VANCOUVER, BC / ACCESSWIRE / August 27, 2024 / Guanajuato Silver Company Ltd. (the “Company” or “GSilver“) (TSXV:GSVR) (OTCQX:GSVRF) is pleased to provide an operations update for several projects at or near the Company’s wholly owned mines, including the Topia Mine (“Topia“) in Durango, Mexico, the San Ignacio Mine (“San Ignacio“) in Guanajuato, Mexico, and the El Horcon Mine project (“Horcon“) in Jalisco, Mexico.

James Anderson, Chairman and CEO, said, “As our consolidation of the Guanajuato Mining Camp continues in step with the ongoing upgrading at our four producing precious metals mines, we would like to provide our investors with an update on the latest initiatives we are implementing as we continue our rapid path of growing Guanajuato Silver into a mid-tier silver producer.”

At the Topia Mine in Durango, the commissioning of a new filter system for silver-gold-lead concentrates has been successfully completed. This new filter system is one of two that will be installed at the mine site; the second concentrator will be for silver-zinc concentrate production. Topia produces concentrates containing silver, gold, lead and zinc through a processing facility that comprises a 260-tonnes-per-day flotation plant; the new concentrate filters will contribute to helping the plant achieve, and potentially exceed, full production capacity, as well as potentially producing higher grade concentrates.

James Anderson commented, “We anticipate that when both filters are activated, the result will be a 2% additional increase in both base and precious metal recoveries derived from minimizing wastage due to a lack of filtering capacity. The Company anticipates a rapid pay-back period of this project’s roughly US$500,000 expenditure.”

Image 1: New Lead Filter Press at Topia

At the San Ignacio Mine, located approximately 20km from the Company’s Cata Processing facility, a new ore sorter, which arrived on site in July, is rapidly approaching the commissioning phase. The NUCTECH MC2000NF Intelligent Mineral Sorting System provides high-tech sorting accuracy, large processing capacity, environmental friendliness, and high reliability through a system that utilizes X-ray and structured light imaging technology to intelligently identify and then separate high-grade silver and gold material. The ore sorter is expected to improve overall efficiencies at San Ignacio, raising the grade of transported material to the Cata mill. The San Ignacio mine accounted for approximately 15% of total silver-equivalent production during Q2, 2024.

James Anderson, said, “Installation of San Ignacio’s ore sorter is nearly complete; we estimate that our new ore sorter will provide significant monthly savings to operating costs, and generate an increase in silver-equivalent ounces per annum through improved grade, reduced energy consumption, reduced haulage charges, and increased concentration production capacity.”

Image 2: Ore Sorter Install

At The Company’s Horcon Mine project, located in the state of Jalisco approximately 60km north-west of the Company’s Cata processing facility in Guanajuato, the Company has recommenced the processing of surface stockpile material. To date, over 28,000 tonnes of mineralized material has been processed, generating over 125,159* silver-equivalent ounces “AgEq” from mid-November 2023 to June of 2024. In July, the project paused to allow for the further evaluation of additional stockpiles in the area; the processing of low-cost mineralised material from Horcon recommenced in August and is expected to continue through the remainder of the year.

*28,455 tonnes grading 34g/t silver and 1.54g/t gold for 165g/t AgEq / AgEq calculated using an 85.18 ratio of silver to gold; silver recovery was 64.4% and gold recovery was 86.3%.

Additionally, at Horcon the Company has completed an underground sampling program that has mapped and surveyed over 5km of tunnels, adits, and old workings. The Company is now designing an underground drill campaign intended to expand geological knowledge in advance of a decision to potentially restart commercial underground operations at this satellite mine in the future.

Image 3: Horcon surface sampling.

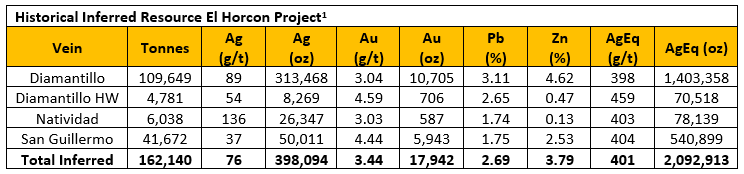

Acquired as part of the purchase of Great Panther’s Mexican assets (see GSilver’s news release dated August 4, 2022 – GSilver Closes Acquisition of Great Panther’s Mexican Mining Assets), the El Horcon mining concessions cover 7,908 hectares comprising 17 contiguous mining concessions. The El Horcon mine is a past producer dating back to the 16th century, and many underground workings, tunnels, and access points are known to exist. In 2017, the previous operator established a historical inferred mineral resource that was prepared in accordance with National Instrument 43-101 of 2.0 million silver-equivalent ounces (“AgEq“) (see notes to table for silver-equivalent calculations) from 162,140 tonnes grading 3.44g/t gold, 76 g/t silver and 2.69% lead, and 3.79% zinc based on 42 drill holes and 463 underground channel samples (see table and description below – the inferred mineral resource is considered historical in nature).

-

See NI43-101 Technical Report on the Guanajuato Mine Complex Claims and Mineral Resource Estimations for the Guanajuato Mine, San Ignacio Mine and El Horcon and Santa Rosa Projects dated February 20, 2017 with an effective date of August 31, 2016; prepared for Great Panther Silver Limited by Robert Brown, P. Eng. Qualified Person & VP Exploration.

Notes:

-

US$110/tonne NSR Cut-off

-

Silver equivalent was calculated using a 70.6 to 1 ratio of silver to gold value.

-

Rock Density for all veins for Diamantillo is 2.77t/m³, San Guillermo 2.78t/m³, Diamantillo HW is 2.62t/m³, Natividad 2.57t/m³.

-

Totals may not agree due to rounding.

-

Grades in metric units

-

Contained silver and gold in troy ounces

-

Minimum true width 1.5m

-

Metal Prices $18.00USD/oz silver, and $1,300USD/oz gold, and $0.80USD/lb lead.

-

Ag eq (g/t) and AgEq (oz) use only Au, Ag, and Pb values.

The El Horcon mineral resource estimate is a historical estimate and the reader is cautioned not to treat them, or any part of them, as a current resource. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves and the Company is not treating the historical estimate as current mineral resources or mineral reserves. The mineral resource is taken from a Great Panther technical report dated February 20, 2017. However, based on the assumptions, parameters and methods in the prior technical report, as well as literature and data review the Company considers such estimate to be relevant and reliable and provides an indication of the extent of mineralization identified by previous operators at the El Horcon Mine. To verify the historical mineral resource estimate as a current mineral resource, a qualified person would need to complete database validation, undertake a full review of estimation parameters and procedures, and complete an updated mineral resource estimate and a NI 43-101 technical report incorporating additional production, drilling, sampling and resaying of core completed at El Horcon since February 2017.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine Complex, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

Technical Information

Reynaldo Rivera, VP of Exploration of GSilver, has approved the scientific and technical information contained in this news release. Mr. Rivera is a member of the Australasian Institute of Mining and Metallurgy (AusIMM – Registration Number 220979) and a “qualified person” as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

ON BEHALF OF THE BOARD OF DIRECTORS

“James Anderson”

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

Gsilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, ongoing upgrades at the four producing precious metals mines, the rapid path in growing Guanajuato Silver into a mid-tier silver producer, the installation of a second concentrator at Topia, the operating capacity of Topia, the excepted increase in base metal recoveries at Topia, the commissioning of the new ore sorter at San Ignacio and its expected impacts, processing of mineralized material from El Horcon, expectations for a drill campaign at El Horcon, and the Company’s status as one of the fastest growing silver producers in Mexico.

Such forward-looking statements and information reflect management’s current beliefs and expectations and are based on information currently available to and assumptions made by the Company; which assumptions, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: our estimates of mineralized material at El Cubo and San Ignacio and the assumptions upon which they are based, including geotechnical and metallurgical characteristics of rock conforming to sampled results and metallurgical performance; available tonnage of mineralized material to be mined and processed; resource grades and recoveries; assumptions and discount rates being appropriately applied to production estimates; the ability of the Company to ramp up processing of mineralized material at Cata at the projected rates and source sufficient high grade mineralized material to fill such processing capacity; prices for silver, gold and other metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company’s projects and to satisfy current liabilities and obligations including debt repayments; capital cost estimates; decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) and inflation rates remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results, level of activity, production levels, performance or achievements of GSilver to differ materially from those expected including, but not limited to, market conditions, availability of financing, future prices of gold, silver and other metals, currency rate fluctuations, rising inflation and interest rates, actual results of production, exploration and development activities, actual resource grades and recoveries of silver, gold and other metals, availability of third party mineralized material for processing, unanticipated geological or structural formations and characteristics, geopolitical conflicts including wars, environmental risks, operating risks, accidents, labor issues, equipment or personnel delays, delays in obtaining governmental or regulatory approvals and permits, inadequate insurance, and other risks in the mining industry. There are no assurances that GSilver will be able to successfully discover and mine sufficient quantities of high grade mineralized material at El Cubo, VMC, San Ignacio and Topia for processing at its existing mills to increase production, tonnage milled and recoveries rates of gold, silver, and other metals in the amounts, grades, recoveries, costs and timetable anticipated. In addition, GSilver’s decision to process mineralized material from El Cubo, VMC, San Ignacio, Topia, El Horcon and its other mines is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and therefore is subject to increased uncertainty and risk of failure, both economically and technically. Mineral resources and mineralized material that are not Mineral Reserves do not have demonstrated economic viability, are considered too speculative geologically to have the economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues. There are no assurances that the Company’s projected production of silver, gold and other metals will be realized. In addition, there are no assurances that the Company will meet its production forecasts or generate the anticipated cash flows from operations to satisfy its scheduled debt payments or other liabilities when due or meet financial covenants to which the Company is subject or to fund its exploration programs and corporate initiatives as planned. There is also uncertainty about any resurgence of COVID-19, the ongoing war in Ukraine and conflict in Gaza and higher inflation and interest rates and the impact they will have on the Company’s operations, supply chains, ability to access mining projects or procure equipment, supplies, contractors and other personnel on a timely basis or at all and economic activity in general. Accordingly, readers should not place undue reliance on forward-looking statements or information. All forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com including the Company’s annual information form for the year ended December 31, 2023. These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.