Hecla Mining Company March 28 filed a technical report outlining 55 million ounces of silver reserves for its Keno Hill mine in Canada’s Yukon. This marks a 45% increase in reserves since gaining ownership of the historic silver property through the acquisition of Alexco Resource Corp. toward the end of 2022.

Calculated at a price of $17 per ounce of silver, Keno Hill hosts 2.07 million metric tons of proven and probable reserves averaging 26.6 ounces per ton (55.1 million oz) silver, 0.01 oz/t (13,000 oz) gold, 2.5% (52,380 tons) zinc, and 2.8% (58,170 tons) lead.

This is enough reserves to support a mining operation at Keno Hill capable of producing 52.9 million ounces of silver over 11 years. At an average silver price of $22/oz, Hecla estimates that this operation would generate $420 million of free cash flow and an after-tax net present value (5% discount) of $305 million.

Hecla, however, expects to quickly expand upon the reserves at Keno Hill.

One of the reasons for this expectation is the substantial resources that have not yet been upgraded to the reserves category.

According to the latest calculation, Keno Hill hosts 4.5 million tons of measured and indicated resources averaging 7.5 oz/ton (33.9 million oz) silver, 0.006 oz/ton (26,000 oz) gold, 3.5% (157,350 tons) zinc, and 0.9% (41,120 tons) lead.

In addition, the Yukon mine project hosts 2.8 million metric tons of inferred resource averaging 11.2 oz/ton (31.8 million oz) silver, 0.003 oz/ton (9,000 oz) gold, 1.8% (51,870 tons) zinc, and 1.1% (32,040 tons) lead.

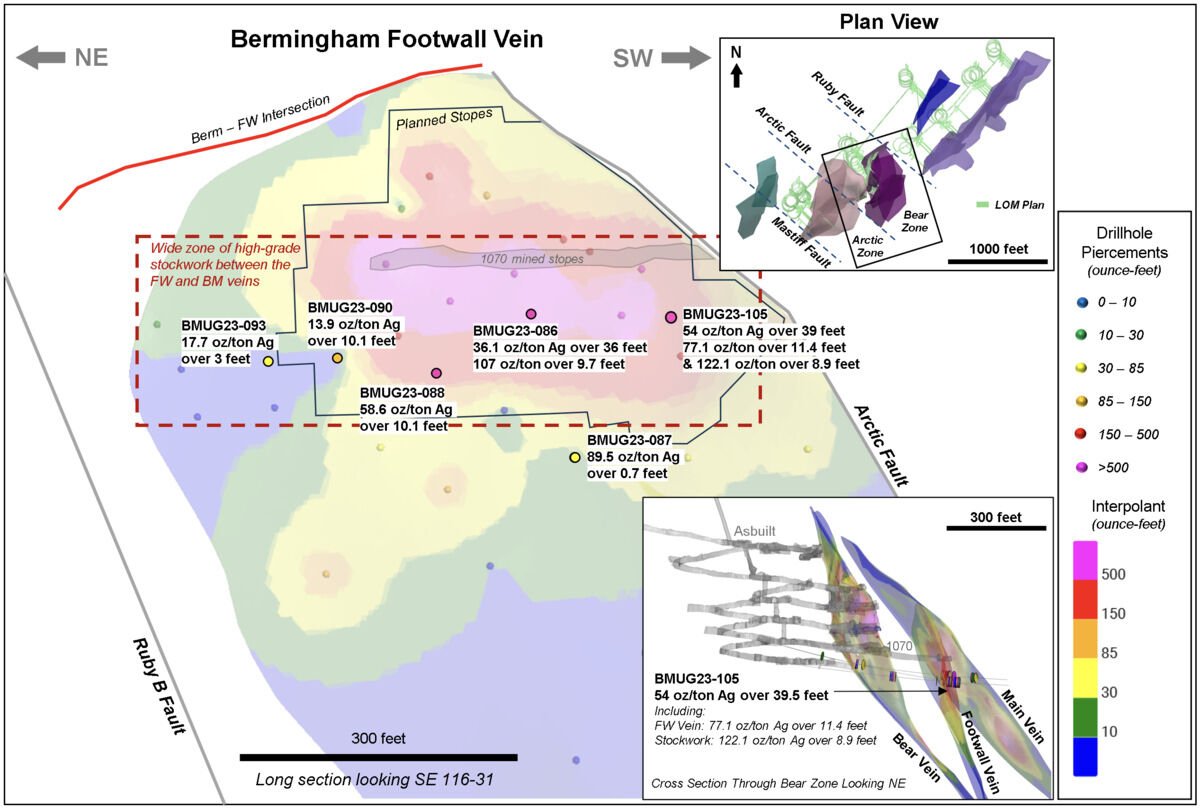

Another reason for Hecla’s confidence in the growth of both reserves and resources is recent high-grade silver drill intercepts that are not included in the reserve calculations.

Highlights from 3,900 meters of underground resource definition and geophysical drilling completed during the fourth quarter of 2023 at Keno Hill include:

• 12 meters averaging 54 oz/ton silver, 4.8% lead, and 2.5% zinc.

• Three meters averaging 58.6 oz/ton silver, 3.6% lead, and 4.3% zinc.

• 4.6 meters averaging 32.7 oz/ton silver, 1.7% lead, and 1.7% zinc.

• 2.8 meters averaging 32.4 oz/ton silver, 8.3% lead, and 4.1% zinc.

“Drilling has intersected wider zones and higher grades – such as 54 ounces per ton silver over 39 feet – than are currently in the reserve model and has encountered high-grade mineralization more than 1,000 feet deeper than any previous drilling; both are changing the potential size of the deposit,” Hecla Mining President and CEO Phillips Baker, Jr. said in February.

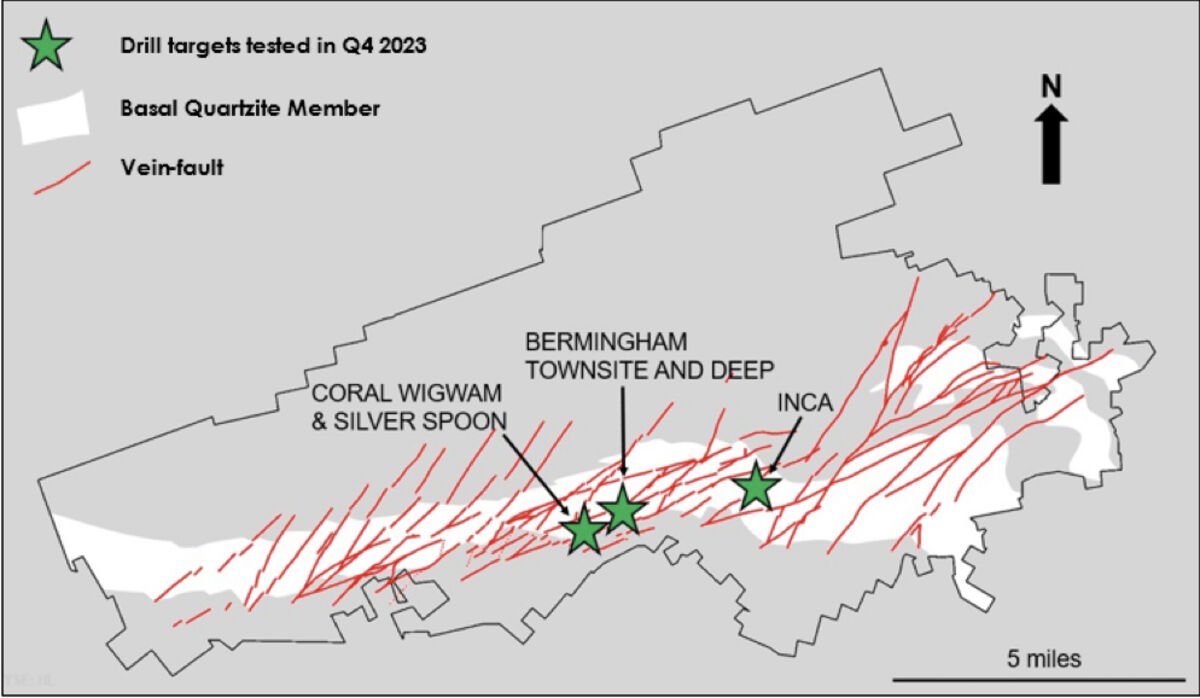

In addition, Hecla reported that its surface exploration drilling during the fourth quarter of last year encountered high-grade silver and intriguing quantities of the critical mineral indium.

Highlights from the surface drilling include:

• 1.4 meters averaging 73.5 oz/ton silver, 1.4% lead, and 0.2% zinc (Bermingham Townsite Vein).

• 6.9 meters averaging 4.7 oz/ton silver, 0.5% lead, 2.7% zinc, and 1.6 oz/ton indium (Inca Vein).

• 2.3 meters averaging 5.8 oz/ton silver, 0.2% lead, 1.6% zinc, and 0.9 oz/ton indium (Inca Vein).

As exploration expands upon the current reserves and resources, Hecla continues to ramp up the Keno Hill silver mine to commercial production.

This ramp-up began during the second quarter of 2023, with the Yukon mine contributing 184,264 oz of silver during the period. This continued into the second half of the year, with the operation producing 608,301 oz of silver during the third quarter and 710,012 oz during the final three months of the year.

Baker said earlier this year that “the roughly half year of production at Keno Hill shows its potential to be a meaningful producer.”

Reaching the Yukon operation’s full potential, however, has gone slower than Hecla anticipated as it was discovered that a safety action plan needed to be implemented to elevate the Keno Hill mine to Hecla’s injury-free standard.

Such a safety plan has been introduced at Keno Hill.