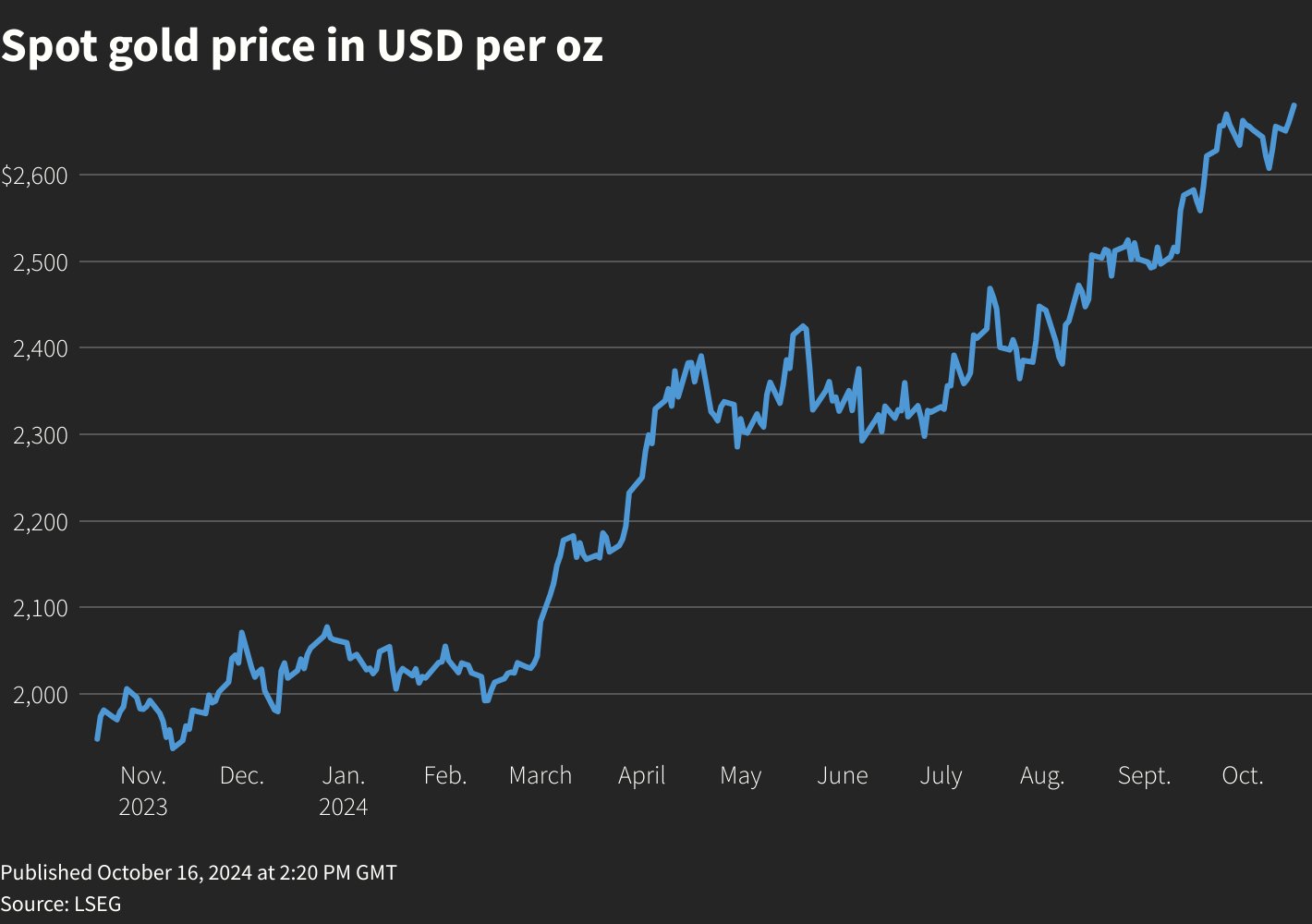

Oct 16 (Reuters) – Gold advanced towards record highs on Wednesday as gains in non-yielding bullion were bolstered by weakness in U.S. bond yields and expected rate cuts by major central banks, with additional safe-haven support from ongoing geopolitical conflicts.

Spot gold rose 0.5% to $2,673.24 per ounce by 5:30 p.m. ET (2130 GMT), inching close to a record high of $2,685.42 it hit on Sept. 26. U.S. gold futures settled 0.5% higher at $2,691.3.

“Expectations of a 25-basis-point rate cut by the U.S. Federal Reserve in November are solidifying, weaker inflation data in Europe and the UK have increased expectations for more aggressive ECB and BoE easing, leading to generally lower yields which have lifted gold,” said Peter A. Grant, vice president and senior metals strategist at Zaner Metals.

“There’s even an outside chance we could see close to $3,000, and that’s probably more of a Q1 2025 target,” Grant said.

U.S. Treasury yields fell to their lowest in over a week, making gold more attractive as it tends to thrive in a low interest rate environment.

Delegates to the London Bullion Market Association’s annual gathering predicted gold prices would rise to $2,941 over the next 12 months and silver prices would jump to $45 per ounce.

Spot silver firmed about 0.6% to $31.67. Platinum rose 1% to $994.43 and palladium climbed 1.5% to $1,024.76.

Sign up here.

Reporting by Anushree Mukherjee in Bengaluru, additional reporting by Swati Verma; Editing by Krishna Chandra Eluri and Tasim Zahid

Our Standards: The Thomson Reuters Trust Principles.