goldmoney.com, the leading platform for investing in and custody of precious metals, for 22 years. It has served clients from more than 100 countries and has protected $2.1 Billion in assets. In the FY 2023, this business segment brought in $87 Million in sales and $15 Million in operating earnings. They possess three properties with a combined approximate floor area of 412,763 square feet (GIA) and generate $11 Million in net rental income annually as per the website.

Its competitive edge in this market is derived from a number of elements. The user interface and experience of the platform are crucial, and businesses such as BullionVault, an online physical gold and silver market for private investors, is among the leading competitors with user-friendly interfaces and smooth transactions. With over 100,000 clients, over US$3.7 Billion in assets under administration, and over US$100 Million in gold and silver traded each month, it allows individuals in 175 countries to purchase and sell professional-grade bullion at the greatest prices online as per the FY 2023 1H report of its parent company Augmentum Fintech.

Another crucial factor is the range of products and services provided, with competitors such as OneGold offering diverse investment options in precious metals. As stated on zoominfo, the company earned total revenue of $40.3 Million .

Additionally, security and transparency play a vital role, and competitors like Kitco are notable for their secure storage solutions and transparent pricing models. As per zoominfo, Kitco’s revenue is $21Million .

The regulatory environment also influences competition, with companies like Paxos and Sprott Money(TSX:SII) navigating the regulatory landscape adeptly. As quoted on zoominfo, Paxos’s revenue is $180.4 Million and Sprott Money’s annual revenue is $145.18 Million in 2022.

Overall, in a sector marked by innovation and evolving consumer preferences, Goldmoney Inc faces competition from companies that excel in various facets, including user experience, product diversity, security, and regulatory compliance.

Valuations

As of January 29, 2024, GoldMoney’s share price sits at a promising 7.90 Canadian dollars. Delving into the financial snapshot, the company boasts an impressive Earnings per Share (Diluted) of 0.82 Canadian dollars for the trailing twelve months, resulting in a PE Ratio of 9.63—a figure that reflects solid investor confidence.

Taking a stroll down memory lane, GoldMoney’s PE Ratios over the past 11 years have seen highs of 139.27, lows of 5.07, and a median of 18.64, showcasing the company’s resilience and adaptability in the ever-changing market landscape.

But that’s not all—GoldMoney’s current PB Ratio of 0.63, based on a Book Value per Share of 12.57 Canadian dollars as of September 2023, positions it favorably, outperforming 77.28% of its peers in the Capital Markets industry. A glance at the historical PB Ratios, ranging from 8.98 at its peak to a low of 0.61, with a median of 1.09, tells a tale of strategic financial positioning.

Moreover, GoldMoney has been on a growth trajectory, with an average Book Value Per Share Growth Rate of 8.10% per year over the past 12 months, signaling not only stability but also a commitment to enhancing shareholder value.

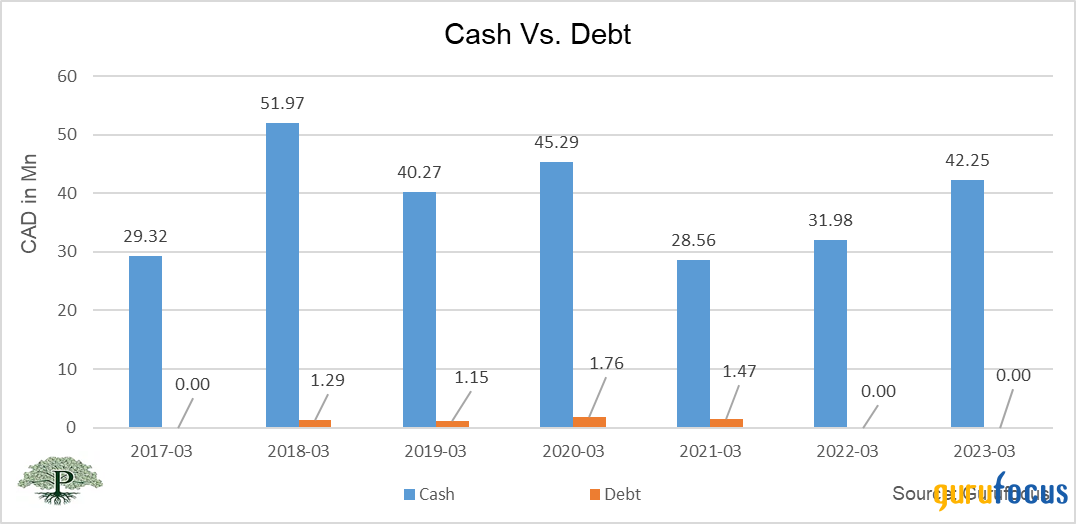

Solid balance sheet – No debt

The company has been without debt for the past two financial years. However, its cash holdings have seen a consistent increase. These funds are being directed toward acquiring properties for their new business stream, with the aim of establishing a stable revenue source in the future.

Overall

Goldmoney has seen volatile past trends. The FCFF has been negative in 8 of the past 10 years. However, now the margins have started improving in the past 2 years. Plus, Goldmoney has no debt and a good cash pile.

While the core business is strengthening, Goldmoney is also focusing on creating a consistent income stream with its Real Estate venture. In addition, Mene is undergoing restructuring with new management taking the reins.

In essence, GoldMoney’s current financial standing and future outlook paint a captivating picture of a company navigating the markets with resilience, adaptability and a commitment to growth.