Silver has often been seen as the lesser sibling in comparison to gold, but is it possible that things are changing? Recent trends suggest so, as silver outperformed gold over the past year. Let’s see if this new trend will continue.

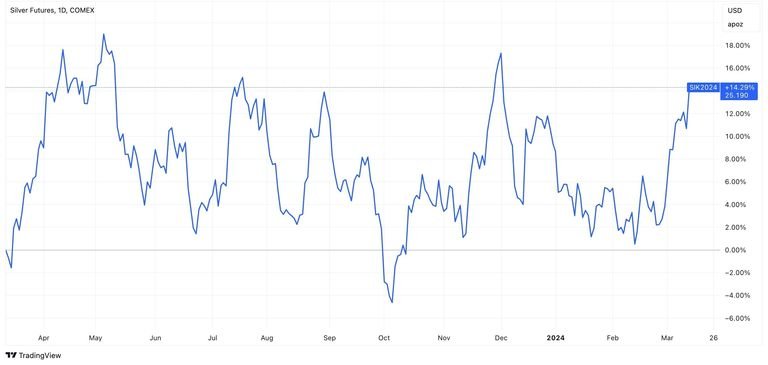

Over the last 12 months, silver has exhibited significant volatility, with price fluctuations of up to 20%. Despite this, it managed to achieve nearly 15% growth by year-end. Economic events have been key drivers of these price movements, and staying updated with the economic calendar can help inform timely trade decisions.

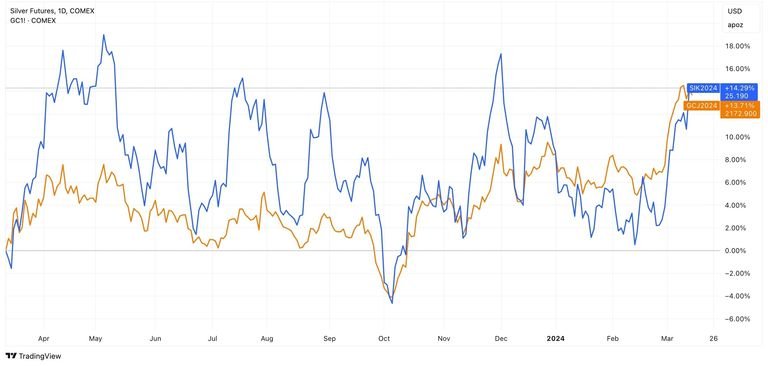

Comparing silver price (XAGUSD) to its age-old rival, gold (XAUUSD), reveals interesting insights. While both precious metals have shown nearly identical results in the past year, silver has edged slightly ahead.

Even when looking back five years, these assets have remained closely intertwined.

This dynamic isn’t entirely unexpected. Gold and silver often move in tandem, as both serve as speculative metals with inverse correlations to the US dollar and government bond yields. Investors typically turn to these metals when the dollar weakens, viewing them as alternative safe-haven assets.

Traditionally, gold has held a more prominent position due to its higher price tag, while silver, considered less precious due to its relative affordability, has sometimes been overlooked. Yet, some experts argue that silver’s affordability could be its advantage.

Silver’s extensive industrial applications, particularly in emerging technologies like 5G, electric vehicles, and solar energy, alongside traditional uses such as medical equipment, continue to expand. However, its industrial reliance can also be a double-edged sword, as it is susceptible to fluctuations in overall economic growth.

The prevailing sentiment suggests that silver is poised for long-term growth. Nonetheless, market conditions evolve rapidly, necessitating staying informed and conducting a thorough analysis.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.