Even the most aggressive bullish trends rarely move in straight lines. Periodic corrections can be an opportunity for traders and investors. In April 2024, gold rose to a new record high, continuing the bull market that began in 1999. Silver reached just below $30 per ounce for the first time since February 2021.

In an April 7, 2024, Barchart article on precious metals in Q2 2024, I wrote:

I remain bullish on the precious metals sector in Q2, expecting higher highs in gold, the potential for an exciting breakout in silver.

Gold and silver reached higher highs in April before correcting, but the current price action could be the calm before a continuation of a bullish storm.

Gold corrects

June COMEX gold futures reached a record $2,448.80 high on April 12, 2204, but ran out of upside steam.

The chart highlights June gold’s 6.7% correction to a $2,285.20 low on May 3. The short-term pattern of lower highs since April 12 remains intact on May 14, but the long-term trend since 1999 remains bullish. From a short-term perspective, gold has been recovering since the May 3 low.

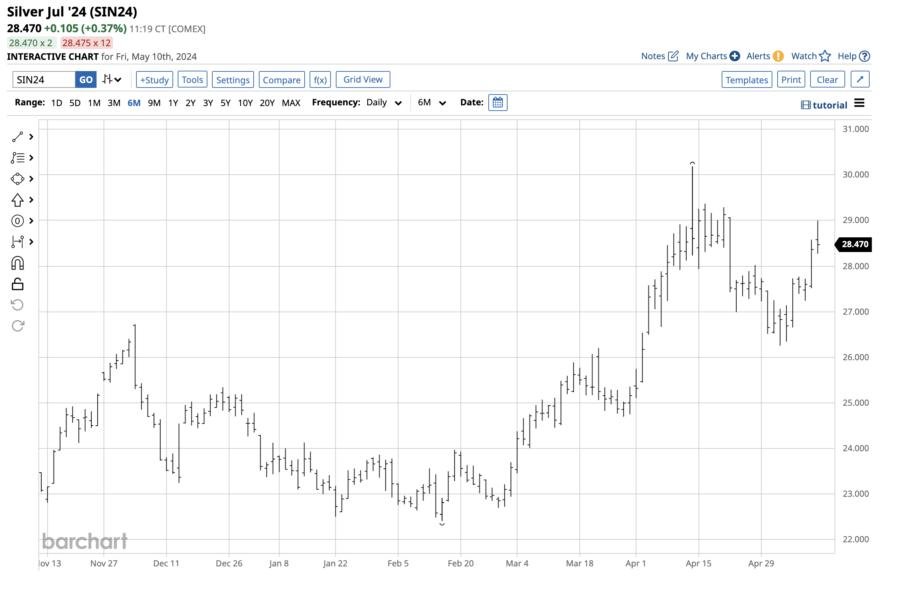

Silver fails at $30

Nearby July COMEX silver futures traded to a $30.19 per ounce peak on April 12, the highest price since February 2021.

The short-term chart shows the 13% correction to $26.255 per ounce on May 2, 2024. Silver failed at the $30 level on its first attempt to eclipse the 2021 high, the highest price in over a decade. Silver futures reached nearly $50 in 2011. Silver has been recovering since the May 2 low.

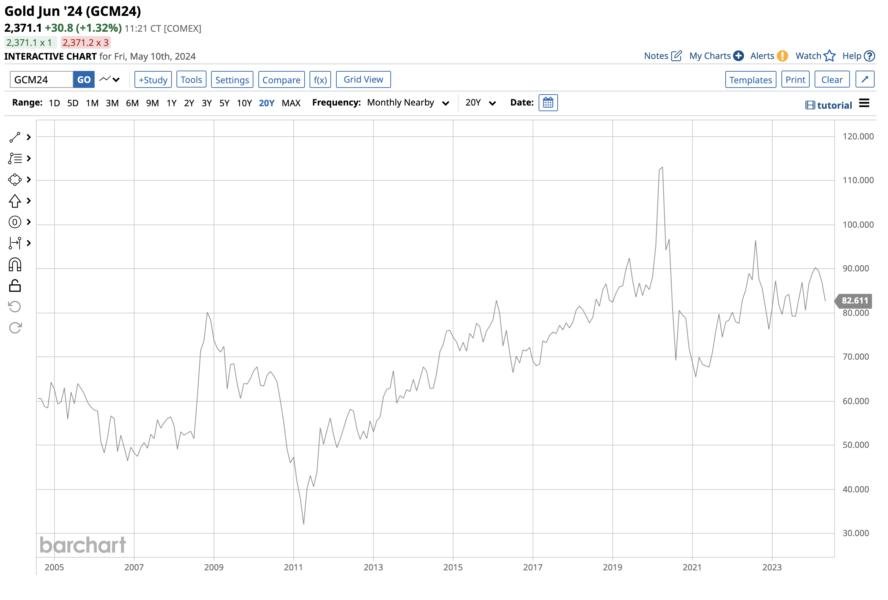

The silver-gold ratio is trending lower- Bullish

The silver-gold ratio measures the price relationship between the two precious metals.

The twenty-year chart ({GCM24}/{SIN24}) shows a pattern of lower highs since the ratio reached over 113 ounces of silver value in each ounce of gold value in 2020 as the global pandemic gripped markets and sent gold and silver prices to lows. At between 82 and 83 ounces of silver per ounce of gold in May 2024, the ratio has been trending lower, a bullish sign for the two leading precious metals.

Since silver is a more speculative metal than gold, it trades at a higher volatility. Higher price variance in silver during rallies and corrections tends to make silver outperform gold during rallies and underperform during corrections on a percentage basis.

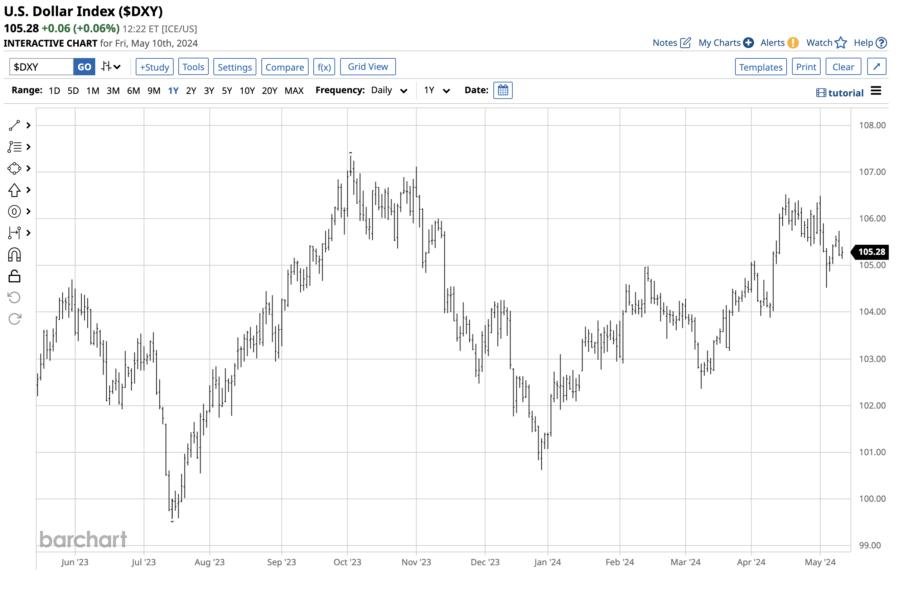

The dollar is losing its grip- Bullish for precious metals

Gold and silver tend to be highly sensitive to moves in the U.S. dollar. They often rally during periods of dollar weakness and when the U.S. index weakens.

The dollar index measures the U.S. dollar against the other world reserve currencies.

While the dollar index has made higher lows and higher highs since July 2023 when it fell below the 100 level, the most recent rally failed before challenging the October 2023 high at over the 107 level. At around 105, the index was trending lower, supporting gold and silver prices.

Meanwhile, in an additional sign of strength, gold and silver prices have rallied over the past months despite higher interest rates, which tend to cause significant price corrections. This is because higher interest rates can make other investments, such as bonds, more attractive, leading to a decrease in demand for gold and silver. The fact that gold and silver have continued to rise despite this suggests a strong underlying demand for the precious metals.

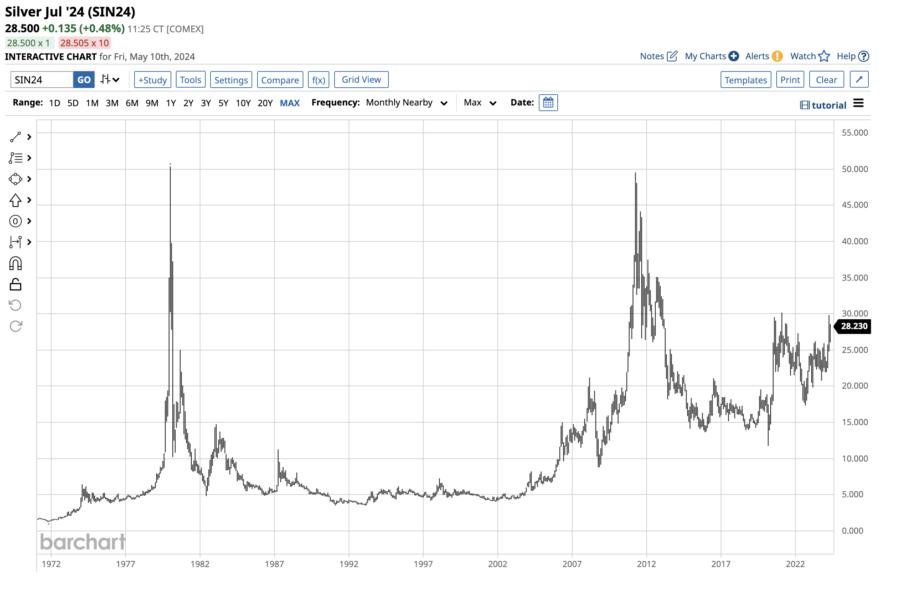

Buying on price weakness has been optimal for years

Gold and silver have long histories as means of exchange. Central banks validate gold’s role in the global financial system as they own gold as an integral part of foreign currency reserves. Over the past years, central banks have been aggressive gold buyers, adding to reserves and signaling the decline in faith in fiat currencies. Silver tends to follow gold as investors often flock to the less valuable metal during rallies.

The chart shows that every correction in gold since the 1999 $252.50 low has been a buying opportunity.

While silver has been far more volatile, the chart shows silver futures have made higher lows since trading at the $4 per ounce level in late 2001.

While past performance is never a guarantee of future performance, it’s worth noting that significant corrections in gold and silver have consistently presented buying opportunities over the past quarter century. This trend, always your best friend, suggests that the long-term paths of least resistance in gold and silver are poised to rise in May 2024, instilling confidence in the reliability of this investment strategy.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.