- Gold analysis: precious metal weakens after strong CPI

- Gold likely to regain poise after CPI-related drop

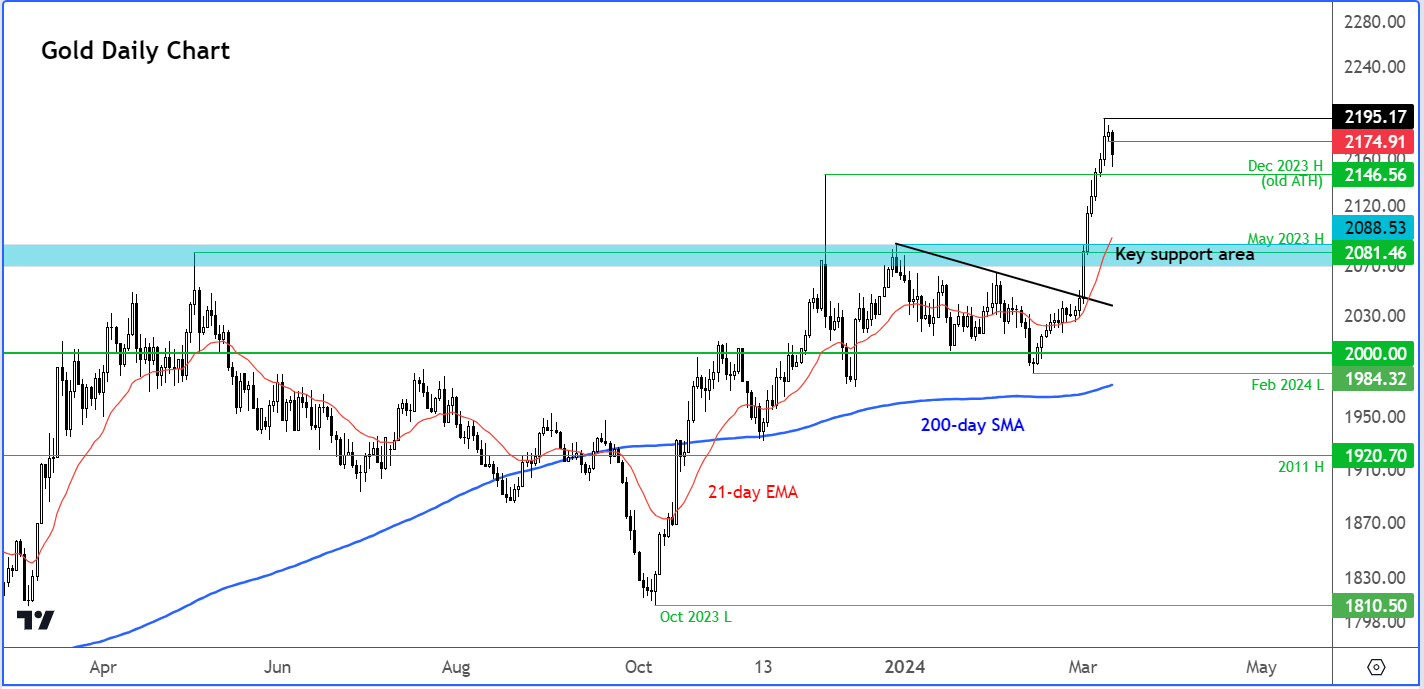

- Gold technical analysis point to a strong bullish trend

Gold analysis: precious metal weakens after strong CPI

Following last week’s sharp 4.6% gains to repeated all-time highs, gold investors were not in a hurry to pile in and push the metal further higher at the start of this week. There was always the possibility of a rebound in bond yields and the dollar, given the importance of inflation data and following a mixed jobs report on Friday. As it turned out, today’s CPI report was actually hotter-than-expected on both the headline and core fronts, which triggered a quick rally in the dollar and a sell-off in government bonds. As yields rose, the opportunity cost of holding gold increased, as too did the selling pressure. Still, the weakness was not too significant in the grand scheme of things, with the metal shedding some $25 worth of gains. Even if gold were to weaken more in the short-term, this wouldn’t necessarily be a sign that the metal has topped. In fact, many investors who missed the opportunity to buy gold when it started to rally last month, will be waiting to pick up short-term dips. So, more gains could well be on the way soon.

US CPI rises to 3.2% in February

At 3.2%, headline CPI accelerated against expectations from 3.1% recorded in the month before. Core CPI was expected to ease to 3.7%, but it came in at 3.8%, albeit a touch lower from the previous print of 3.9%. Still, this was the third month of above-forecast inflation with prices of basic necessities like car insurance, transportation and hospital services all rising noticeably. Looking ahead, we have more inflation data coming up later in the week with PPI on Thursday and UoM Inflation Expectations survey on Friday. But CPI was the main data highlight this week and it didn’t disappoint those who were calling for a stronger print.

Gold analysis: Can the metal regain poise after CPI-related drop?

Well, stock market investors have certainly shrugged off the strong CPI print, so why can’t gold investors? Either that, or stock markets are under pricing the risks of inflation remaining sticky for even longer. So, there is a chance that we may see gold and silver stage a comeback either later in the day or week, for as long as we don’t see too much technical damage.

As mentioned, the stronger and sticky inflation data caused gold to weaken, but US equity markets managed to rebound as technology stocks rallied. Investors are clearly still expecting the the Federal Reserve to cut interest rates this year, with the odds of a June trim rising to more than 70%.

With the market remaining confident of a rate cut in June, despite a slightly stronger CPI report, gold’s weakness should be short-lived.

Gold technical analysis

Source: TradingView.com

Gold has only on Friday reached a fresh record high, so there is no reason to be extremely bearish just because of a slightly above-forecast inflation print. While there is the potential for gold to weaken a bit more, key short-term support is now not too far around $2146, which was the high made back in December. Below this level, $2100 is the next round level to watch, followed by long-term support, around the $2081/88 area, which was once strong resistance. Therefore, even if gold were to weaken more in the short-term, this wouldn’t necessarily be a sign that gold has topped. In fact, many investors who missed the opportunity to buy gold when it started to rally last month, will be waiting to pick up short-term dips.

— Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore - Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade