Silver has declined from its December peak of $24.60, but it is currently displaying signs of recovery. As 2024 begins, silver has bounced back from a yearly low of $22.9, prompting anticipation about its potential upward trajectory. The metal’s performance remains influenced by broader economic factors.

Recent economic indicators, including the Job Openings and Labor Turnover Survey (JOLTS) and the ISM Manufacturing Index, signal a contracting U.S. manufacturing sector and easing labor market conditions. Amid this backdrop, the demand for silver is under pressure, contributing to a bearish outlook in the short term.

Currently trading at $23.17, silver reflects nearly a 1% gain in the past 24 hours. This increase is partly attributed to decreasing bond yields and a weakened dollar.

Notably, the impending Federal Reserve policy is anticipated to shape silver’s trajectory significantly. However, market sentiment remains cautious due to silver’s failure to capitalize fully on various catalysts, such as geopolitical tensions.

ChatGPT predicts silver’s price for the end of 2024

Examining future price trajectories, Finbold consulted generative artificial intelligence (AI) tools to obtain insights into how the precious metal might fare at the end of 2024.

OpenAI’s ChatGPT provided both bullish and bearish scenarios for silver. The bullish outlook hinges on factors like the global economic recovery, inflation concerns, and a weakening U.S. dollar. ChatGPT suggested a potential trading range of $30 – $35 if these factors align.

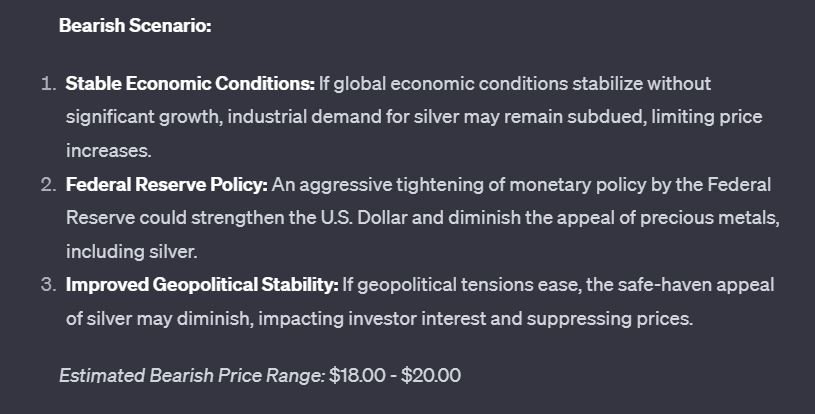

ChatGPT also suggested a $18 – $20 price range in the bearish scenario, noting influences from improved geopolitical conditions and Federal Reserve policies.

Google Bard predicts silver’s price

Google Bard also projected potential bullish and bearish trends for silver. A bullish trend is anticipated, driven by potential Federal Reserve rate cuts weakening the U.S. dollar and increased demand for silver in green technologies. Bard predicts silver prices could reach $27.80 to $34.70 per ounce by the end of 2024.

At the same time, Bard suggested a bearish scenario where silver prices could fall and trade between $19.69 and $20.00 per ounce by the end of 2024. This projection is based on continued concerns about the Federal Reserve rate hikes strengthening the U.S. dollar, potential global economic slowdown, and a resurgent U.S. dollar diminishing silver’s appeal.

In general, both AI tools suggested that the price of silver could eventually experience fluctuations, pointing to unforeseen factors influencing overall market sentiment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.