- Gold analysis: Reasons why gold has been largely out of favour so far in 2024

- Gold likely to struggle in short-term but long-term outlook is positive

- FOMC and NFP among week’s key macro highlights

Gold and silver were trading noticeably higher in the first half of Monday’s session, despite the dollar rising against the likes of the euro and pound. Gold climbed above $2035, and silver breached the $23.00 level before the US cash equity markets opened. Gold is aiming to break free from a series of weekly losses after a less-than-ideal start to the year. Despite experiencing a downturn at the beginning of 2024, the precious metal concluded 2023 with three consecutive months of gains in Q4, briefly reaching a new all-time high in December. The prolonged uptrend indicates a bullish trajectory for gold in the long term. However, it remains uncertain if the short-term fluctuations will align with this overarching trend in the near future. Key US data and central bank meetings scheduled for this week possess the potential to influence the metal’s direction, with the risks skewed to a modest downward movement, in my opinion.

Gold analysis: Reasons why gold has been largely out of favour so far in 2024

Gold showed a modest decline last week, although still managed to remain above crucial support in the $2000 range, supported by geopolitical risks in the Middle East. The precious metal has faced a few challenges in the early part of this year, preventing it from rising to a new high. There are at least three primary factors behind gold’s struggles, all of which could be temporary obstacles:

- The first reason behind gold’s slows start can be attributed to a positive risk sentiment prevailing in financial markets, with major US indices reaching new record highs last week amid the tech-fuelled rally. Investors have favoured the racy technology sector stocks over safe-haven assets like gold or the yen.

- Secondly, the US dollar has seen an upward trajectory, with the Dollar Index rising in almost all of the weeks of the year thus far, exerting pressure on certain dollar-denominated assets such as gold and silver.

- The third factor contributing to gold’s struggles this year relates to investors postponing their expectations of rate cuts, leading to a rise in bond yields and consequently increasing the opportunity cost of holding assets with zero interest rates (like gold) compared to those that do (such as bonds and stocks with dividends).

These factors have counteracted the safe-haven demand for gold stemming from escalating tensions in the Middle East and the belief that global interest rates have peaked, which propelled the precious metal to a new all-time high in December. As we head deeper into the year, I anticipate that these expectations regarding interest rate cuts will provide support for gold on any short-term declines.

Gold analysis: Metal likely to struggle in short-term

The initial strength observed in gold could diminish once again this week, given the dollar’s resilience against other currencies. The robust economic growth in the US is providing room for the Fed to ease off on immediate rate cuts. The upcoming FOMC meeting may witness the Fed maintaining a resolute stance against excessive dovishness. Another crucial point of interest is the US Treasury’s Quarterly Refunding announcement on Wednesday, when there is a risk of higher yields and a potential weakening of gold as a consequence.

In addition, quarterly earnings reports from a few of the ‘Magnificent Seven’ technology firms this week might divert investor attention toward equity markets rather than gold, especially if the tech rally persists. The week concludes with the release of the monthly non-farm payrolls report. If the recent trend of stronger-than-expected labour market data continues, reinforcing the rationale for the Fed’s cautious approach to rate normalisation, it could be another factor restraining gold in the near-term outlook.

But there’s no doubt in my mind about gold’s longer-term bullish view.

Gold’s longer-term outlook remain positive

As we go deeper into the year, it is likely that global inflationary pressures will calm down absent any major supply shocks, making room for possible interest rate cuts. The European Central Bank could be the first to loosen its policy, although it could be beaten by the Federal Reserve in kicking off this process. The rate-cutting may start in the second quarter or more likely later in the year. This delay could be due to some officials from these central banks taking a relatively hawkish stance and concerns about sticky inflation in Europe.

The Fed has plans for three rate cuts in 2024, but the actual timing and how big the cuts will be dependent on the data coming in. Just like gold got a boost in 2023 when rate cuts were expected, we might see similar gains in 2024 as central banks adopt more accommodating policies, leading to lower yields. With inflation on the rise in recent years and fiat currencies losing value, there’s undoubtedly demand for gold. As a trusted store of value for many, gold is likely to get some support during short-term pullbacks.

Gold technical analysis

Source: TradingView.com

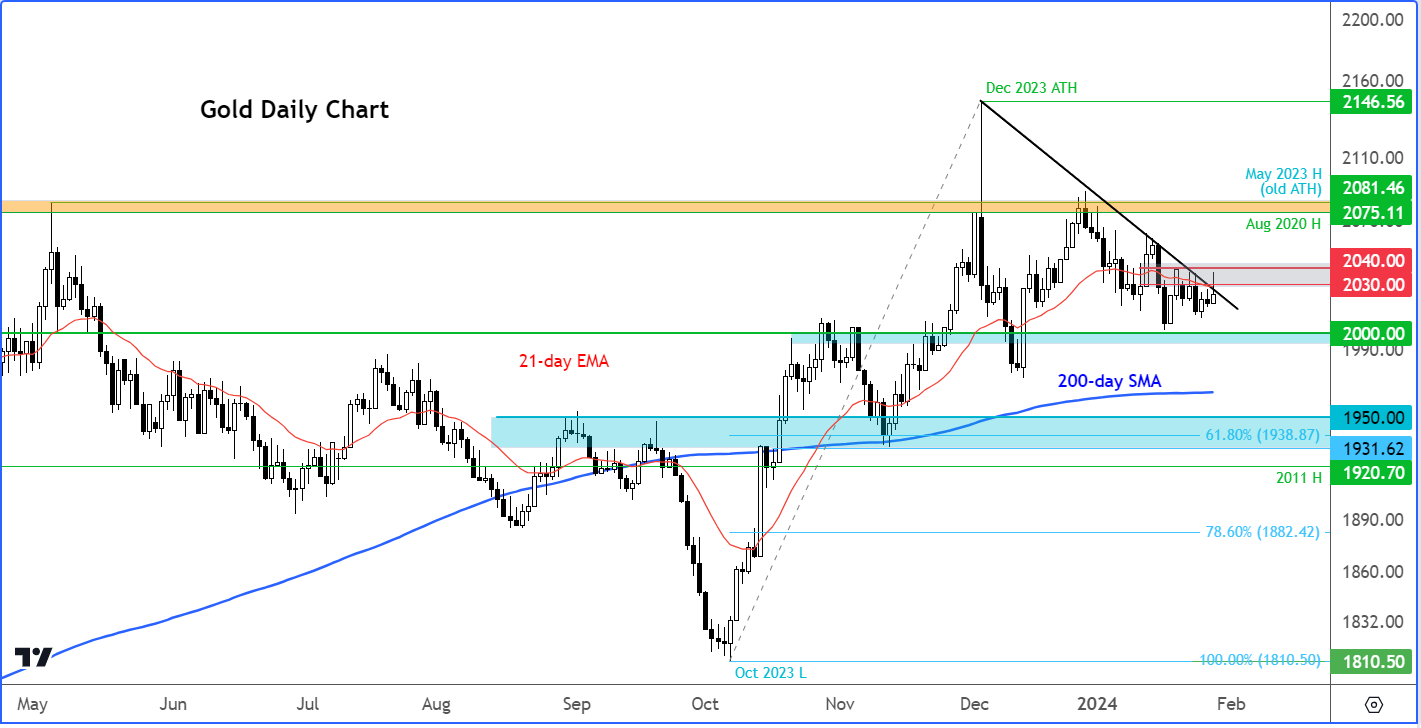

The current technical position of gold might not spark much excitement among traders, as it remains in a holding pattern despite a stronger start to the week. Consequently, many gold traders are likely to stick with range-bound trading, at least in the early part of this week. If macro events later in the week lead to a breakout or breakdown, trend trading may become a more suitable strategy.

I’m keeping a close eye on key zones, particularly the range between $2030 to $2045 on the upside, where resistance has been observed recently, and support around the $2000 mark. For bullish trend-following traders, a clean move above $2045 would be considered ideal. On the other hand, the bears would prefer to see a convincing break below the $2000 support level.

Although I maintain a bullish outlook on gold in the long term, I currently lean towards fading into any short-term strength. This approach is influenced by the overall bullish trend of the dollar and central banks’ resistance to rate cuts.

— Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore - Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade