Nitesh Shah, Head of Commodities and Macroeconomic Research, WisdomTree

While classed as a precious metal, silver has a high utilisation in industrial applications. We like to think of it as a hybrid metal. Gold, its closest cousin, is used in far less industrial applications and thus is seen as a greater pure-play in financial/geopolitical/inflation hedging. Falling interest rates – as we expect this year – could drive the metals closer together in performance and we expect silver to outperform.

Silver’s price disappointment after tight balance

Relative to gold, silver has underperformed. While gold reached an all-time high in 2023, silver prices fell 0.65%. It’s surprising given how much demand for silver has risen in industrial applications and the decline in supply of the metal in 2023. When including investment demand, the metal has notched three years of back-to-back supply deficits, with a 253-million-ounce record high deficit in 2022 and the second highest deficit in 2023, of 194 million ounces . When excluding net physical investment (which is arguably the better way to look silver balances as silver in investment isn’t ‘consumed’, but stored and is very mobile), silver was in surplus in 2023, but the smallest surplus on record (WisdomTree calculations ).

Figure 1: Silver market balance

| Million ounces | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Total supply | 1,026 | 1,054 | 1,047 | 1,046 | 1,012 | 1,000 | 1,000 | 959 | 1,006 | 1,018 | 1,002 |

| Total demand | 1,067 | 1,021 | 1,065 | 992 | 971 | 999 | 1,004 | 923 | 1,087 | 1,270 | 1,143 |

| Market balance | -41 | 34 | -19 | 55 | 40 | 2 | -4 | 36 | -81 | -253 | -140* |

| Balance excluding investment | 260 | 317 | 291 | 268 | 196 | 167 | 183 | 241 | 193 | 80 | 69** |

Source: Silver Institute, WisdomTree. 2023 Preliminary estimates provided in November 2023. *As reported in November, but we know from a January 2024 press release it was a higher deficit of 194 million ounces, indicating supply was lower and demand was higher than estimated in November. **WisdomTree estimate.

Historical performance is not an indication of future performance and any investments may go down in value

Gold to silver ratio

The elevated gold to silver ratio (Figure 2) indicates that gold is getting more support from geopolitical risks, worries about economic conditions stemming from unsustainable debts and unprecedented demand from central banks. Silver – often seen as a leveraged play on gold – is less of a defensive, safe-haven asset and certainly no central banks are buying it. The next major catalyst for gold – central bank rate cuts – may reestablish the historic strength in correlation between the metals in 2024. But for now, with rate cut expectation being pushed out and geopolitics taking centre stage, gold may have the upper hand. Also, if central banks are committing a policy mistake by waiting too long to cut, gold will also likely outperform as it is seen as the defensive hedge.

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

Industrial demand for silver

Industrial demand for silver has been scaling new highs (Figure 3), propelled by photovoltaic demand and increasing use of silver in 5G and electronics in cars. Photovoltaic installations significantly exceeded anyone’s forecast at the beginning of 2023, with new capacity additions forecast to reach another record high in 2024. Silver offtake should also benefit from the technological breakthrough that has brought new, higher-efficiency N-type solar cells (with higher silver loadings) into mass production. In the automotive industry, greater use of electronic components and investment in battery charging infrastructure will continue supporting silver offtake.

Consumer electronics were an area of relative weakness for silver demand in 2023, but with artificial intelligence applications set to expand in 2024, we expect silver demand from this segment to rise.

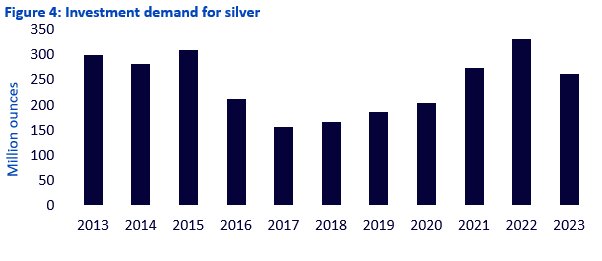

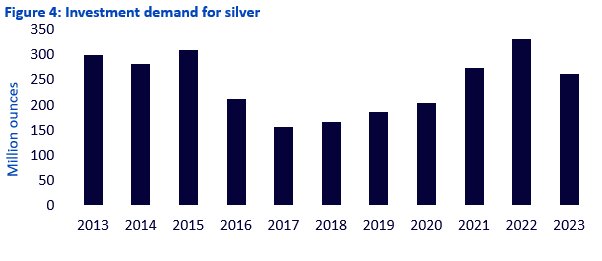

Investment demand

Silver investment demand in 2023 was close to the average since 2013, but a decline from 2022 highs (Figure 4).

Historical performance is not an indication of future performance and any investments may go down in value

Most of that investment would have been retail. Looking at the London over-the-counter market, the mainstay of institutional demand, silver in vaults plummeted in 2022 and barely recovered in 2023, with a notable drop in October 2023 after five months of rebuild (Figure 5). In that way silver is similar to gold – institutional investors seemed to have turned their back on the metal, while retail investors still hold it in high regard.

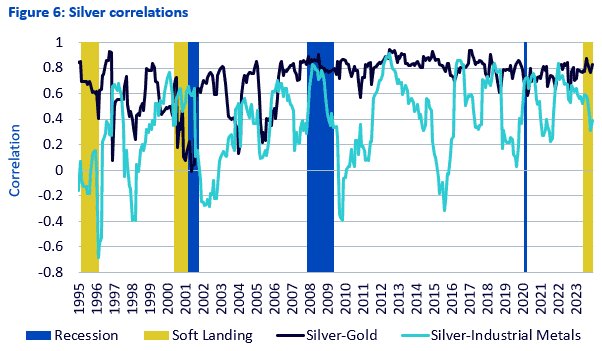

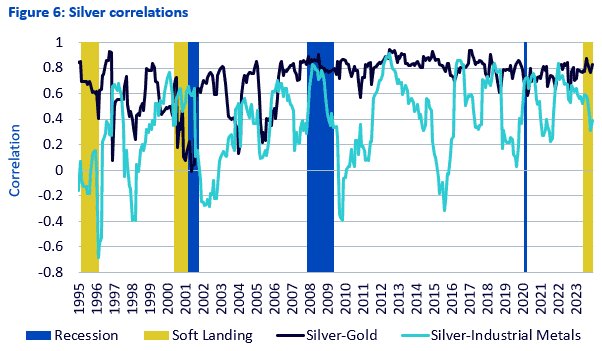

Silver in the next leg of the economic cycle

We expect silver’s correlation to gold to remain strong. So, if we head into an economic recession, silver should benefit from gold’s rise. Silver’s correlation with gold has been surprisingly consistent at around 0.8 since the 2008 Global Financial Crisis (Figure 6). Silver’s correlation with industrial metals, however, has moved in a wide range – it has sometimes been positive and sometimes negative (Figure 6). Although consensus expectations are for a soft-landing in 2024, there are relatively few observations of soft landings in the past (at least where we have industrial metal basket data). Looking at the few observations of soft landings and recessions, silver’s correlation with industrial metals tends to decline. In the current period (assuming the last Federal Reserve rate hike was in July 2023), the silver-industrial metal correlation has been declining.

Outlook for silver

We believe that silver will outpace gold, to gain 9.2 % over the coming year versus 7.3% for gold. By Q4 2024, we expect silver prices to trade above US$26/oz (Figure 7). That largely reflects silver’s historic ‘leveraged’ play on gold. Our models indicate that for every 1% increase in gold prices, silver has historically risen 1.4%. Although in the past year, that leverage has been weak, the next main catalyst for both metals will be rate cuts and we believe industrial demand for silver and sentiment toward the more cyclical metal should continue to rise as a result.

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

Framework

Given gold and silver’s strong correlation, the main driver for silver prices should be gold prices. However, to account for the remaining c.20% of price behaviour that gold does not explain, we use the following variables:

- Growth in manufacturing activity – more than 50% of silver’s use is in industrial applications (in contrast to gold where less than 10% comes from that sector). We use global manufacturing Purchasing Managers Index (PMI) as a proxy for industrial demand.

- Growth in mining capital investment (capex) – the more mines invest, the more potential supply we will see in the future. Thus, we take an 18-month lag on this variable. Given that most silver comes as a by-product of mining for other metals, we look at mining capex across the top 100 miners (not just monoline silver miners).

- Growth in silver inventory – rising inventories signal greater availability of the metal and hence is price negative. We use futures market exchange inventory as a proxy.

Gold prices to a new high

Our consensus gold scenario takes Bloomberg Survey of Professional Economists average views on inflation, US Dollar and Treasury yield forecasts as inputs. Consensus is looking for inflation to continue to decline (although to remain above the central bank target), Dollar to depreciate and bond yields to continue to fall. Consensus is based on Fed rate cuts commencing in Q2 2024 and ending the year a full percentage point lower.

Without a consensus forecast on gold sentiment we reduce speculative positioning to a conservative 75k, which is below the long-term average of 111k since 1995 and down considerably from end of 2023 levels (217 contracts net long). The risk is clearly to the upside on positioning this year if a recession or financial dislocation risks materialises or geopolitical tensions escalate.

In the consensus case scenario, gold reaches US$2,210/oz by Q4 2024, piercing through previous all-time nominal highs (US$2,078/oz on 28 December 2023). That is approximately a 7% gain from end-December 2023 levels.

Industrial demand

Global manufacturing PMIs have been recovering in recent months and hit the crucial 50 marker that separates contraction from expansion (Figure 8). We believe it will continue to recover, supported by interest rate cuts in developing countries. China, a key drag on global PMIs in the past year, could unleash a new stimulus package after the recent rout and its central bank looks like it is waiting for G7 central banks to cut rates before it follows suit. Apparently, a new buzz word is circulating among Chinese officials and state media, “Xin san yang”, which translates as the “new three” – referring to solar cells, lithium-ion batteries and electric vehicles (EVs). China seeks to promote exports of these to benefit from its comparative advantage in their manufacturing. All of these technologies use silver, with photovoltaics being a key driver of demand growth for silver.

Mining capital expenditure

Metal mining capex has been rising in recent years (Figure 9). Although in 2023 silver supply fell 3.0% y-o-y to 808Moz, the pressure of rising capex will likely push supply higher. Silver, which largely comes as a by-product of mining for other metals, could see greater supply in due course as a result of the higher volumes of general mining activity. Metals Focus expect global mine output to rise to 867Moz in 2025. The largest production gains over the next five years are estimated to come from Canada, the USA, India and Guatemala, adding a combined 44Moz of silver.

Historically, mining capex has been correlated with industrial metal prices. Recent declines in industrial metal prices may drive investment activity lower. However, our silver model depends on capex with an 18-month lag, and so rising investment a year ago will weigh on the forecast price.

Historical performance is not an indication of future performance and any investments may go down in value

Silver inventory

In our model we use silver inventory on futures exchanges as proxy for total silver inventory. This is not a perfect measure as inventory elsewhere, which is not visible, could be rising or falling. We expect futures exchanges inventory to largely flatline after falling between 2021 and H1 2023 (Figure 10). The declines plateaued in H2 2023 and we expect that to set the trend for 2024.

Historical performance is not an indication of future performance and any investments may go down in value

Conclusion

After lagging gold in 2023, silver could outperform in 2024. Silver’s industrial demand has been stellar, bucking the general trend in industrial metals in 2023. Silver’s price, however, failed to benefit from that high demand and tight supply. As silver’s correlation to industrial metal prices weakens in 2024, that should help the metal to shake off some of the baggage that has been weighing it down.

Footnotes