Gold (XAU/USD) Key Points

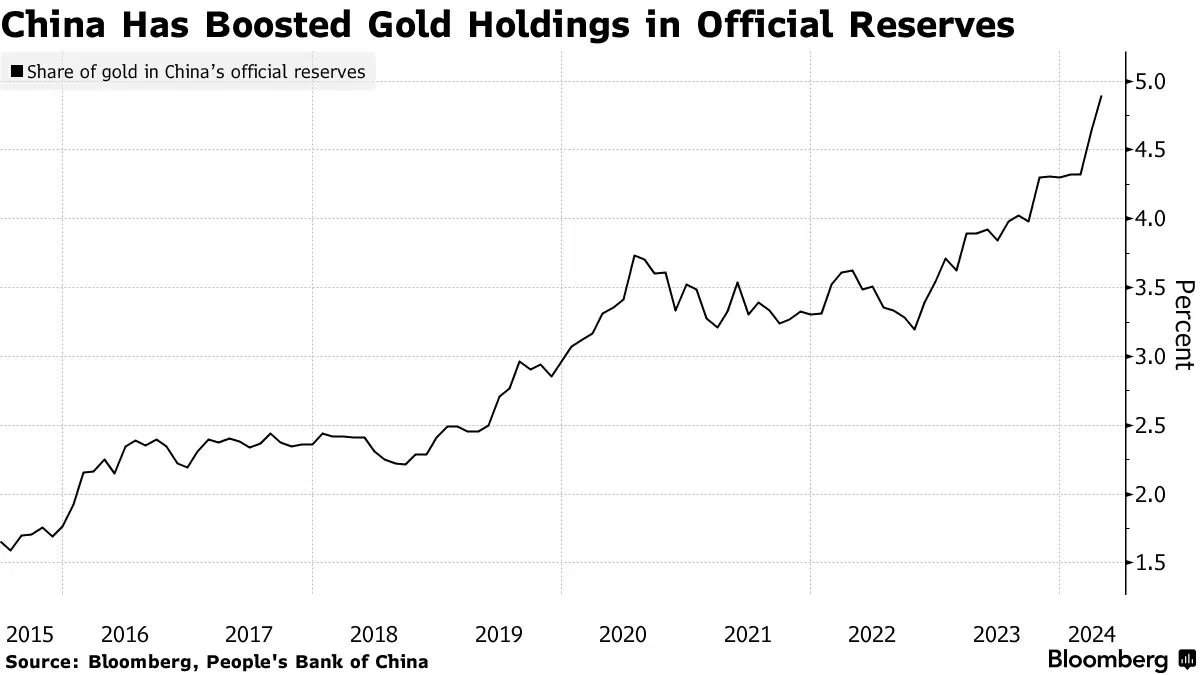

- China’s gold reserves are approaching 5% of its total reserves, providing a consistent source of buying pressure for the yellow metal.

- Wednesday’s UK CPI report will be a key release in determining whether the BOE will join the ECB in cutting interest rates next month, potentially giving gold another boost.

- Gold remains in a clearly bullish structure, with all eyes on the record highs in the $2420-30 zone.

Gold saw strong performance last week, but bulls on the yellow metal might still feel like they’re getting the short end of the stick with rivals like Silver and Copper outperforming gold and hitting record highs. The “Year of Metals” continues unabated amidst structural undersupply, sovereign purchases, and imminent monetary easing.

Gold Key Theme: Is China Accelerating its Gold Purchases?

Outside of the long-standing-but-thus-far-unrealized concerns about record sovereign debt loads, monetary debasement, and the dangers of fiat currencies, there is a far more traditional factor driving gold prices higher this year: rising demand, especially at a sovereign level.

The proverbial “Dragon in the Room” on this front is China, the world’s second-largest economy.

According to a US Treasury report from last week, China sold a record $53.3B of US Treasury and agency bonds. This move reflects China’s strategy to diversify its investments away from American assets amidst ongoing trade tensions with the US. The shift in China’s investment strategy is drawing attention as trade tensions between the US and China show signs of escalating. President Joe Biden has introduced significant tariff increases on Chinese imports, and former President Donald Trump has suggested he might impose even higher tariffs if re-elected.

China’s reduction in US dollar assets aligns with an increase in its gold reserves, which reached 4.9% of its total reserves in April, the highest since 2015. This trend is part of a broader pattern among China and its allies, who have been increasing their gold holdings as a safeguard against potential sanctions risks.

Source: Bloomberg

Gold Key Theme: Monetary Policy Easing Nears

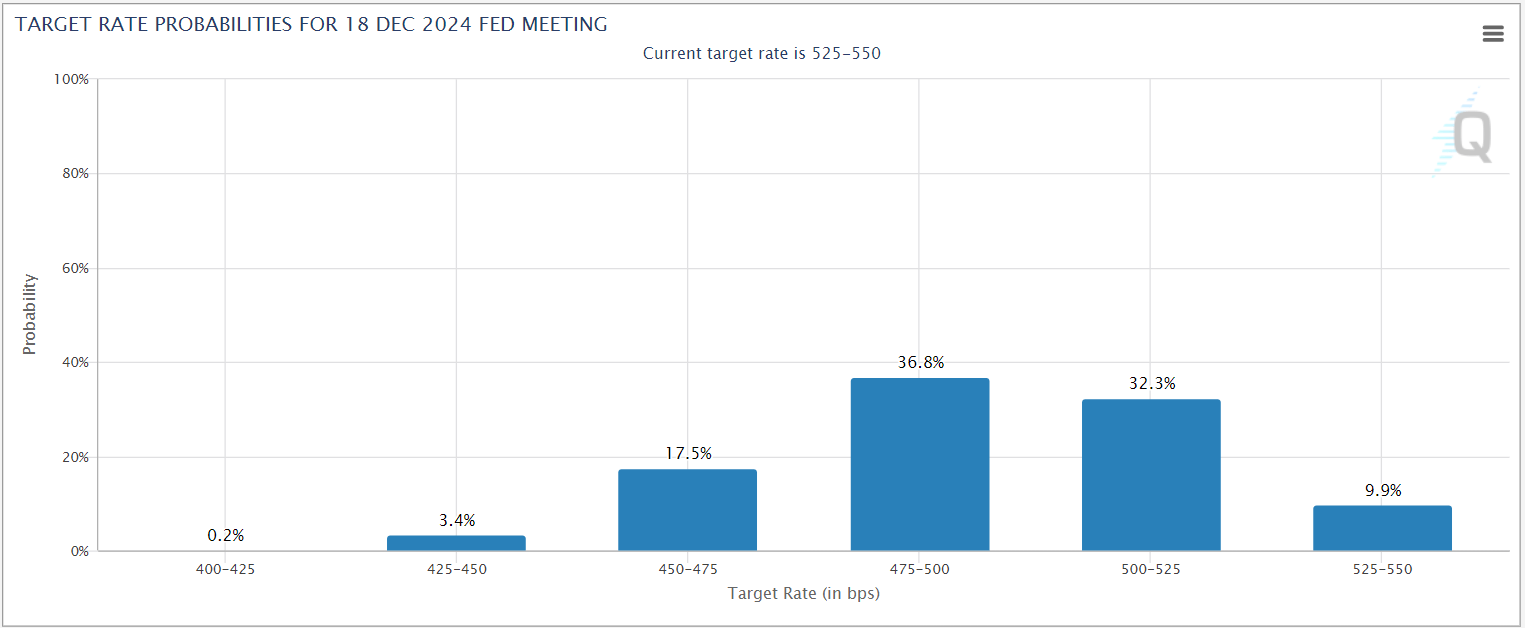

To the extent gold serves as a hedge against “money printing” and general stimulative monetary policy, the yellow metal is also strengthening on hopes of imminent interest rate cuts. The (slight) miss in US CPI last week gave traders more confidence that the US Federal Reserve would cut interest rates at least twice this year; According to the CME’s FedWatch tool, there’s about a 60% chance that we see at least two cuts from the US central bank this year:

Source: CME FedWatch

Similarly, European Central Bank (ECB) policymakers seemingly go marching orders to endorse a June rate cut midweek, with the following comments all coming in a 24 hour period on Thursday:

- ECB Member Schnabel: OPEN TO JUNE RATE CUT, URGES CAUTION AFTER

- ECB Member Villeroy – PROBABILITY OF JUNE RATE CUT IS ‘SIGNIFICANT’

- ECB Member Kazaks – ECB LIKELY TO CUT INTEREST RATES IN JUNE

While the outlook beyond June is more murky, the imminent start of easing in a G3 economy is no doubt contributing to gold’s rally. For next week, the focus will shift to the UK, which will release April CPI figures with traders pricing in about a 60% chance the BOE will join the ECB in cutting interest rates next month. A softer-than-expected UK inflation report this week could be the driver for another leg higher in gold.

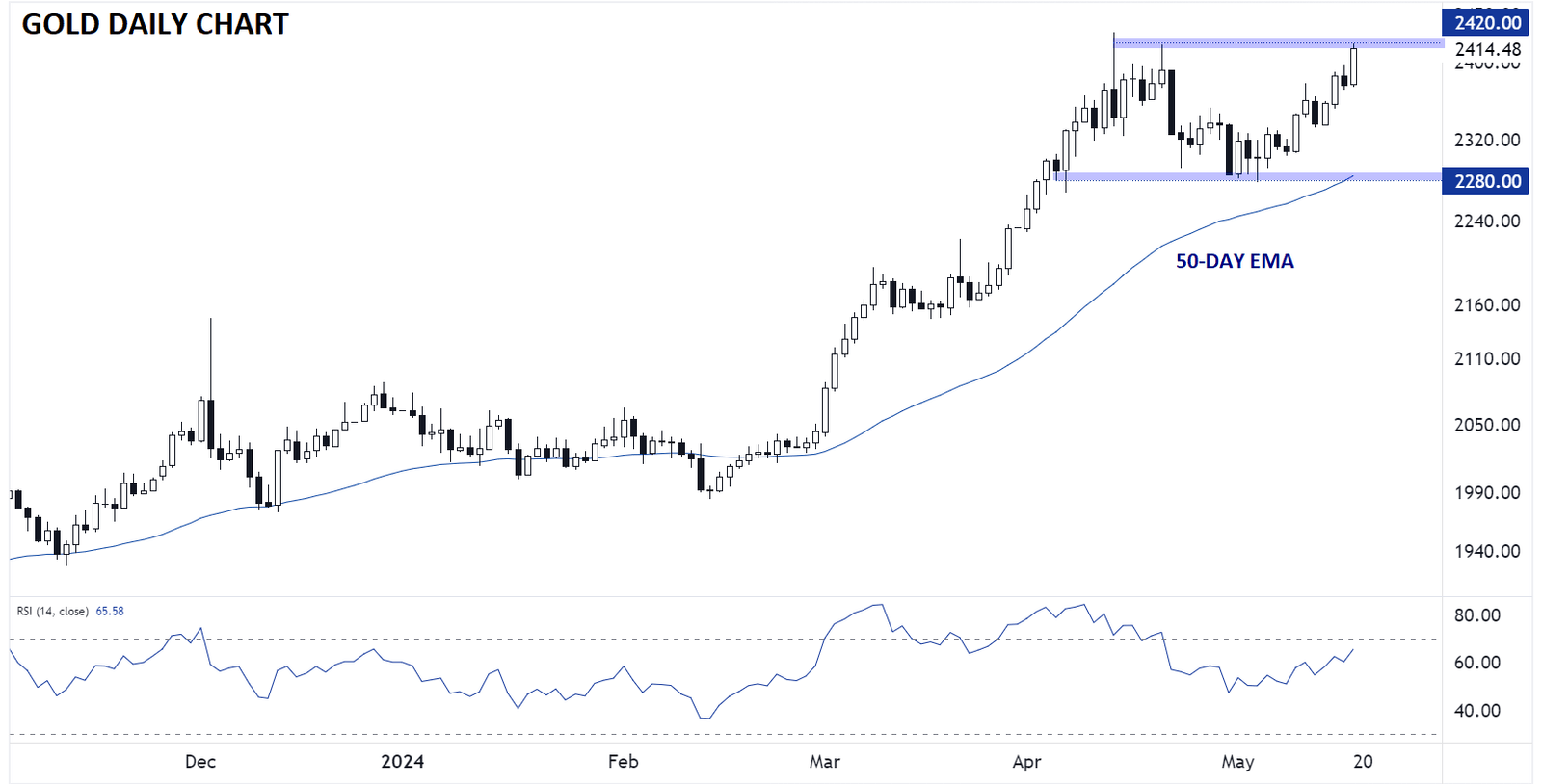

Gold Technical Analysis – XAU/USD Daily Chart

Source: TradingView, StoneX

Turning our focus to the chart, Gold remains in a clearly bullish structure. As of writing on Friday afternoon, the precious metal is on track for a record high close, just below the all-time intraday high in the $2420-30 zone. While it wouldn’t be surprising to see prices take a breather or pull back from this key resistance level, traders are likely to be buyers on any short-term dips given the long-term uptrend and fundamental drivers. Only a break below the 50-day EMA and previous support in the 2280 area would call the bullish technical setup into question at this point.

— Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX