Precious metals were looking strong even before the release of US CPI data, with gold holding in a bullish consolidation pattern following last week’s 2.5% gains and silver was already on the ascendency over the past couple of days. Both metals rallied once the CPI report was released, and after some profit-taking, recovered again to rise to fresh session highs. Our silver analysis suggests that the precious metal now looks poised to hit that key $30 level and potentially rise far beyond that level, if the recent gains by gold and copper are anything to go by.

Silver analysis: US dollar drops on weaker US data

Today’s data releases from the U.S. underscored the view that the economic growth is losing momentum and that inflation is heading lower. This gave traders, who had already been selling into the dollar’s recovery attempts, more reason to swap their dollars for foreign currencies and precious metals. For the same reason, equity indices hit fresh record highs in the US.

As well as the monthly headline CPI missing expectations with a print of +0.3% m/m compared to +0.4% expected, we also saw a flat headline retail sales print when a 0.4% increase was expected. What’s more, the Empire State Manufacturing Index painted another gloomy picture for the manufacturing sector, with yet another below-forecast negative reading (-15.6 vs. -9.9 expected).

In recent weeks, we have also seen the April non-farm jobs report, the latest ISM surveys and the weekly jobless claims data, all disappointing expectations.

So, it looks like the US economic recovery is slowing, and this will help bring inflation down, reducing the need to keep monetary policy tight for an extended period of time. The Fed’s tapering of its balance sheet runoff has been an additional bearish factor for the dollar.

Meanwhile, external factors are also helping to weigh on the dollar, boosting the appeal of precious metals. The big recovery in Chinese markets and the higher copper rally all seem to indicate that China has turned a corner. What’s more, we have seen improvement in Eurozone and UK data too, boosting the appeal of the euro and pound.

Thus, gold and silver’s recent gains partly reflect a weaker dollar and increased odds of a rate cut by the Fed, although the bulk of its gains have been driven by inflation hedging demand and central bank purchases (in the case of gold).

Silver analysis: Technical levels and factors to watch

Source: TradingView.com

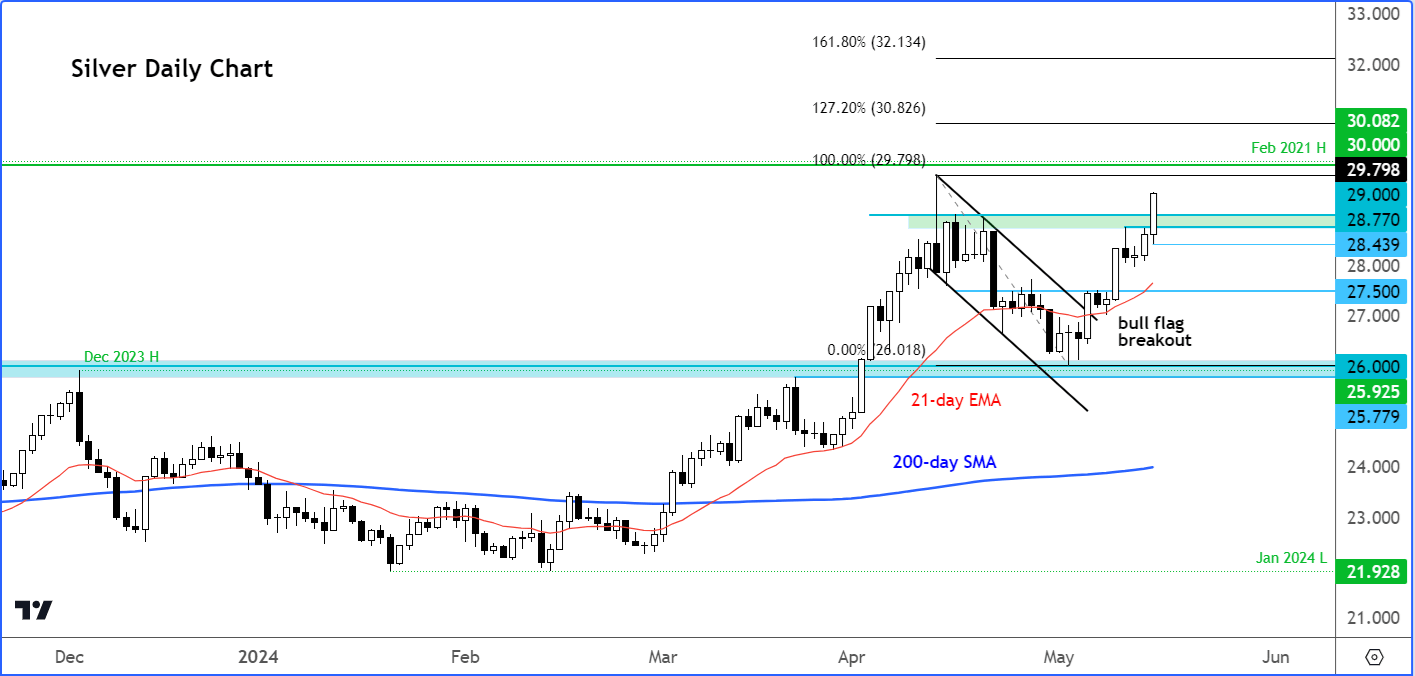

Silver is about to take out $30, by the looks of its. For as long as today’s earlier low at $28.43 holds, the path of least resistance will remain to the upside. Short term support is now seen around $29.20, followed by $29.00 and then $28.75-$28.80 zone.

On the upside, last month’s high comes in at $29.80. Above this level we have the psychologically important $30 level where silver has topped in the last few years. If and when silver breaks and hold above $30 this could potentially pave the way for a run towards its 2011 record high near $50. But we are miles from there and the immediate focus is now on $30. Can we break above this level and hold there?

Silver analysis video and insights on gold and major FX pairs

— Content created by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore - Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade