In the ever-evolving world of precious metals, Franco-Nevada Corporation stands as a beacon of resilience and growth. As of February 13, 2024, the company boasts a market cap of $20.47 billion, securing its position as the 874th most valuable company globally by market cap.

Franco-Nevada: A Royalty and Streaming Powerhouse

Franco-Nevada’s success lies in its unique business model. As a precious metals royalty and streaming company, it provides a less risky alternative to traditional mining companies. By securing royalty and streaming agreements, Franco-Nevada gains exposure to a diversified portfolio of mining assets without bearing the operational risks associated with mining activities.

The company’s income stems from two primary sources: royalties and streams. Royalties typically apply to a small fraction of a mining project’s production, with no ongoing payment obligations. Streams, on the other hand, involve the right to purchase a percentage of a mine’s output at a predetermined price.

Market Capitalization: A Measure of Worth

Market capitalization, a common metric for gauging a company’s worth, represents the total market value of a publicly traded company’s outstanding shares. With a market cap of $20.47 billion, Franco-Nevada demonstrates its strong footing in the precious metals industry.

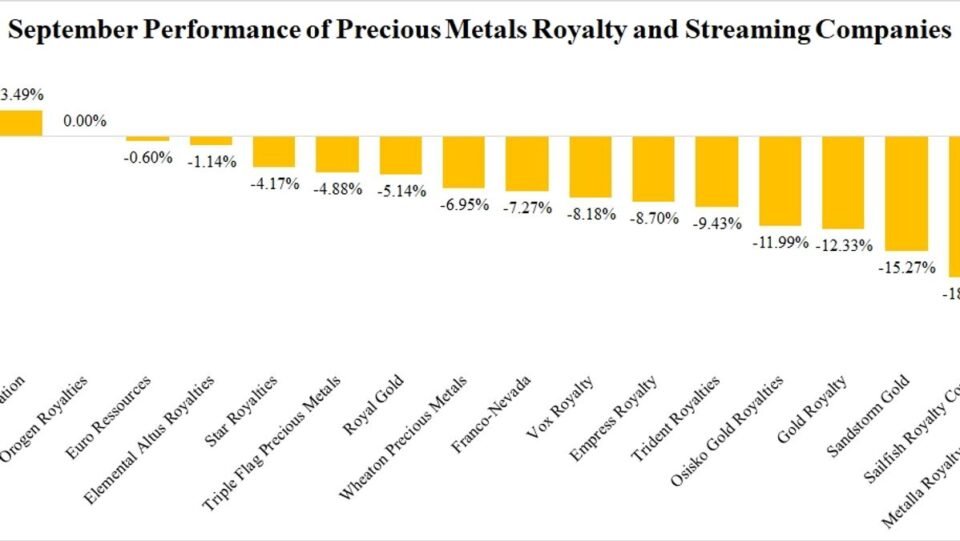

Despite the recent 3.68% decrease in the Precious Metals Royalty and Streaming Index in January 2024, Franco-Nevada continues to thrive. This decline can be attributed to the overall poor performance of precious metals and mining stocks.

Analysts’ Outlook: A Mix of Optimism and Caution

Analysts have set varying price targets for Franco-Nevada, reflecting the diverse perspectives on the company’s future performance. Institutional ownership stands at a notable level, indicating confidence from major investors.

Franco-Nevada’s earnings expectations remain positive, with a dividend payout ratio that appeals to income-focused investors. The company’s P/E ratio and P/B ratio also suggest a favorable valuation compared to industry peers.

With an upcoming earnings announcement, investors and analysts eagerly await the release of quarterly earnings data. Past performance indicates a company capable of weathering market fluctuations and delivering consistent results.

In the complex landscape of precious metals, Franco-Nevada’s story serves as a testament to the power of innovative business models and strategic decision-making. As the company continues to navigate the intricate web of global markets, its journey unfolds as a captivating tale of resilience and growth.

Key Takeaways:

- Franco-Nevada Corporation, a precious metals royalty and streaming company, has a market cap of $20.47 billion as of February 13, 2024.

- The company’s unique business model provides exposure to a diversified portfolio of mining assets with reduced operational risks.

- Market capitalization serves as a measure of a company’s worth, with Franco-Nevada ranking as the 874th most valuable company globally.

- Despite recent declines in the Precious Metals Royalty and Streaming Index, Franco-Nevada’s strong fundamentals and positive earnings expectations position it for continued success.