- Silver analysis: Metal breaks bull flag resistance trend

- Powering industries and paving the way for future growth

- What to watch out for this week

Our gold and silver analysis remains bullish. The precious metals’ prices rose on Monday before easing back a little at the time of writing on Tuesday. Out of the two metals, silver’s rise was more eye-catching as the new week began, with the metal rising a good 3.3% on the session. Silver rally has helped it to climb out of a consolidation pattern, suggesting that it may be ready to challenge the key $30 level in the next few days or weeks after coming just short of it during April’s rally.

Both metals have enjoyed a strong performance so far in 2024, even if the momentum faded somewhat since mid-April. However, the long term trend for both metals remain positive amid a favourable macro environment.

Friday’s disappointing US macro data and continued signs of sticky inflation are helping to keep precious metals supported. The probability of a Fed rate cut by September has increased again, although more evidence of an economic slowdown is needed for a significant repricing of US interest rates. Despite limited data this week, the longer-term outlook on gold and silver remains bullish.

Before discussing these macro influences on gold, and especially silver, let’s first take a look at the chart of the grey metal as we have had some interesting price action this week…

Silver analysis: Metal breaks bull flag resistance trend

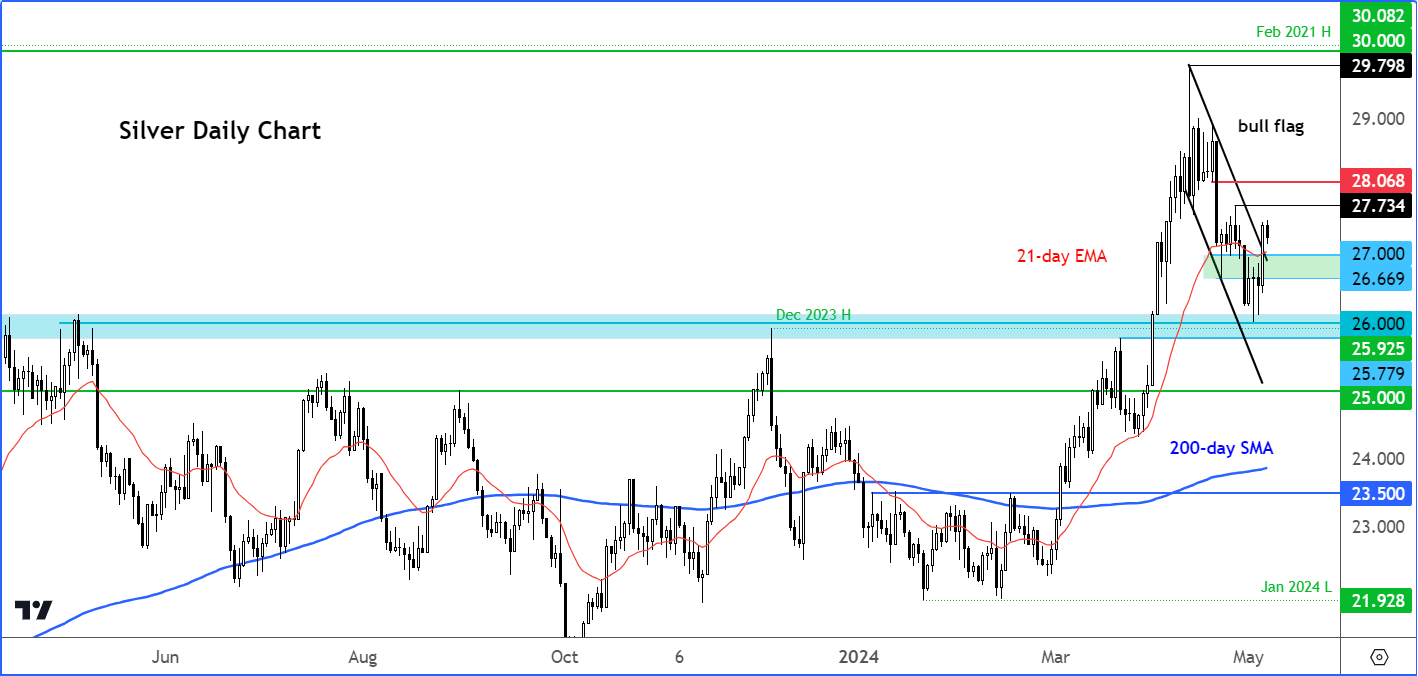

Following Monday’s rally, silver managed to break and close above the short-term bearish trend line of the bull flag pattern that had been in place since the metal created what looks like an interim top last month at just below $29.80. With the metal now out of the bull flag continuation pattern to the upside, silver may have provided the bullish signal many traders, who missed out the big rally last month, what they were looking for.

The grey metal has also moved above its 21-day average and momentarily at least the high of last week at $27.44.

Thanks to these bullish indications, I will be looking for the buyers to now start fading into short term dips. Today’s slightly weaker start may lure dip-buyers later on.

Short term support is now seen around $27.00 area, which is the other side of the broken trend line. The highs from Thursday and Friday of last week, now representing the first trouble area for the bears, are additional support levels to watch at $26.82 and $26.89.

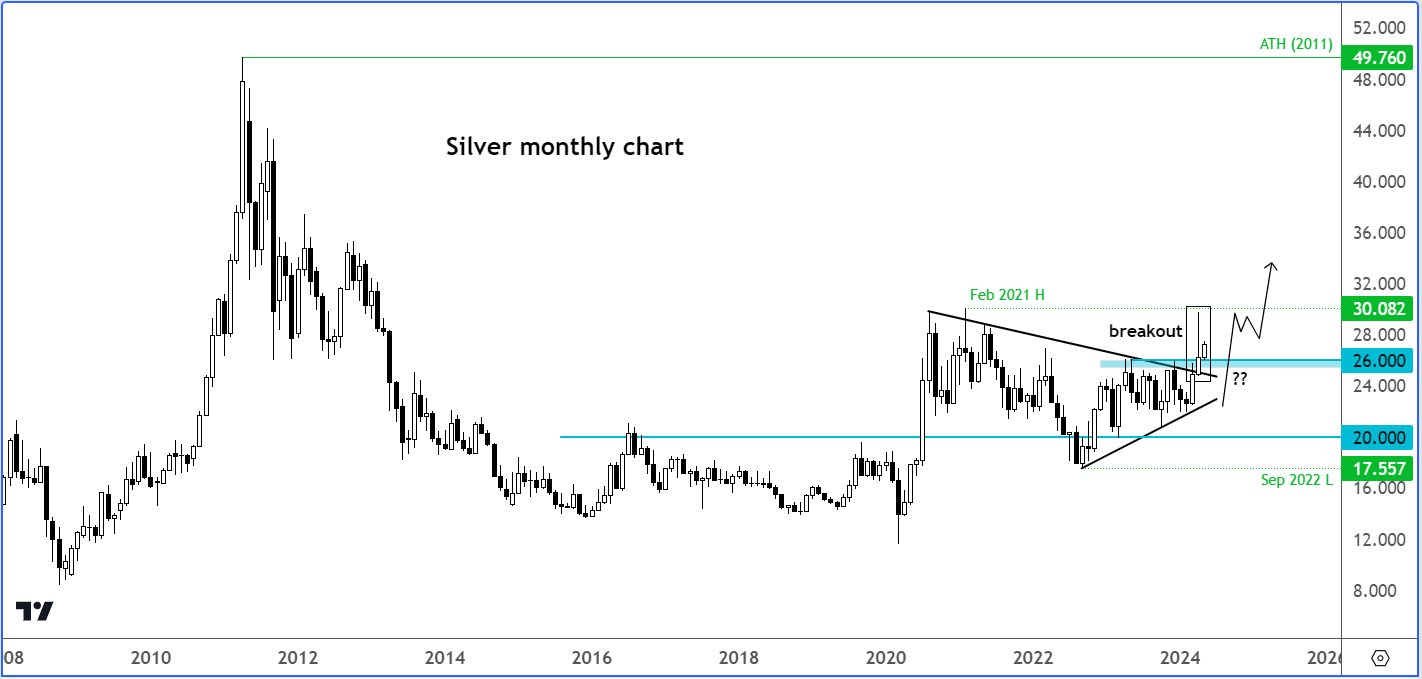

Silver’s big breakout lost some momentum in the last few weeks of April. But the monthly chart still closed well above prior resistance in the $25.78-$26.00 range. That marked a second consecutive monthly gain and a breakout from a 3.5-year consolidation zone. Well, that breakout was above a well-established bearish trend line anyway, as the rally didn’t quite take us above the high of $30.00ish that had capped the gains at the height of the Covid pandemic, when lockdowns and mine closures had raised supply worries and triggered that move.

Still, the multi-year consolidation and the now the desire to move high means the metal has now found renewed fundamental driver to potentially push it well beyond that $30 mark. This time, it is all about inflation concerns and expectations of elevated demand for silver’s use in industrial processes.

Silver analysis: Powering industries and paving the way for future growth

In addition to being a precious metal and a great market to trade, silver boasts diverse industrial applications, such as electronics, solar panels, medical equipment, and automotive components. Its conductivity and reflectivity make it essential in electronics for circuit boards and microchips. In solar energy, it’s vital for photovoltaic cells. The electric vehicle market also relies on silver for batteries and infrastructure. Moreover, silver’s antimicrobial properties enhance its use in healthcare equipment like wound dressings.

Many analysts believe that the demand for silver is poised to surge with technological advancements, renewable energy growth, and sustainability trends. As industries evolve, silver’s versatility will continue to play a crucial role in shaping various sectors as mentioned above, and more.

So, the demand outlook for silver is bullish and for as long as supply growth does not exceed it, prices should remain supported.

What has supported gold and silver prices this year?

Gold’s rise this year is fuelled by persistent inflation eroding fiat currencies. Recent profit-taking and Fed rate cut delays led to a temporary weakening. Yet, investors eye price dips for buying opportunities, citing precious metals’ resilience against a strong dollar and rising bond yields. With ongoing central bank gold acquisitions and their role as inflation hedges, demand remains robust.

Despite strong inflation figures, softer survey-based data and economic indicators suggest a potential economic slowdown in the US later this year. The closely watched ISM manufacturing and services PMI data from last indicated contraction in both sectors, alongside softening labor markets. Elevated inflation and weakening leading indicators hint at future policy easing, supporting gold as an inflation hedge and a dollar-denominated asset.

What to watch out for this week

Well, there are not many major macro releases today, tomorrow or Thursday to significantly influence the direction of the US dollar. As such, gold and silver may remain supported thanks to their revived bullish momentum following the release of weaker US economic indicators on Friday. That said, we do have plenty of Fed Speak that could influence the dollar and by extension precious metals.

This Friday, attention will turn to the University of Michigan’s Inflation Expectations survey. Inflation expectations have been on the rise this year. And another stronger print could benefit gold, even as it strengthens the dollar.

In summary, silver’s rise amidst inflation concerns, potential Fed rate cuts, and technical indicators all point to continued upward momentum, barring any major unexpected surprises from economic shifts.

Source for all charts used in this article: TradingView.com

— Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore - Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade