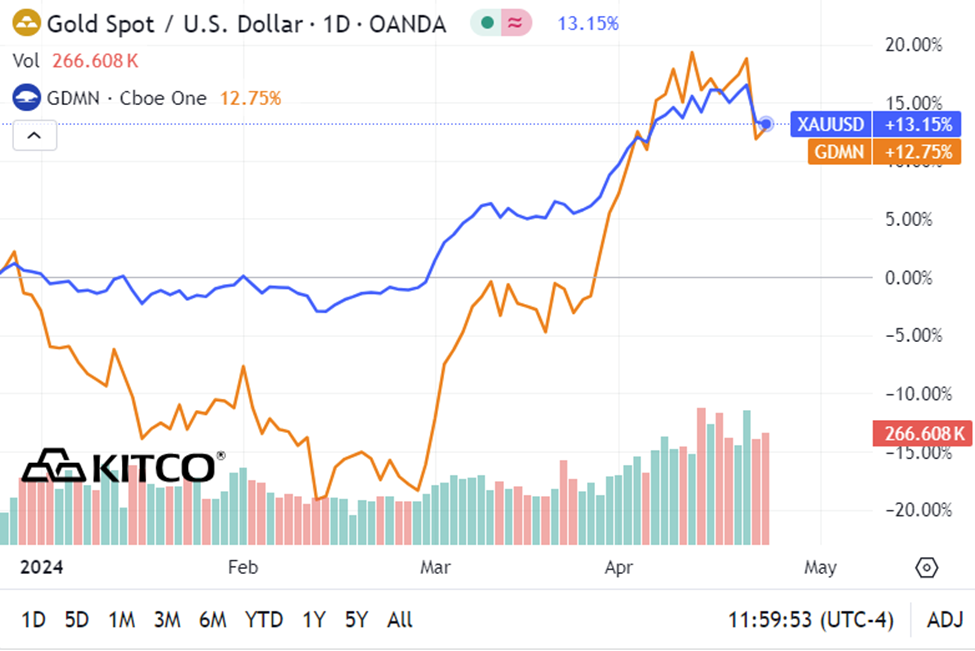

(Kitco News) – Although the gold market has seen an unprecedented rally to record highs above $2,400 an ounce, the mining sector continues to see lackluster demand, significantly lagging behind the precious metal.

However, sentiment could see some solid positive growth as the sector’s first-quarter earnings season quickly approaches, according to fund managers at WisdomeTree. Although gold‘s rally to record highs started in the final month of the first quarter, prices saw significant growth in the first three months of the year.

The average gold price during the first quarter was roughly $2,130 an ounce, up more than 5% compared to average prices seen in the fourth quarter of last year. Average prices are up more than 9% compared to this time last year.

Jeremy Schwartz, global chief investment officer at WisdomTree, said in an interview with Kitco News higher gold prices are expected to have a significant impact on company margins, even if costs have risen.

Schwartz added that it’s only a matter of time before investors recognize the value in the mining sector.

“I’m looking at the earnings growth over the next 12 months and for a gold miners’ basket something like 45%,” he said. “I see estimated earning growth ahead of the S&P 500 and ahead of tech stocks over the next three to five years.”

Schwartz noted that they are already seeing signs of the sector’s outperformance. He said that WisdomTree gold miners ETF, WisdomTree Gold Plus Gold Minters Strategy Fund (BATS: GDMN) has been one of the best performing funds so far this year.

“It’s up around 15% year-to-date because of its gold overlay,” he said.

Although higher gold prices are generating some new attention in the mining sector, Schwartz said it is not surprising that generalist investors continue to ignore it. He pointed out that in the last decade, it has done nothing after hitting unsustainable record highs in 2011. Investors were significantly burned in the 2010 rally as major gold producers blew out their balance sheets to chase production.

As gold prices fell, sector earnings took a significant hit as companies were forced to write down many of their projects. Schwartz said that the sector has seen major negative sentiment since then.

Schwartz noted that even within WisdomTree, GDMN doesn’t get much attention, even though it has become one of its top funds.

“The history of the mining sector has not been great. Going back 18 years, they’ve had less than 1% return; so, they’ve done nothing for two decades,” he said. “Instead, investors are chasing more exciting returns in the tech sector and AI.”

Christopher Gannatti, global head of research, said that it’s going to take some time to undo the perceptions in the last 20 years. However, he added that sentiment is slowly starting to change.

Gannatti added that along with the value play, investors are starting to take more defensive positions in their portfolios to protect their wealth and purchasing power.

With inflation remaining stubbornly high, gold miners, with their strong correlation to the precious metal, can be a good hedge against rising consumer prices.

“We see a strong case for investors to dial up their inflation-sensitive exposures,” he said. ‘It’s not even just inflation; there are some geopolitical risk elements that can come into the fore; there are some government debt issuance elements that can come to the fore. All these elements are percolating in the background, so dialing up exposure to assets like gold could make some sense.”

As to what it will take to bring generalist investors back into the fold of the mining community, both Gannatti and Schwartz said mining companies must show consistent balance sheet prudence in these higher price environments.

Schwartz added that stable earnings over the next few quarters would allow companies to increase their cash margins and reward investors with share buybacks.

“Sometimes it takes a few quarters for the earnings to come in, but then the earnings potential will start being picked up on quant screens, and investors will take notice,” said Schwartz. “I think it’s really the earnings power of these companies that will drive their market share. And if they’re going to compete, they got to keep delivering better earnings growth.”

Gannatti pointed out that although gold has seen an unprecedented run in the gold market, it has been a fairly quick move.

“If gold is able to exhibit some stability and people get used to this sort of relative range in prices above $2,000, that can create a very nice foundation to allow people to think more about the miners, ” he said.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.