J Studios

I have not written on precious metals for months… till now, where I see huge upside potential for gold.

I first published a bullish view on gold (XAUUSD:CUR) on 23 February when gold was trading at $2031.

My subsequent article on 25 April called for a near term top on precious metals. Then, gold was trading at $2315. My view was that gold could pull back to $2100, an attractive buy level.

That steep pullback did not materialise, but it proved to be a near term top in gold, as prices spent the next 4 months consolidating in a range.

Now, gold looks ready to embark on its next leg higher, and I have initiated a long position at $2505, with stop at $2449. I will look to add to this position if price action proves constructive.

Daily Chart: XAUUSD

TradingView

Just look at the beautiful 4-month base gold has been trading in. We may observe that the key moving averages on the daily chart (10, 20, 50 day) have all caught up substantially with price, so prices are not as stretched as back in April. Markets alternate between periods of low and high volatility, and we are now on the verge of breakout territory.

The upward sloping neckline of this base (demarcated in the daily chart above) denotes persistent buying pressure that has been coming in during these 4 months, thus leading to a series of higher highs and higher lows.

Technically, this chart looks close to 5-star in my opinion.

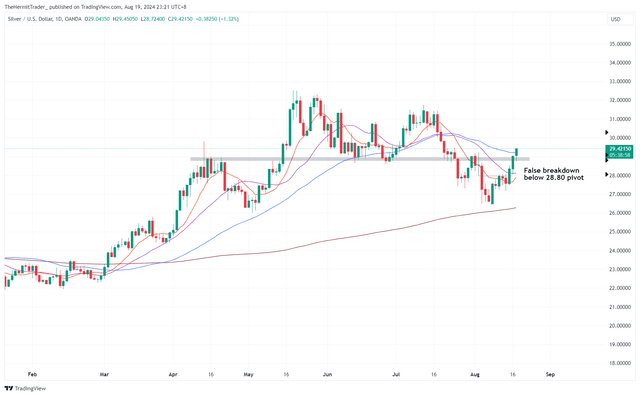

When we look at correlated charts, silver (XAGUSD:CUR) has also largely been range bound for 4 months. Prices broke below the $28.80 key pivot back in July, but instead of following through lower, have swiftly reclaimed above this level again.

Daily Chart: XAGUSD

TradingView

This is likely to be a “false breakdown”. As the saying goes, “from false moves come fast moves in the opposite direction”. We could now see swift upside in silver prices.

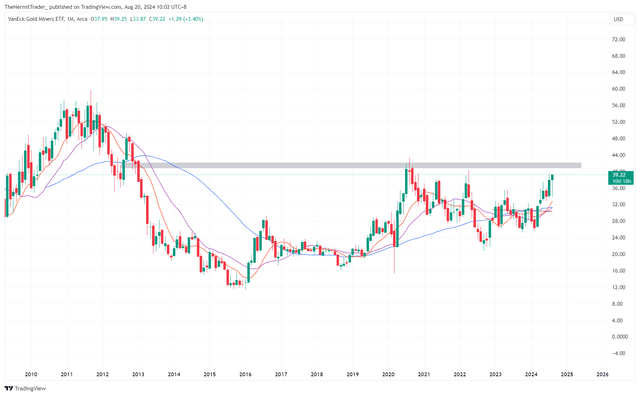

Gold miners (GDX) have also been building a massive, rounded base, dating back to 2013. This is a 11.5 year base! As the saying goes, “the larger the base, the higher in space”. If gold miners successfully breakout higher from this base, we will likely see the start of a powerful bull run.

Monthly Chart: GDX

TradingView

Macro forces are also combining to support gold prices. We have bond yields and the USD falling, as the Fed is deemed to be behind the curve, and is now under pressure to begin a rate cut cycle. Lower yields and a weaker USD are likely to be powerful drivers of higher gold prices.

In addition, we have geopolitical tensions brewing in the background surrounding Iran and Israel. This could support gold prices, although I think the former catalyst of a dovish Fed is a more powerful one.

With gold’s recent 4-month consolidative range spanning 10% from its low to its high, I am targeting at least 10% upside if the breakout proves successful. This will bring gold prices to approximately $2750 to $2800, which, I think, could happen in the next 8 weeks.