KARACHI: In the aftermath of a significant crackdown on the jewellery sector in September aimed at curbing speculation and smuggling, the only benefit that appears in sight so far has been the advancement of daily bullion rate announcements by three to four hours. Previously, these rates were released around sunset.

However, a series of commitments made by the bullion trade representatives to law enforcement agencies to increase the sector’s transparency remain unfulfilled.

Last year, the All Pakistan Gem and Jewellers Association (APGJA), led by Haji Haroon Rasheed Chand, halted the publication of daily gold prices for around a month, from Sept 13 to Oct 10, and for some more days due to the arrest of five jewellers implicated in illegal activities.

The arrests were made amid negotiations with law enforcement agencies and Mr Chand in Islamabad. The traders were later released on the assurance given by the APGJA chief that the association would help control speculation, encourage physical trading, promote legal trading practices, and enhance documentation and computerisation within the trade.

Traders have yet to fulfil most promises made to LEAs

The issue of releasing daily rates remained disrupted until the third week of October, and inconsistency in gold pricing posed significant challenges for consumers. Some upcountry-based bullion traders began setting their rates independently despite mutual understanding that prices all over Pakistan should be uniform based on the rupee-dollar parity in the interbank market instead of the open market.

Despite the APGJA’s assurances, implementing measures promised to law enforcement agencies has largely remained theoretical.

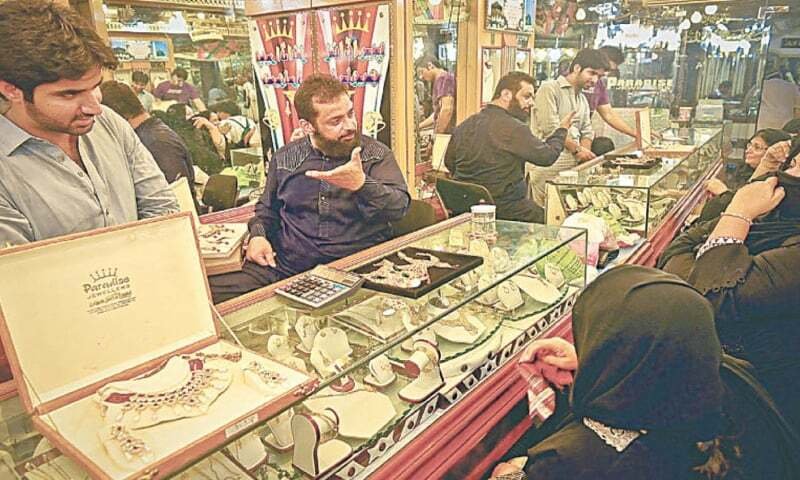

Moreover, trade practices within the sector continue to be opaque, with dealers often not providing receipts for transactions and asking sellers to show old cash memos of their gold-related items.

Some traders also confuse consumers about the quality of their gold. As sellers are not up to date in identifying the gold quality, they sell the precious items in haste to get cash.

Most shops lack computerised systems for documenting sales and purchases, contrary to practices in other retail sectors. Some gold traders have set up mini shops outside their outlets to deal with people looking for smaller transactions.

A trader from the Saddar area said before the crackdown, local gold rates witnessed wild fluctuations of Rs 9,000-10,000 per tola. On many occasions, the rates did not match the changes in global prices, the exchange rate, and the demand-supply situation.

“To some extent, I can claim that the rates are currently being issued in a somewhat transparent manner and much earlier,” he said.

He said a meagre one to two per cent of big gold shopkeepers might be integrated with the Federal Board of Revenue’s point-of-sale (POS) system, but the majority, especially small and medium traders, remained disconnected.

He said that a leading gold trader was giving awareness about how trade could be digitised, but it would take some time to lure small traders.

To address these issues, Mohammad Haseen Qureshi, president of the All Karachi Jewellers and Manufacturers Association, has called for establishing a dedicated authority comprising bullion market representatives.

This entity would oversee daily rate issuance, quality control and monitor speculative and black-market activities in gold trading. The authority would also facilitate the resolution of disputes with the FBR and other government bodies and reassure consumers regarding tax and duty compliance among traders.

“Every retailer must pay taxes and duties,” Mr Qureshi said.

Published in Dawn, March 24th, 2024