Disappointing economic numbers raised hopes of rapid and deeper cuts by the Fed, while the dollar continued its losing streak.

Gold and the greenback often move in opposite directions and lower interest rates also bolsters gold’s prospects because the metal offers no yield and investors have to rely on price gains for returns.

All eyes are now on Fed chair Powell’s speech in Jackson Hole this week, although judging by this analysis, Jackson Hole is usually not a gold-friendly event.

Global average daily trading volumes in gold exceeds $160 billion, more than T-bills, so days like Friday gives everyone a chance to shine.

The champagne corks must be popping in Perth, Denver, Vancouver and Toronto, right. Mumm maybe. Dom, not likely.

Because as in so many markets, grass roots operations and financial markets have lost touch altogether.

Just under $1.1 billion disappeared from gold exploration budgets last year. 36% fewer gold holes were drilled. Junior mining financings are the lowest since 2019 after dropping by 23% last year.

Barrick CEO Mark Bristow likes to say “value creation is through the drill bit”.

That may be, but even if you strike gold, the wait for that value takes an awfully long time.

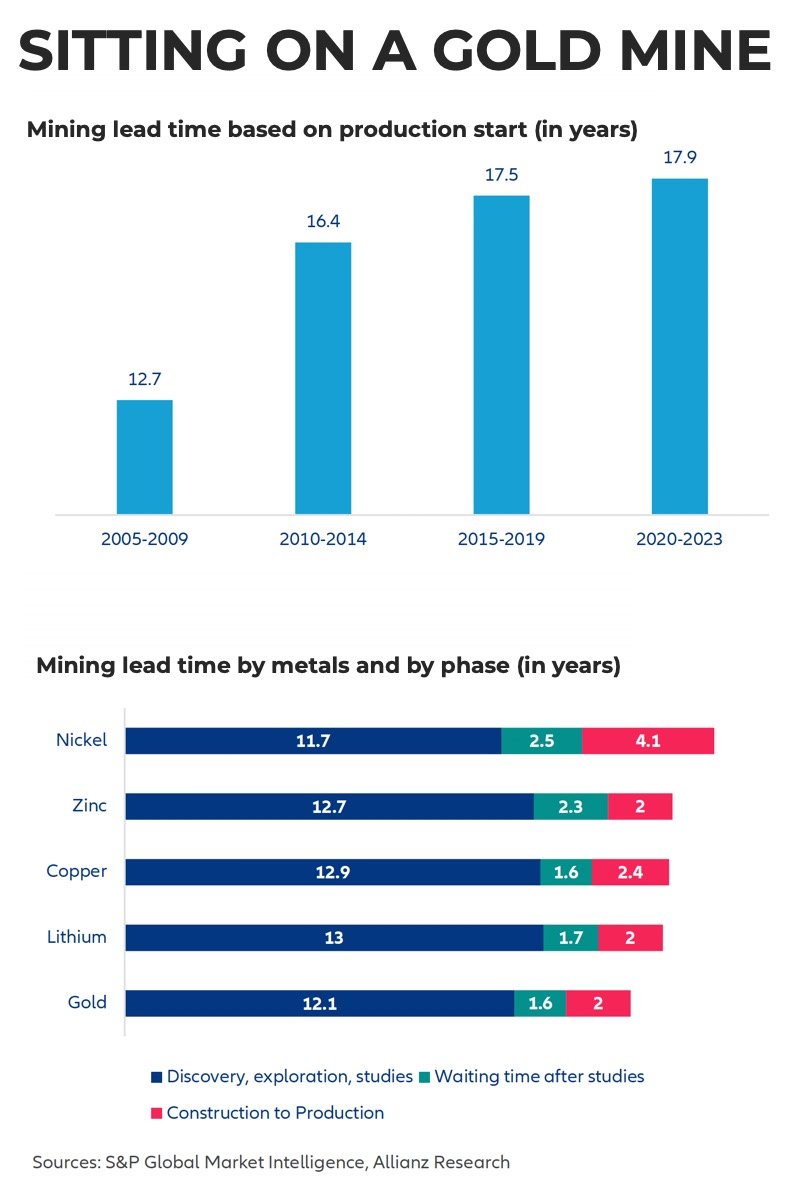

A recent Allianz Trade report shows just how long and lays the blame on the usual suspects:

“Extended exploration and authorization phases, and the complexities associated with securing financing and building permits. Regulations have become stricter, requiring extensive environmental and social impact assessments that increase red tape. The time required to secure financing and obtain the necessary building permits has also been increasing.

“Furthermore, as accessible high-grade deposits become rare, mining companies are increasingly targeting deeper or lower-grade deposits, which require more sophisticated, hazardous and costly extraction techniques. This technical complexity adds to the exploration and development phases, further extending the timeline to production.”

Gold miners still have it relatively good compared to the likes of nickel and copper.

From discovery to flowing ounces takes almost 16 years.

What the world looks like in 2040 is anyone’s guess.

If AI pundits are to be believed the technology would have progressed enough to spin straw into gold.