Given the lingering uncertainty in the global economic landscape, investors are seeking products to hedge against potential challenges, such as rising inflation. Commodities like precious metals, including silver, have consistently appealed to investors in such environments, and the trajectory of their prices remains a focal point of interest.

In this context, Finbold turned to the generative artificial intelligence (AI) tool ChatGPT to provide insights into the likely trading patterns of silver in the coming months. Specifically, we tasked the tool developed by OpenAI with offering insights into the anticipated price trajectory for the end of 2024.

Bullish scenario

ChatGPT outlined a bullish scenario, citing several factors that could contribute to a surge in the price of silver. The tool noted that a rebound in global industrial activity, especially in sectors heavily reliant on silver, could drive up demand for the metal.

The weakening of the US dollar was also highlighted as a potential catalyst, as a depreciating dollar often makes commodities priced in dollars more attractive to investors holding other currencies.

In addition, heightened concerns about inflation were identified as a factor that could propel investors towards precious metals like silver. At the same time, the AI platform pointed out that geopolitical tensions or uncertainties were seen as potential triggers for increased demand for precious metals, further boosting silver prices.

In this optimistic scenario, ChatGPT suggested that the price of silver might trade within the range of $28 to $32 per ounce by the end of 2024, surpassing its current value.

Bearish scenario

According to ChatGPT, a significant global economic slowdown could be a primary concern, with reduced industrial demand for silver anticipated as industries may cut back on production and consumption.

The strength of the US dollar was highlighted as another bearish factor. A stronger dollar can exert downward pressure on commodities like silver, making them more expensive for holders of other currencies. Furthermore, if inflation expectations decrease, the demand for precious metals as a store of value, including silver, may decline.

In this less optimistic scenario, ChatGPT proposed a potential price range of $18 to $20 per ounce for silver by the end of 2024.

Silver price analysis

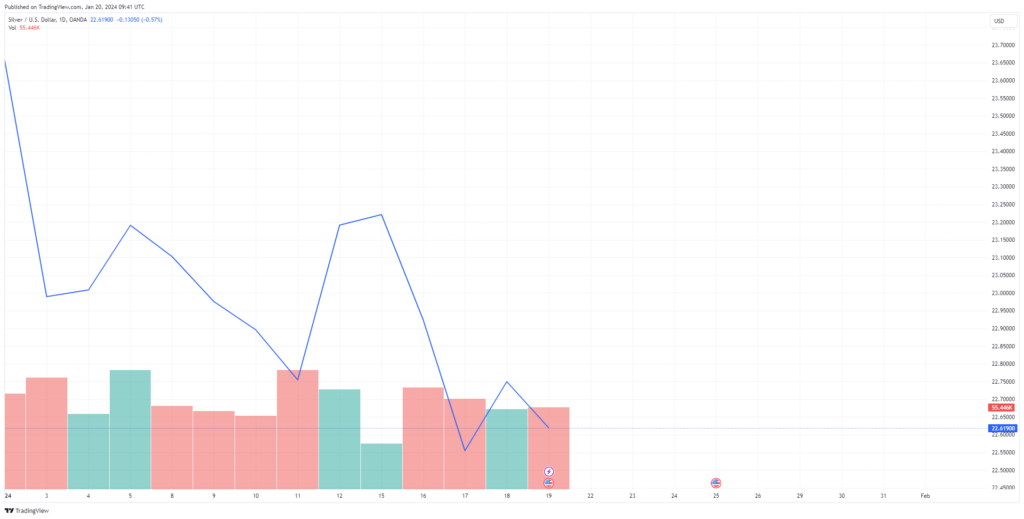

It is worth noting that, in recent days, the price of silver has consistently declined. As of press time, the metal was valued at $22.61, reflecting a 0.6% decrease within 24 hours. Silver has also experienced a decline of over 4% on a year-to-date basis.

Meanwhile, silver technical analysis obtained from TradingView is predominantly characterized by bearish sentiments. A summary of the one-day indicators aligns with a ‘strong sell’ sentiment at 16, while moving averages also indicate a ‘strong sell’ at 14. Oscillators recommend a ‘sell’ sentiment at 2.

In the interim, the immediate fate of silver prices hinges on several factors, with the bond market performance playing a key role.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.