(Kitco News) – Gold prices are firmly higher and hit another record high of $2,308.80 basis June Comex futures today. Silver prices are sharply up and hit a two-year high of $27.00 basis May Comex futures. Safe-haven demand is featured this week as geopolitical tensions in the Middle East have ratcheted up. Bullish charts are also pushing the technical traders to the long side of the two precious metals markets. June gold was last up $21.90 at $2,304.00. May silver was last up $1.032 at $26.955.

(Hey, in my latest Front Burner weekly report, out this morning, I gave my price projections for gold and silver in the coming weeks or few months. If you are not signed up for my report, you are missing out! And it’s free! Email me at jwyckoff@kitco.com and I’ll send you today’s report and sign you up. Jim)

The economic data pace picks up the rest of this week, including Fed speak. Several Federal Reserve officials are also scheduled to speak today, including Fed Chairman Jerome Powell. On Friday comes the U.S. employment situation report.

Asian and European stock indexes were mostly lower overnight. U.S. stock indexes are firmer near midday.

In overnight news, there was a major 7.4 magnitude earthquake in Taiwan that killed at least seven and injured dozens. The temblor was the strongest in a quarter century and may have impacted the region’s semiconductor industry.

Eurozone inflation cooled a bit in March, as its consumer price index was reported up 2.4%, compared to up 2.8% in February, year-on-year. Reads a DowJones Newswires headline: “Eurozone inflation cools, setting the stage for June rate cut.”

The key outside markets today see the U.S. dollar index lower. Nymex crude oil prices are higher, hit a five-month high, and are trading around $86.00 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently fetching around 4.4%.

Technically, the gold futures bulls have the strong overall near-term technical advantage. A six-week-old uptrend is in place on the daily bar chart. Bulls’ next upside price objective is to produce a close in June futures above solid resistance at $2,400.00. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at $2,200.00. First resistance is seen at the overnight contract high of $2,308.80 and then at $2,320.00. First support is seen at Tuesday’s of $2,267.10 and then at $2,250.00. Wyckoff’s Market Rating: 9.0.

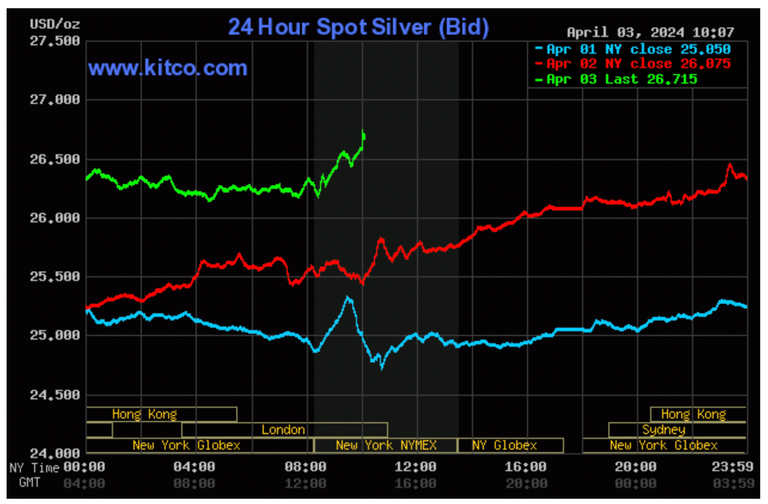

The silver bulls have the solid overall near-term technical advantage. Bulls have revived a six-week-old uptrend on the daily bar chart. Silver bulls’ next upside price objective is closing May futures prices above solid technical resistance at $27.50. The next downside price objective for the bears is closing prices below solid support at $25.00. First resistance is seen at the overnight high of $26.68 and then at $27.00. Next support is seen at the overnight low of $26.235 and then at $26.00. Wyckoff’s Market Rating: 7.5.

Technically, June gold futures bulls have the strong overall near-term technical advantage. A six-week-old uptrend is in place on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $2,400.00. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at $2,200.00. First resistance is seen at today’s contract high of $2,308.80 and then at $2,320.00. First support is seen at today’s low of $2,285.70 and then at Tuesday’s low of $2,267.10. Wyckoff’s Market Rating: 9.5

May silver futures bulls have the solid overall near-term technical advantage and have restarted a six-week-old price uptrend on the daily bar chart. Silver bulls’ next upside price objective is closing prices above solid technical resistance at $28.00. The next downside price objective for the bears is closing prices below solid support at $25.00. First resistance is seen at $27.25 and then at $27.50. Next support is seen at $26.50 and then at today’s low of $26.235. Wyckoff’s Market Rating: 8.0

May N.Y. copper closed up 1,065 points at 417.70 cents today. Prices closed near the session high and hit a 14-month high today. The copper bulls have the solid overall near-term technical advantage. Prices are in a seven-week-old uptrend on the daily bar chart. Copper bulls’ next upside price objective is pushing and closing prices above solid technical resistance at 430.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 396.75 cents. First resistance is seen at today’s high of 418.10 cents and then at 425.00 cents. First support is seen at 410.00 cents and then at today’s low of 406.90 cents. Wyckoff’s Market Rating: 8.0.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.