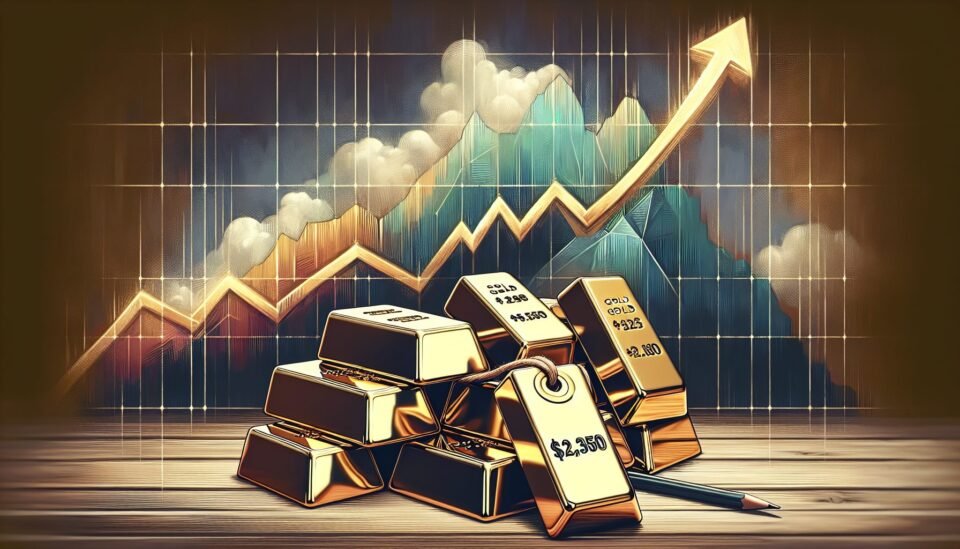

In an exciting development, precious metals like gold, silver, and platinum are enjoying a remarkable market stride. Gold has now surpassed a high of $2,350, with silver and platinum not far behind, exceeding $31.50 and $1,050 respectively.

The decreasing gold/silver ratio is making investors sit up, signaling a potentially robust silver market. This, coupled with rising costs of these metals, signals a thriving sector for those who have placed substantial bets on precious metals.

The interest in precious metals is skyrocketing. As gold’s value continues to rise, unusual or antique pieces are catching the eye of both collectors and investors. The anticipated resistance levels for gold are predicted between $2390 to $2400, assuming the price remains above $2,350.

Just like gold, silver is on a robust uphill journey too, with potential resistance expected between $30 and $31, given it retains a steady price above $29. Recognizing this upward trend, a growing number of buyers are now expanding their financial portfolios to include gold and silver.

Palladium and platinum are also on the uptake.

Gold’s ascent: tracking precious metals’ performance

Experts are recommending potential investors keep a close watch on these metals, especially considering the fluctuating economic environment.

Silver stands tall with the gold/silver ratio at its lowest since last year, generating a vibrant market rally. If silver continues to hold its position above $31.50, it may reach resistance levels between $33.50 and $34.00.

Meanwhile, platinum is partaking in the global rally in precious metals. Experts are watching for price per ounce to possibly surpass $1,080, which could signify a strong bull market for platinum.

Despite the controversies in the digital currency arena, Ethereum is nearly at the $5k mark, thanks to a $2 billion boost from ETF approval. This is despite recent scandals like TerraUST’s founder, Do Kwon, facing crypto fraud charges.

Ex-President Donald Trump is encouraging the U.S to strategically approach this expanding market, amidst controversies and impeachment inquiries.

On the economic front, despite the consumer sentiment index in Michigan unexpectedly dropping to 69.1, durable goods orders have been continually increasing for the third month. Possibility of bolstered crude oil prices is looming due to supply constraints by OPEC+.

As far as Bitcoin’s performance is concerned, despite its overall muscular showing, there are whispers of potential stress. Silver, on the other hand, seems stable at around $31.36, despite a weakening USD. However, the rumor mill is buzzing with talks of a likely sell-off.