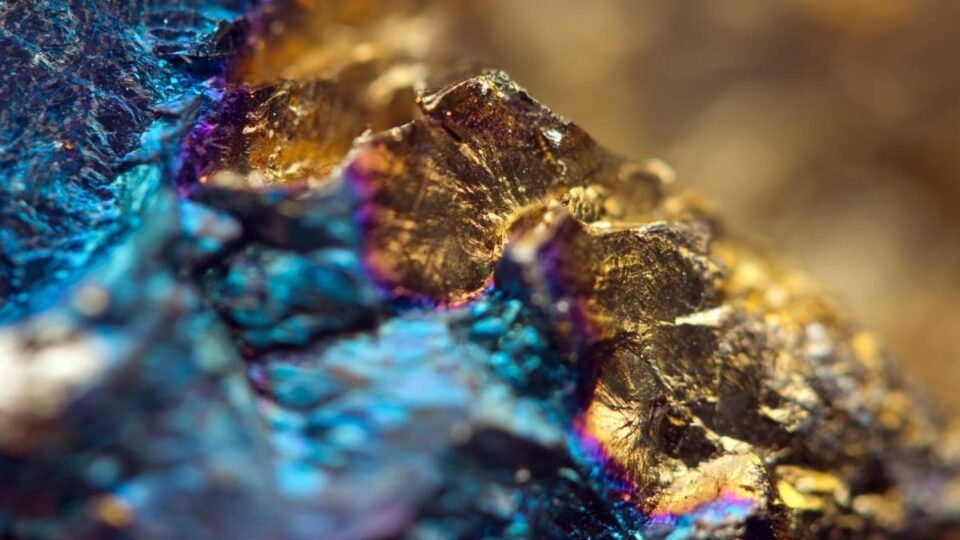

Copper (HG=F) and Silver (SI=F) have both risen to new highs as demand increases for these metals, while Gold (GC=F) also rises as China’s Ministry of Finance proceeds with a stimulus plan involving the sale of $138 billion worth of ultra-long special sovereign bonds.

Bloomberg Intelligence Senior Commodities Strategist Mike McGlone joins Market Domination Overtime to give insight into metals and how the markets might trade moving forward.

McGlone elaborates on what could happen with silver as China looks to buy many precious metals: “There’s potential rumors that, we know China has been the biggest buyer of gold, not just Chinese Central Bank, but citizens. There may be some hoarding of silver, but the key thing I’m more worried about silver is that it might follow that path, that autocorrelation path in copper which spikes and then goes back down. In the macro, the big picture, though, I’m very favorable in terms of commodities, most favorable to metals versus most other commodities. “

For more expert insight and the latest market action, click here to watch this full episode of Market Domination Overtime.

This post was written by Nicholas Jacobino

Video Transcript

One area of the market that is really shining get it is metals, gold is up 1% on the day but taking a look at the other metals, silver and copper in particular are surging as well.

Joining us now, Bloomberg Intelligence, Senior commodities analyst, Mike M Mike.

Excuse me, Mike, it’s good to see you.

Thanks for being here.

I want to start with copper which has just been such a fascinating story.

As of late, there have been all kinds of sort of odd supply disruptions just for people who haven’t been following it as close closely walk us through what’s been going on.

Hi Julie.

Well, the significance this week is pretty, pretty profound short covering in futures.

The CME trading contract that traded in New York, there was some decent short covering those front contracts.

It really pumped up the front contracts into a decent like most significant backward nation in about 10 years and pulled back, which is oftentimes a sign of highs and so that contract closed at an all time new high and made new highs.

But the C the LME contract that trades in London did not make new high, but it’s catching up.

So to me right now, what I see is more shenanigans and futures, the futures contracts is a percentage of open interest manage money net positions.

IE hedge funds are very long, about 30% of open interest.

So they’re already on top of this trade, which is a bit of a headwind.

Now, the more macro there is, you know, decarbonization, digitalization electrification, but there’s been some supply issues out of South America and Panama.

But overall, I’m more worried for copper that its auto correlation tendencies will, will vary through.

It usually has a tend to see the spike to go down and basically it was it right now it’s just catching up to gold.

Gold has been the star performer in medals.

Uh Mike, I also want to get your take on silver which has had such a move here.

Is this, you know, is it a story, Mike about industrial demand or is it financial demand or is it both?

Well, the macro for silver is, it’s industrial, basically gold is the has demonetized silver.

Um But it, it’s known as the devil’s metal for a reason because it has a tendency to spike and then go right back down.

So right now it’s the same price as it was for, I guess it’s about at the highest level since 2013.

So it’s 11 year high.

It’s right now, the way I see silver, it’s stuck between gold and copper and it’s catching up the gold and it’s got copper in its back.

And there’s potential rumors that you know, we know China has been the biggest buyer of gold, not just Chinese central bank, but citizens there, maybe some boarding of silver.

But the key thing I’m more worried about silver is that it might follow that path, that auto correlation in Athens in copper where it spikes and then goes back down in the macro.

The big picture though, I’m very favorable in terms of commodities most favorable than metals versus most other commodities.

So give us a little bit more detail there, Mike about then what you expect to happen next?

Do you expect that spike and to come back down in a copper or do you think that there will be a more sort of sustained action here?

Well, let’s start with the most enduring trend in commodities and that is gold out before most commodities.

I think that’s accelerated.

I think it’s going to continue.

And to me, it’s just a matter of time, gold gets at $3000 an ounce.

I don’t know when.

Now it’s got very good support.

Now, below the market, around $2200 and ETF outflows have been significant at some point.

Those are flip higher.

I think that’s going to take a little bit of a pin in the stock market.

To me, that’s the problem with more than in commodities.

Silver is an industrial commodity.

Now, copper is an industrial commodities.

At some point, we probably should see a little bit back up in the stock market.

It’s pretty expensive here mentioned earlier.

The mix is running around 11% handle and P 500 is 22% above its 100 week mover.

In average.

That’s pretty much oftentimes a headwind for industrial metals.

And then there’s China.

The key thing I’m worried about in China is Chinese C GB tenure note yield at 2.3%.

It’s the lowest in our database.

It’s over 200 basis points below the US.

That’s a sign of deflationary, recessionary um in claims in China.

So I’m worried about that macro for industrial metals and the thing, the key thing is beta beta can keep going up industrial metals to do fine.

But in both environments, I think go a little outperform.