Two weeks ago, I attended and spoke on a panel at the spring edition of the Swiss Mining Institute investment conference. This year we were witnessing all-time highs in gold prices. I was asked if I thought this was finally going to be a true breakout for precious metals. As always, I gave my honest opinion, saying that I don’t know for certain, but believe it is. So why haven’t silver prices really rallied…yet? Here’s my take, recounts Peter Krauth, editor of Silver Stock Investor.

I get this question all the time: “If there’s so much demand for silver, and it’s in ongoing deficits, why hasn’t the price moved?” It’s a legitimate question, and one that I’ve been asking myself for a while.

The setup in silver could hardly be more compelling. Supply is flat. Silver miners don’t expect any growth in mined silver supply for years. Mine supply peaked around 900Moz in 2016, then gradually fell to the current roughly 800Moz, and it’s likely to stay there for some time going forward.

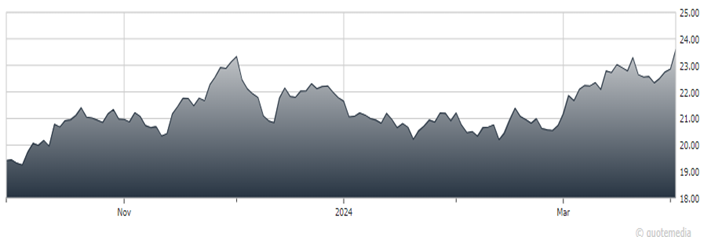

iShares Silver Trust (SLV)

And yet this is in the face of robust and growing demand, led of course by industrial demand and more specifically by solar. The photovoltaic industry’s silver needs have essentially tripled in the last decade, reaching 190Moz last year, and demand is expected to surpass 200Moz this year.

Bottom line: The silver market is extremely tight as it is. For now, some large silver consumers are able to tap the futures and ETF market for supply. But that can’t go on forever. When those inventories run out, I expect that will help trigger a huge rally in silver and silver stocks.