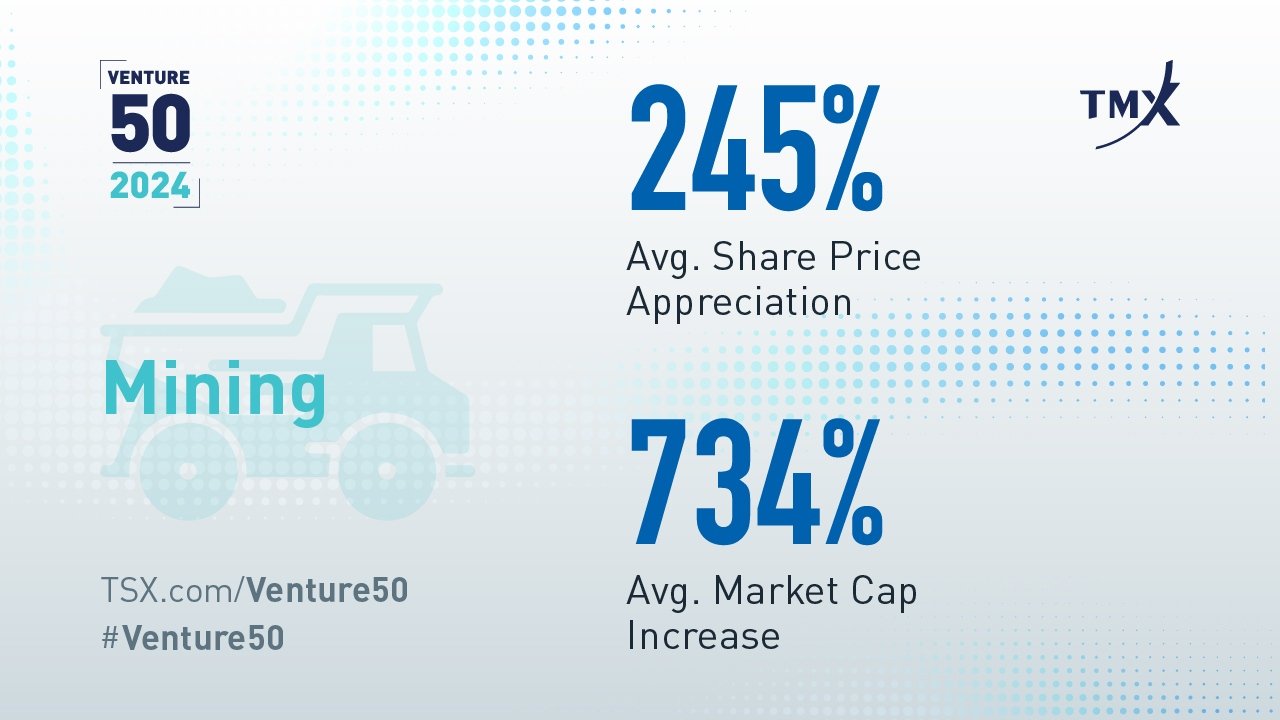

The 10 mining companies on the 2024 Venture 50 ranking posted an average market capitalization increase of 734% and saw a 245% average share price appreciation during 2023.

The global energy transition theme is continuing to attract investors to mining companies focused on critical minerals. Combined with new opportunities in precious metals, this contributed to the outperformance of the mining sector on TSX Venture Exchange’s (TSXV) 2024 Venture 50™ ranking.

The list highlights the top-performing companies driving growth across their respective sectors, based on an equal weighting of each firm’s performance during 2023 across three key indicators: market capitalization growth, share price appreciation, and trading value.

On the 2024 list, mining companies posted 734% average market capitalization appreciation, reflecting growth through both financing and acquisitions. Those companies also saw a 245% average share price increase, demonstrating notable value for shareholders.

Of the 10 mining companies included this year’s ranking, six are focused on critical minerals, such as uranium, lithium, and copper – necessary for renewable energy production and storage, electric vehicle batteries and motors, electronics and more.

“The mining sector clearly plays a major role in the global energy transition theme and will continue to do so,” says Dean McPherson, Head of Global Mining for Toronto Stock Exchange and TSX Venture Exchange. “Energy transition has been accelerating investor attraction to many of these firms for the past few years. In particular, investors are being drawn to well-managed, low political risk firms with international projects. The mining issuers on our list reflect the global reach (international projects) of the companies listed on our Exchange.”

Patriot Battery Metals Inc. (TSX: PMET), a hard-rock lithium exploration company headquartered in Vancouver, B.C., is just one example. In February, the firm graduated from TSXV to Toronto Stock Exchange (TSX). This was a major milestone for the company as it continues to build its corporate profile and broaden its reach of potential investors. Patriot Battery Metals credits its maturation in part to the emerging scale of its Corvette Property project in the Eeyou Istchee James Bay region of Quebec.

The global energy transition combined with new opportunities in precious metals contributed to the outperformance of the mining sector on the Venture 50 list.

Along with the success of critical minerals-focused firms, the strong price of gold in 2023 has also contributed to the performance of precious metals companies, with four representatives on the 2024 ranking. Canadian firm Hercules Silver Corp. (TSXV: BIG) is the top-ranked mining firm for the year and its project is focused on the silver district of western Idaho.

Meanwhile, Founders Metals Inc. (TSXV: FDR), a Canadian exploration company focused on acquiring and advancing gold projects in South America’s Guiana Shield, had a 1570% market capitalization increase and a 772% increase in share price.

McPherson points out that more than half of the mining firms on this year’s list are also listed on the S&P/TSX Composite Index*, which many investors look to for investment opportunities. Projects in Canada and Latin America also continue to stand out to investors as low risk jurisdictions, relatively speaking.

Several of the companies on the 2024 list are focused on geologically rich areas that are well known to North American investors. Experienced management teams with a track record in surface and underground mining, including geology, engineering, exploration and mine management, also support investor confidence.

A notable example of this is G Mining Ventures (TSX: GMIN), which is focused on precious metals, namely gold, through its flagship Tocantinzinho Gold Project in the State of Pará, Brazil. The Quebec-based company graduated to TSX in January, pointing to its strong corporate governance as a key reason for this accomplishment.

“These successes, particularly the pace of mining companies graduating to TSX, demonstrate the strength and robustness of our unique two-tiered ecosystem,” McPherson says. Investor interest in critical minerals needed for battery production and renewable energy production required for the energy transition also drew strong research analysts coverage throughout the year, which in turn supported these companies’ growth.

Overall, Canadian companies make up nearly all (47 of 50) of this year’s list, demonstrating how important the TSX Venture Exchange is to Canada’s economic growth.

To learn more about the mining stories on the 2024 Venture 50, watch this playlist. You can view the complete list of ranked companies, including those in the clean technology and life sciences, diversified industries, energy, and technology sectors on our website.

*The S&P/TSX Indices are products of S&P Dow Jones Indices LLC (“SPDJI”) and TSX Inc. (“TSX”). S&P® is a registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and TSX® is a registered trademark of TSX. SPDJI, Dow Jones, S&P and TSX do not sponsor, endorse, sell or promote any products based on the Indices and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions or interruptions of the Indices or any data related thereto.

Copyright © 2024 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this publication without TSX Inc.’s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, The Future is Yours to See., Toronto Stock Exchange, TSX, TSX Venture Exchange, TSX Venture 50, Venture 50, the Venture 50 logo, TSXV, and Voir le futur. Réaliser l’avenir. are the trademarks of TSX Inc.