Rhona O’Connell, StoneX Financial Ltd

Any views expressed here are of the writer and do not reflect a house view either from StoneX Financial Ltd., nor from NASDAQ.

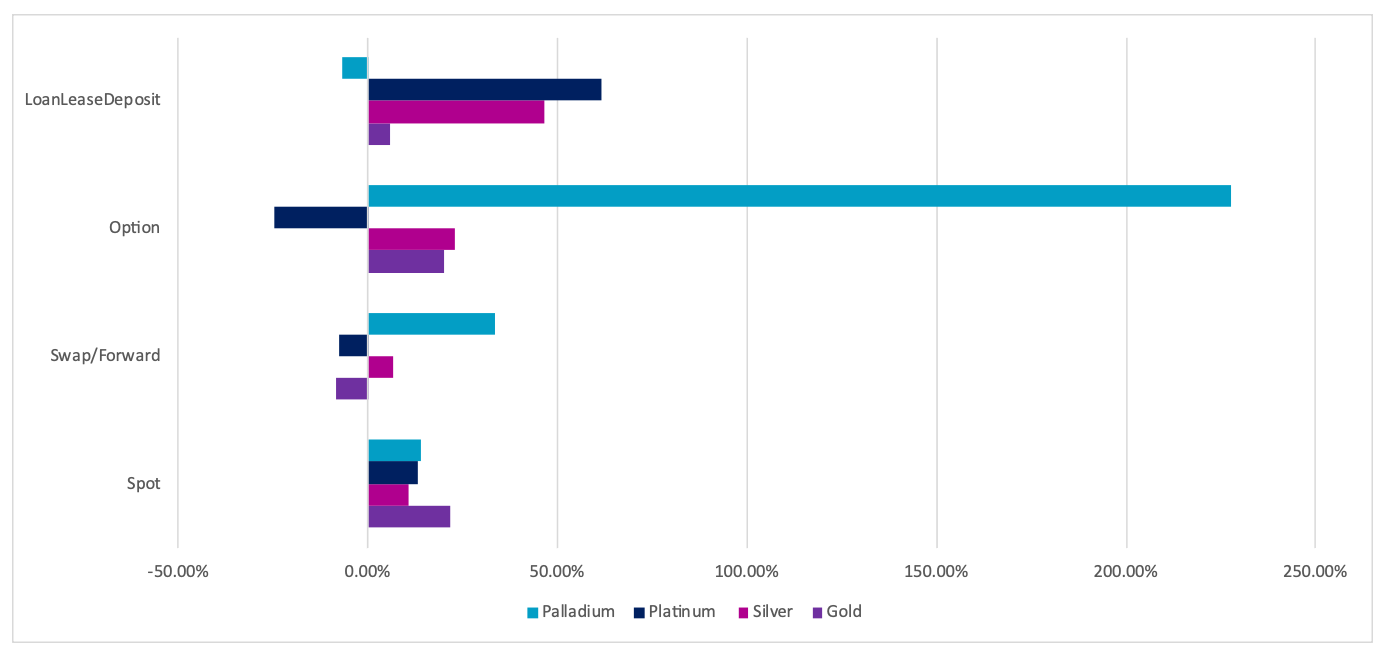

Daily March average compared with daily average for 2023

Source: LBMA

Source: LBMA

Welcome to our monthly round-up of the LBMA OTC trading volumes in gold, silver, platinum and palladium, as recorded on a daily basis by the Association. These are split into spot, swap/forward, options and LoanLeaseDeposit (LLD) and give a flavor of the markets’ activity and how they were influenced by external forces and news items.

All references to COMEX or NYMEX positioning refer to Managed Money, not commercial positions.

General introduction:

After a couple of quiet months in January and February, things really took off in March with gold bursting onto the scene, silver following not long after and outperforming as usual. Platinum and palladium joined the party, with each posting a rally through to mid-month – but then retreating. Even so, platinum posted a net gain of 9.7%, and palladium, 5.4%; gold put on 10.0% after an initial bull run then consolidation; and silver, 11.9%. Volumes were up substantially almost across the board (see above table), certainly in spot, but the really interesting numbers are those for the gold and silver options. Palladium options look spectacular, but this is from a very low base.

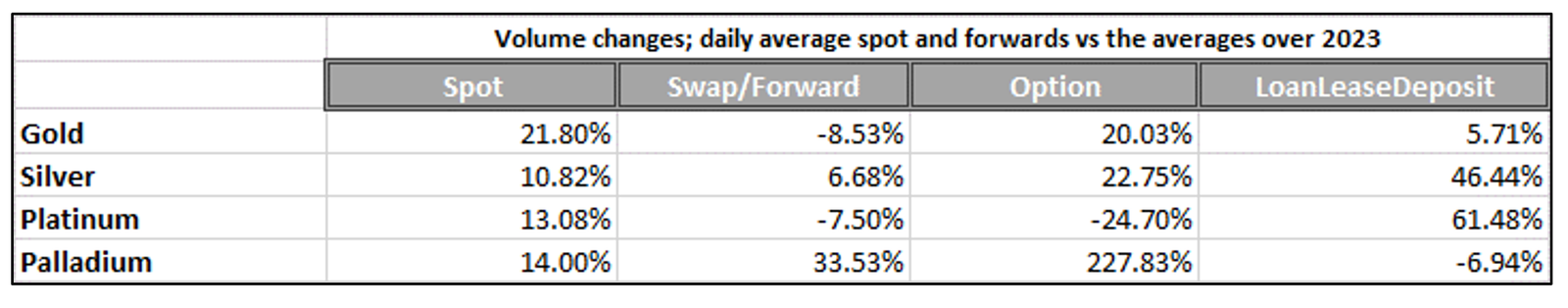

GOLD Spot gold volumes, March, M ounces

Source: LBMA

After a flat period in January and February, gold took off in the first half of March, then spent a period again in a narrow range, consolidating and forming a base for its next aggressive leg in April, with a series of fresh record highs. The trigger for the move was weaker-than expected economic numbers form the United States at the end of March, which yet again brought the outlook for the Fed’s rate cycle into the crosshairs, but there was a lot more to it than that, with a series of background factors all contributing to what became an increasingly excited, if not overheated, market.

These background factors are:

- Growing international geopolitical tensions

- also the majority of ACCA (Association of Certified Chartered Accountants) members in the banking sector are concerned that the high number of elections around the world this year adds to geopolitical risk and this element was by far the element that was giving them the most concern

- Small-to-medium banking stresses also in the spotlight

- and of course the inevitable focus on the Fed…

…but there is more to it than that. While the physical market for coins and bars, and price-elastic investment-grade jewellery, has evaporated (and some coins are trading at a discount to spot and returning to refineries accordingly), the professional market has been firmly on the bandwagon and the rise in price has become self-fulfilling as not only are momentum traders and CTAs involved, but as well as technical stop-driven trading, there has been evidence of fresh investors.

In other words, the initial rise in price deterred some buyers and generated some profit taking, but as it gathered speed, every-one appeared to want to join the party.

The period of stabilisation in the second half of the month was also triggered to some extent by US numbers; this time the US CPI and PPI were, for the second successive month, higher than expected and poured some cold water on the bond markets’ over-benign view of the Fed’s likely future course of action. Some profit taking appeared but gold had grabbed the markets’ attention and the bull run resumed towards month-end.

The move was accelerated by the action in the options markets. Anecdotal evidence had already suggested that there was some high volume option trading going through and after a period of relatively narrow horizontal ranges in January and February, premia would have been low. The gearing on the delta of these options also contributes to the self-fulfilling nature of the move.

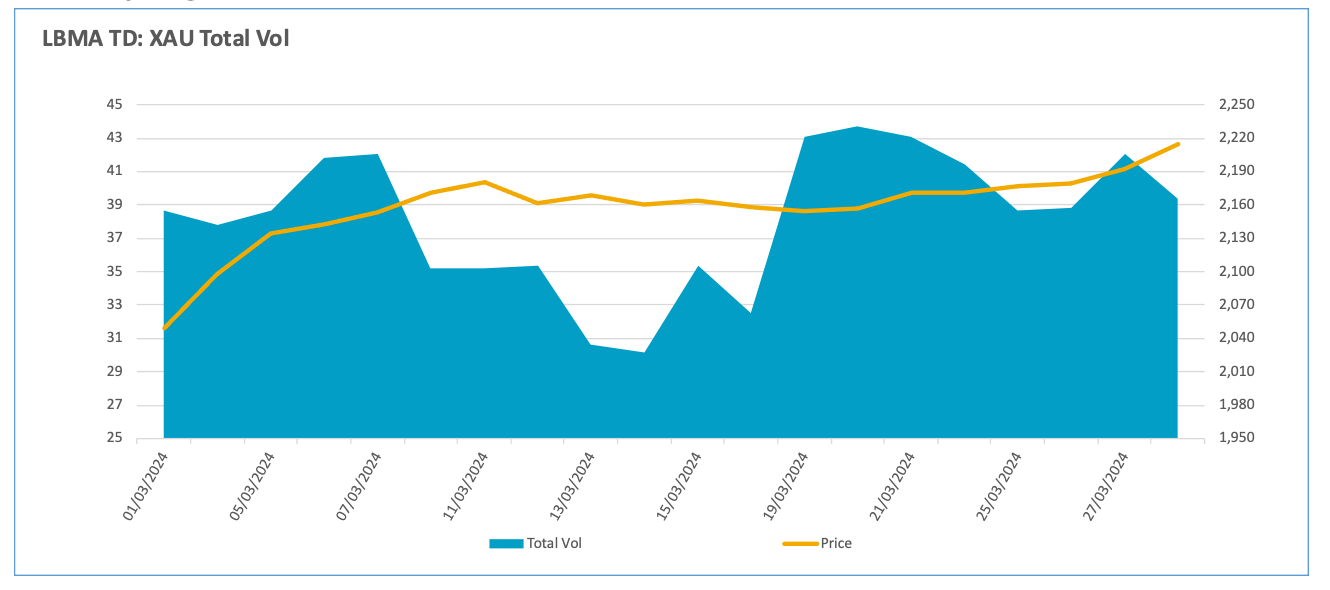

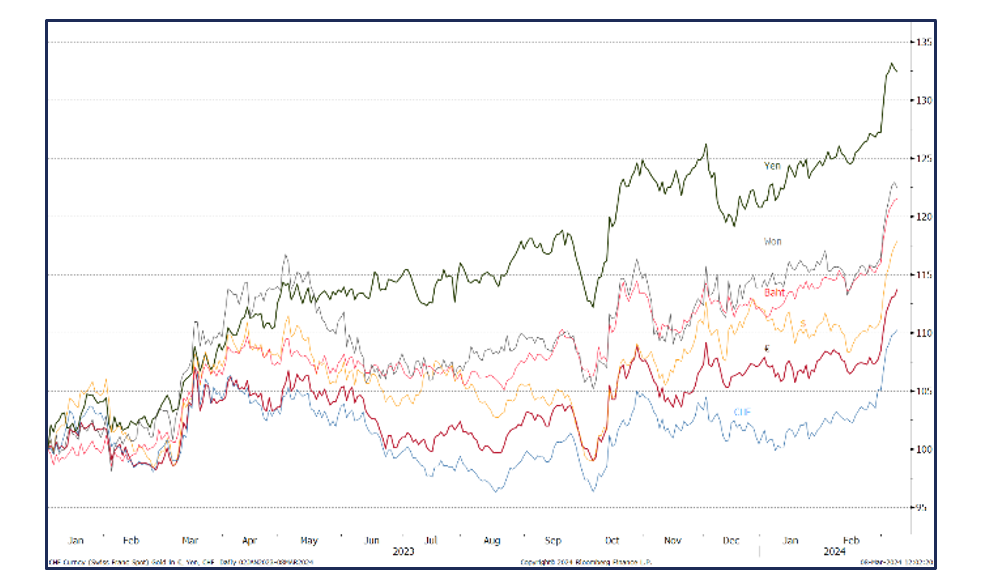

Gold in key local currencies, January 2023 to date

Source: Bloomberg, StoneX

Meanwhile the Exchange Traded Products remained continued to see net redemption despite the febrile atmosphere elsewhere. For the whole of 2023, the World Gold Council (the most reliable source) shows a fall of 244t (funds exodus of $14.7Bn), leaving holdings at yearend of 3,226t, AUM $214.4 Bn. In 2024 to end-March there were fresh redemptions, although the pace was also slowing, with just 13.6t leaving the funds; and over the month overall, all of this came out of Europe, with a drop of 1.6% or 22t. North America bought 4.8t (+0.3%) and Asia, 3.1t or 2.2% with 0.5t going into other areas. This left holdings at month-end of 3,112.4t with $222.2Bn in Assets Under Management. World mine production is roughly 3,650t. The net change over the quarter was -113.23t, with 68.,2t (4.1%) and 54.2t (3.9%) from Europe, while Asia took in 9.6t (7.1%) and a minor loss of 0.4t (0.7%) from elsewhere.

The Money Managers’ activity on COMEX largely reflected the OTC activity, with outright longs gaining 215t or 67% and shorts contracting by 46%, taking the net position up by factor of 1.6. At the close of business on 2nd April, therefore, the outright long was 538t compared with a twelve month average of 405, pointing up the possibility of sizeable lqiudiation should the surrounding financial and geopolitical environment change, substantially – which looks unlikely.

SILVER

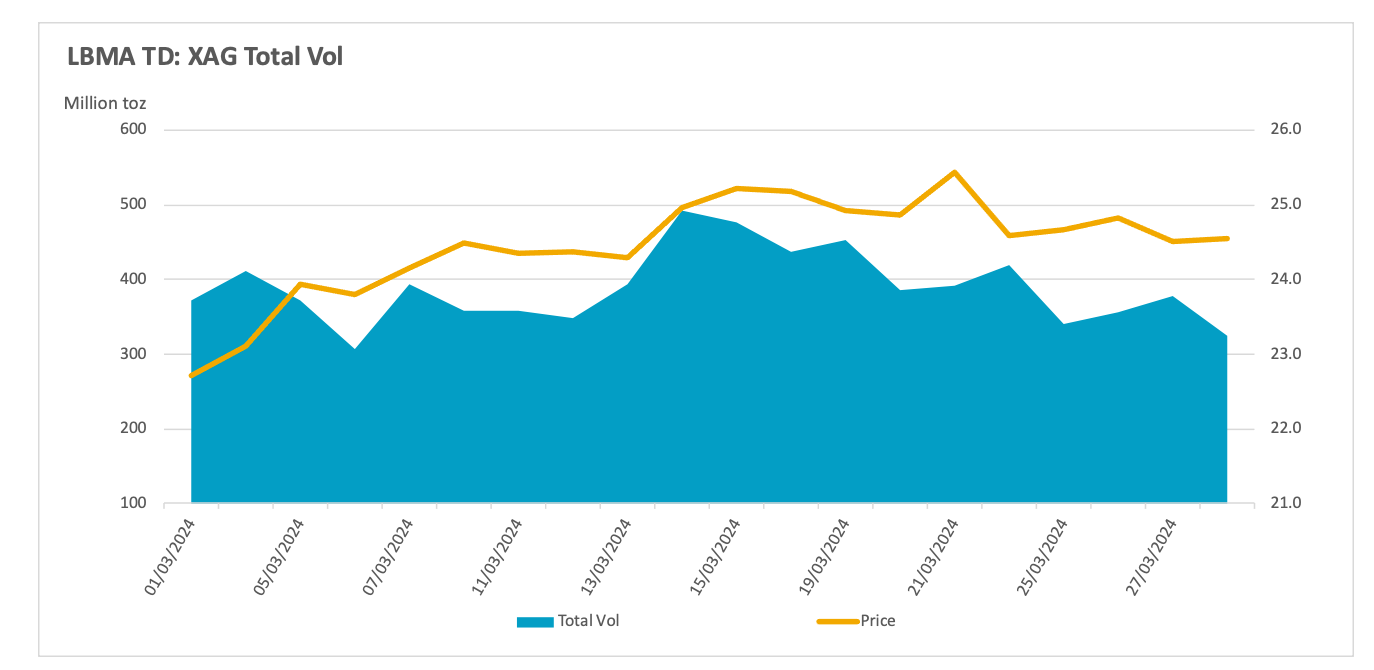

Spot silver volumes, March, M ounces

Source: LBMA

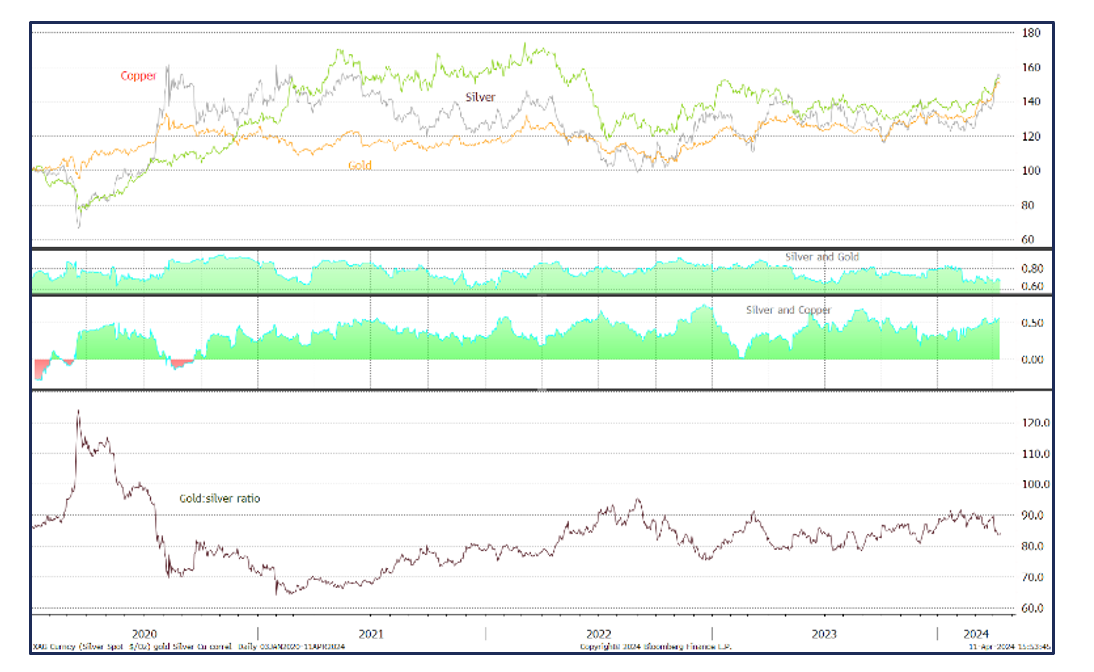

Silver, gold and copper; , the correlations and the gold:silver ratio, January 2023-to-date

Source: Bloomberg, StoneX

Many of the influences on gold applied to silver as the markets sprang to life, but there are other elements involved here also. As we have often noted before, while silver is often thought of as being in the same stable as gold because of its history in coinage and the use in jewellery and for silverware and decorative ware, we must always remember that 60% of silver’s fabrication demand (i.e. exclusive of -investment activity) is in the industrial sector; when gold prices are not doing anything of note silver will often turn to copper for guidance. Remember also that silver does usually tend to piggy-back on one or other of these metals because of its own fundamentals; the demand side tends to be the key river here because the majority of supply is price-inelastic; only roughly 28% of silver mine production is from primary silver mines with the balance coming very largely from copper, lead-zinc or gold operations. Add to this the return from industrial scrap which – except in extremis – is also price-inelastic and the price-sensitive element of silver mine production drops to roughly 25% of total silver supply.

Also the primary silver mines’ cost curve means that at prices above $22, as they were for all of March, no primary silver mine is under threat. Metals Focus’ analysis puts global average cash costs at just under $5/ounce with all-in sustaining costs between $14 and $15. These figures come from last year and inflationary forces will have boosted those numbers this year, but by nowhere near enough to put production under threat.

Meanwhile in the first week of March silver did move with gold, but not with it relatively reluctantly. By this we mean that when gold is moving with conviction – either up or down – then silver will take the same direction but will move by at least twice as much as gold. It took until April for silver to catch up with and then overtake gold; in March gold rallied by 8.7% and silver, by just 11.2%. This most likely reflected two elements; firstly a lack of belief that gold’s rally would persist as there didn’t seem (erroneously, as we can see above) to be any visible triggers for gold’s move; and secondly the fact that economic uncertainties were at that point keeping copper firmly on the back foot.

As far as trading patterns are concerned, silver options were also lively, in fact posting a 22.5% gain on average over the 2023 daily average, compared with gold’s 20% uplift. LoanLeaseDeposit volumes were also up by a thumping 46%, suggesting that some base metal (and possibly primary miners also) were locking in some by-product credits. We should look at this with caution, though, as there was one massive outlier on 14th, with 35.9M ounces going through against an average over Jan/Feb of 14.6M ounces, suggesting a hedge programme / financing exercise underway.

Breaking down the volume patterns, the highest spot turnover came in the third week of the month, as a battle royal developed between bulls and bears, keeping prices in a very narrow range of just 70 cents centred on $25, until a push towards $26 followed by an equally aggressive retreat. As prices slipped thereafter volumes dwindled, with participants standing back and looking for direction.

The $25 level was also the arena for the swap/forward market with a big boost in volumes suggesting that this was a key target on both sides of the market and the LLD figure underpins this.

As far as options are concerned there was here, too a big outlier with 19M ounces in one day against a Jan/Feb average of 6.0M ounces, although it is fair to say that silver options volumes are highly variable. On this occasion the big outlier was the 13th, the day when silver rallied from $24 to $25, suggesting some sizeable call activity.

Exchange Traded Products saw increased buying although it remained sporadic; of 21 trading days only nine saw net creations, while the cumulative activity over the month saw a net increase of 24t as most of those nine creating days saw heavy volume going through. On COMEX there was a massive 78% increase in outright longs, up from 5,352t to 9,302t by 2nd April. There was some sizeable short covering in the face of the rising price, coming down by 2,060t or 34.3%. Whereas at end- February silver looked vulnerable to a short-covering rally, by early April the heavy outright long position was looking menacing.

PLATINUM

As we noted in January and February, the falls in palladium and rhodium prices mean that some platinum primary supply is under threat, notably in South Africa, while NorNickel has also said in its results statement that its platinum and palladium production are expected to be down by 12% this year – although part of that is ascribed to geopolitical circumstances and changes in infrastructure plans.

The problems with power supplies from Eskom in South Africa are showing no signs of abating and it looks as if at least 15t of platinum is building up as work-in-progress, as some ore has been mined but not fully treated because of power supply restrictions. The miners are all reporting substantial damage to their bottom lines last year and while restructuring at the moment is affecting workforce headcount rather than outright production, the CEO of one major has said that if the restructuring plans aren’t effective enough then the company will consider some shaft closures.

As we write in early April this position has not improved – if anything it is worsening as prices continue to flounder and political commentators are suggesting that the erosion of support for the ANC could mean a coalition government after the General Election (end-May) and that this could mean more disruption to infrastructure operations. The South African miners will continue to strive to maintain mining operations, but there still is some nervousness surrounding the medium-term prospects.

For now, these disruptions are more likely to affect the forward curve than the outright spot price given that the metal will eventually reach the market.

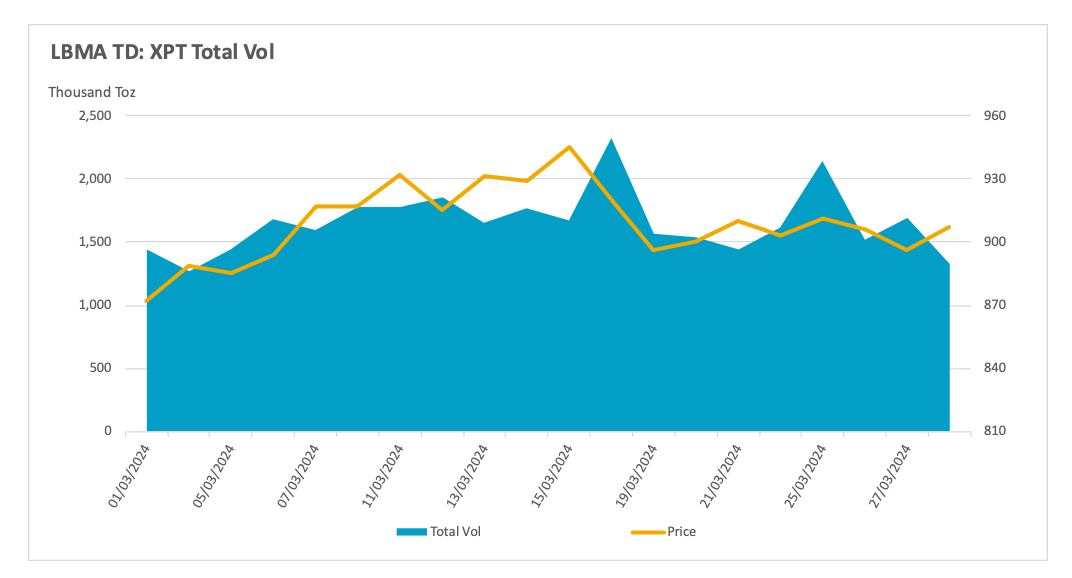

Spot platinum volumes, March, 000 ounces

Source: LBMA

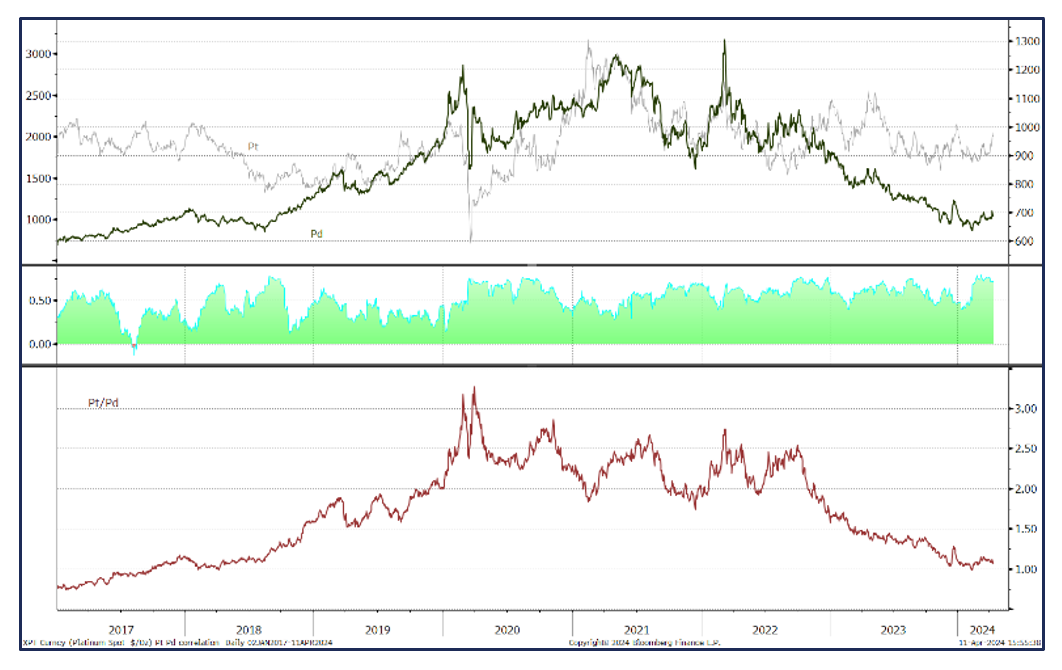

Again, as we noted in previous months, the programme for substituting some palladium automotive emission control catalysts loadings with platinum, reflecting the period at the start of the decade when palladium was at a hefty premium to platinum, is due to complete during the third quarter of next year.

What is interesting now is that the onward march of the electric vehicle programmes is easing. Production is not falling but the rate of growth is slowing and we are starting to see some auto companies openly reduce their programmes. Within the green auto sector, at least one company is moving away from hybrids and battery vehicles in favour of fuel cells. This supports platinum over the longer term.

Working against this, however, is the fact that diesel vehicles now only comprise roughly 30% of the European vehicle purchases. For many years, largely due to favourable taxation policies, diesel comprised more than 50% of European vehicle purchases. Further, the European Parliament is now arguing that average diesel emissions are to be reduced by 90% by 2040 (against 2019 levels) via 45% by 2030 and 65% in 2035. Consultants Euractiv say that in 2023, diesel trucks accounted for 96% of all diesel truck sales in Europe. The head of Volvo, in an interview with Euractiv, called the measures “tough but feasible”.

Platinum rallied from $880 to $927 in the first half of March before reversing and finishing the month at $911. So narrow ranges all round and with the notable exception of LLD trading, volumes in the other three sectors were uninspiring as industrial enquiry was relatively sluggish. Within the month, spot volumes peaked on the mid-month reversal, a phenomenon that we have seen many times before as sentiment changes and positions are adjusted accordingly. Spot volumes were relatively busy on the way up, before contracting on the way down. The retreat in price generated increased volume in the swap/forward sector, suggesting some possible industrial buyside hedging (it is unlikely that the miners would commit on the short side given the background conditions in South Africa. Options were languid.

The LLD sector was particularly interesting with the daily average 62% higher than the 2023 average, boosted by three individual heavy days. The first two were at the bottom of the market and then two days later as prices pushed through $900; and then just after prices peaked. Given the amount of borrowing and leasing in the market it is possible that all three of these days were seeing action coming from the industrial side, borrowing against existing or future spent catalysts, for example in the chemical and glass sectors.

Spot platinum and NYMEX inventories, five-year view

Source: Bloomberg, StoneX

Exchange-Traded Products were mixed during February, with just eight days of net purchase from 21 trading days; the result was a very small drop of just 60kg to a total of 92t, compared with world refined production of 224t. On NYMEX, meanwhile, the outright short side was high volume but more controlled than in previous months. Outright shorts picked up to 79t in the first week of March and then contracted to 49t over the rest of the month until a small increase in the final week, finishing at 52t. Longs, meanwhile, rose, fell and then picked up smartly in the final week, giving spot prices a small boost. March thus closed with a net short of 1.6t, 30t fewer than at end-February.

PALLADIUM

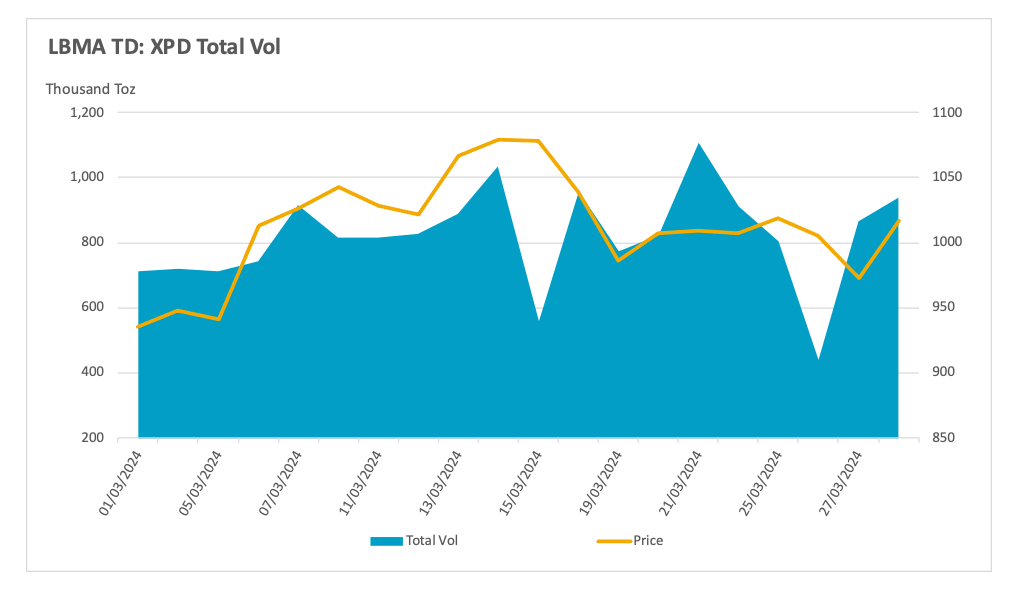

Palladium spot volumes, March, 000 ounces

Source: LBMA

Palladium remains under a cloud and is likely to do so for the foreseeable future, although the slowing in EV inroads into the ICE sector gives palladium some relief in the short term. The price profile was again largely similar to that of platinum but stronger, with a bull run from $925 to a high of $1,110 in mid-month, followed by a correction, to post a net gain in March of 11%, closing the month.at $1,1017.

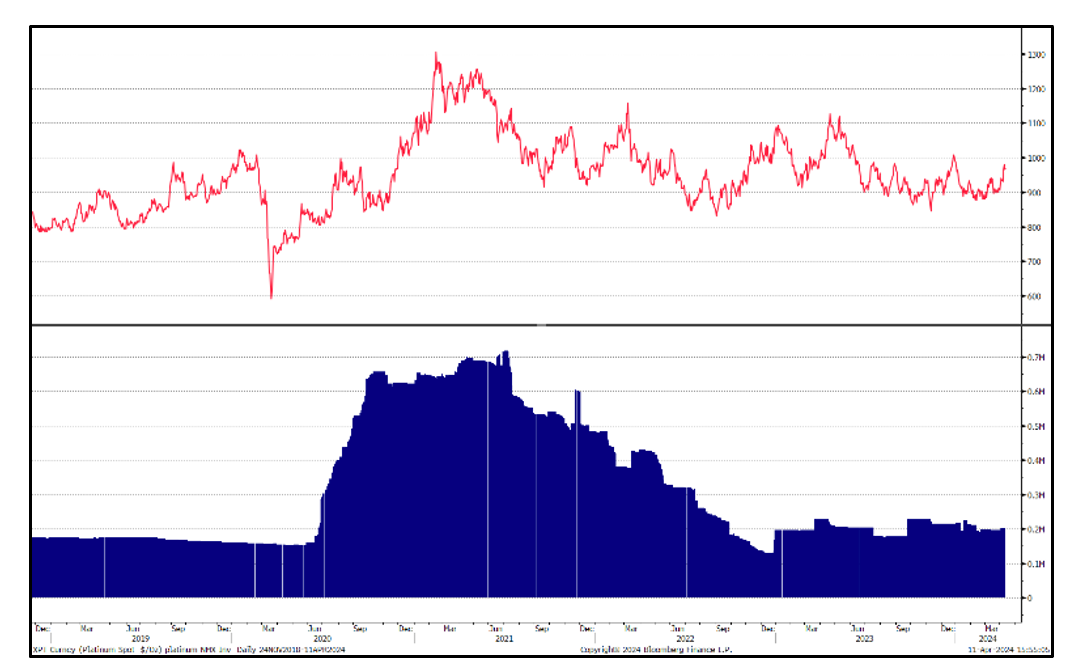

Platinum, palladium, and the correlation

Source: Bloomberg, StoneX

It is well-documented that there have been record high short positions in palladium although these are gradually contracting (see below) and with poor fundamentals for the longer term, but the possibility of supply disruption in the nearer term horizon if South African producers do indeed need to close shafts, coupled with some reports for fresh interest from the automotive sector, has taken palladium back into a reasonable premium over platinum after briefly trading at a very small discount in February.

In trading terms, spot volumes were 15% higher than the 2023 daily average, with higher volumes concentrated in the second and third weeks of March, both on the way up and on the way down. The big rally on 6th March came on the back of Sibanye’s results that referred to a platinum mine impairment in late 2023, posted weaker-than-expected production guidance and posted a loss. At the time the shorts on NYMEX were a massive 49t and this contracted by five tonnes over the following week and it is certainly arguable that most of this covering was early in that week.

That rally did not produce much activity in the forwards or in LLD although options volumes picked up smartly as spot rallied from $1,024 to $1,109 in mid-month, suggesting call buying and the relevant delta hedging. Swaps and forwards did pick up towards month-end as prices eased towards $1,000 and then again as the month closed, with the result that volume was 31% higher than the 2023 daily average.

The CFTC numbers from NYMEX show an initial gain then gradual decline in outright shorts, which had been massive . At end-month, however, there was a renewed increase, so that over the month as a whole we dropped from 46.1t to 45.1t, a minimal change .Outright longs also traded in narrow volumes with an overall mildly bullish tone, resulting in a net increase from 10.2t to 11.8t, the highest since mid-December. The net position was a short of 33.3t, compared with a twelve-month average of 26.8t.

Exchange Traded Products were mixed. It looks as if investors have been taking profits where they see the chance, as ETP holdings contracted during the bull phase of the month and then expanded as prices retreated.

In January we said, “This nervous and illiquid market that will at some stage generate another short-covering rally, but the overriding sentiment is that any strength in price (barring exogenous shocks) will be generated by short-covering and nothing else”. Barring supply disruptions, we see little reason to modify that view.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.