- Gold is outperforming Silver, so traders should be more confident of being long of Gold than of Silver.

- Gold is breaking to new record highs, while Silver has broken to a new 11-year high.

- The best new trade opportunities which might set up today will likely be a long trade in Gold above the $2450 area or in Silver above $32.50.

- Stock markets are mostly bullish, which is probably good news for further rises in Gold and Silver.

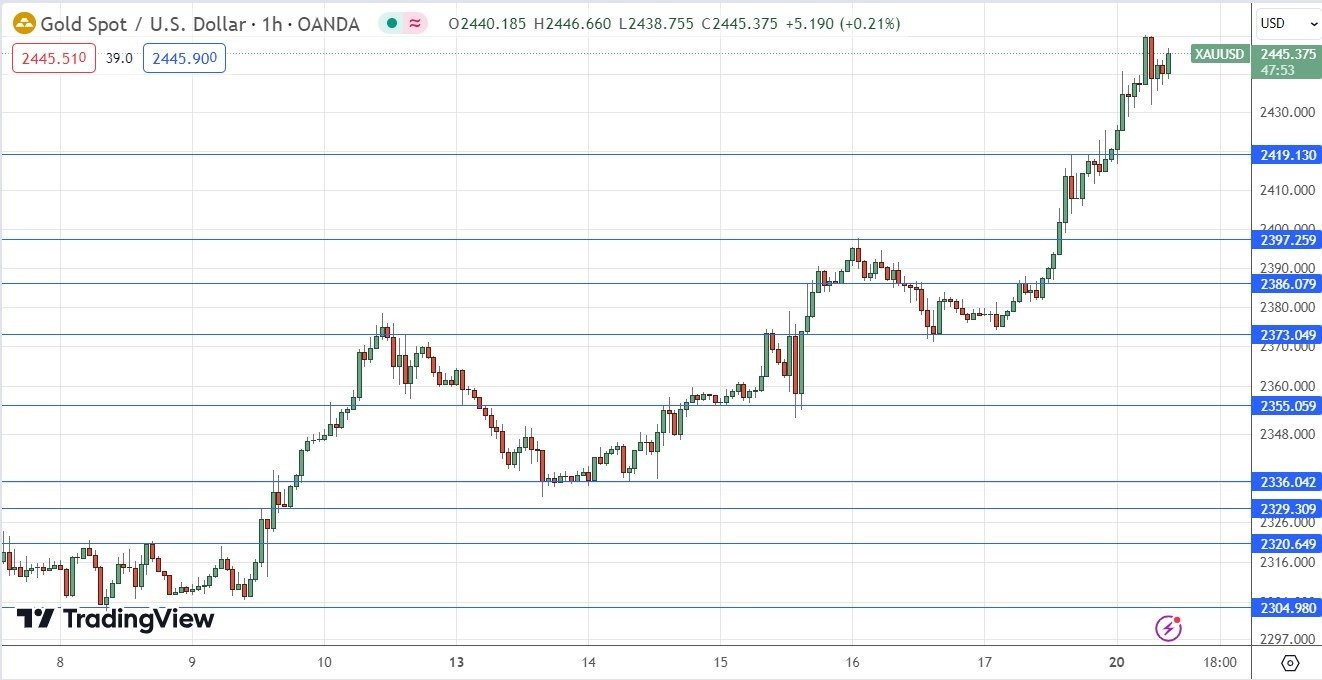

The price chart below shows that Gold is well established within a long-term bullish trend. Bulls can be excited and optimistic for several reasons:

- The price has reached a new all-time high for the second consecutive day and is trading in blue sky, so has no obvious resistance levels to stop it except the high and round numbers above that.

- Precious metals as an asset class are generally bullish, and Gold is showing more bullish short-term price action than Silver.

- Stock markets are rising in most geos and there is generally risk-on bullish sentiment in the markets. These conditions have historically been correlated with a rising price of Gold.

After reaching a record high of $2450 just a few hours ago, the price made a small bearish retracement, but it is now rising again and is just a few Dollars off $2450.

Traders should consider entering a speculative long trade if the price gets established later today above $2450, which can usually be measured by two consecutive higher hourly closes above that level, without the second hourly candlestick having a significant upper wick.

The price chart below shows that Silver is well established within a long-term bullish trend. The price has been rising very strongly, and within the past few hours it reached $32.50 which is an 11-year high. There are several reasons to be bullish:

- The price has reached a new 11-year high for the second consecutive day and is trading in blue sky, so has no obvious resistance levels to stop it except the high at $32.50 (which is also a half number) and round numbers above that.

- Precious metals as an asset class are generally bullish, although Gold is showing more bullish short-term price action than Silver. Traders looking to go long here might consider being long of Gold instead of Silver, or being long of both, but overweight Gold.

- Stock markets are rising in most geos and there is generally risk-on bullish sentiment in the markets. These conditions have historically been correlated with a rising price of Silver.

A few hours ago, the price made a relatively shallow retracement from the high at $32.50, printing new support at $31.62 where it made a bullish bounce. The price is now rising again.

Traders should consider entering a speculative long trade if the price gets established later today above $32.50, which can usually be measured by two consecutive higher hourly closes above that level, without the second hourly candlestick having a significant upper wick.

Traders who prefer to buy at bounces on support after dips could try to enter if we get another bullish bounce at the support level of $31.62 later today.

Ready to trade our precious metal price forecast? Check out our list of the best Gold brokers and the best Silver brokers worth trading with.