Equities are having another impressive month, but the gains are just half those of gold and barely 40% of silver

- Gold prices have been trading sideways for the past two weeks, but a fresh all-time closing high is in store.

- Silver prices have struggled this week but, technically, the bigger picture remains bullish.

- A pullback in U.S. Treasury yields and the U.S. dollar may ultimately pave the path for more gains by precious metals.

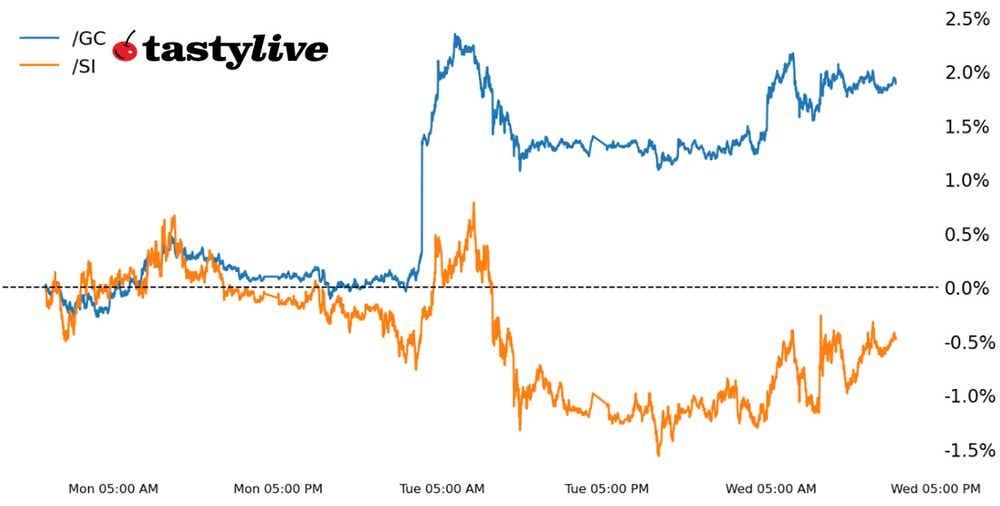

U.S. equities may be having another impressive month, but the gains in the S&P 500 (/ESM4) are just half those of gold prices (/GCM4) and barely 40% of what’s been achieved by silver prices (/SIK4). What could have triggered the outperformance by precious metals?

Signals from the Federal Reserve that interest rates may come down without inflation returning to the medium-term target of 2% has pushed down real rates, which tends to be beneficial for financial assets. Alongside a push higher in metals volatility, the fundamental backdrop has been ideal for precious metals, even though traders have settled in with the idea that there will only be three 25 basis-point (bps) interest rate cuts by the Federal Reserve this year.

Earlier in March, it was observed that “resiliency was an early sign bulls were waiting in the wings. Technical breakouts in both [/GCM4] and /SIK4 may just be getting started.” Indeed, the technical tailwinds remain bullish in the short term.

/GC Gold Price Technical Analysis: Daily Chart (May 2023 to March 2024)

After establishing fresh all-time highs earlier in the month, gold prices (/GCM4) have spent the better part of the past three weeks trading sideways. The consolidation has seen fits and starts of an attempt to trade higher without success, though it should be noted that /GCM4 has been consolidating above former all-time highs, hardly a bearish development.

The sideways price action has led to a relaxation of overbought momentum conditions; this may have been a correction in time rather than price. /GCM4 remains above its daily 5-, 13- and 21-EMA (exponential moving average) cloud, which is in bullish sequential order. Slow stochastics have issued a bullish crossover while above their signal line, as has MACD (moving average convergence/divergence). Even though volatility is high (IV Index: 13%; IV Rank: 51.7), there’s no technical reason (yet) to try to fade the move (e.g. selling at ATM or OTM call spread).

/SI Silver Price Technical Analysis: Daily Chart (September 2023 to March 2024)

The correction in silver prices (/SIK4) has been more about price than time, although /SIK4 is at the same price levels it was two weeks ago, underscoring the directionless move. However, support may have been found: The daily 21-EMA has marked the lows each of the past two sessions. Contextually, the bullish falling wedge has yet to be completed, which ultimately calls for a rally into the December 2023 high of 26.575. For traders who missed the initial move higher, long exposure (via an at-the-money call spread, given the relatively low volatility) may be appropriate as long as this week’s low of 24.445 holds.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.