June 25, 2024 – Outcrop Silver & Gold Corporation (TSXV:OCG, OTCQX:OCGSF, DE:MRG) (“Outcrop Silver”) is pleased to announce significant improvements in gold and silver recovery following metallurgical testing at its flagship Santa Ana project. This recent comprehensive test work, a follow-up to previous flotation-only and gravimetric-only tests (see news releases dated August 23, 2023, and April 22, 2024), combined gravimetric separation followed by flotation of the gravimetric tails. The results demonstrated remarkable recovery rates of 96.3% for silver and 98.5% for gold.

Key Highlights:

– High-Efficiency Recovery: The integrated gravimetric and flotation test work resulted in an overall recovery of 96.3% for silver and 98.5% for gold, setting a new benchmark for the project.

– Initial Gravimetric Concentration: The gravimetric process alone recovered 7.6% of silver and 35.8% of gold, with the gravimetric concentrate assaying at 2,883 g/t silver and 164 g/t gold.

– Subsequent Flotation Recovery: Flotation of gravimetric tails recovered and additional 88.6% of the remaining silver and 62.7% of the remaining gold, with rougher concentrate grades reaching 4,356 g/t silver and 37.5 g/t gold.

– Unique Mineralogy: The process highlights the project’s distinctive mineral composition where 88% of the silver is in the form of argentite – a silver sulfide which is amenable to flotation, enhancing recoverability and high-grade concentrates.

“The exceptional recoveries of both silver and gold at the Santa Ana project, achieved through environmentally conscious methods, underscore the uniqueness of Santa Ana as one of the world’s highest-grade undeveloped primary silver deposits. Our ability to achieve incredible recovery rates and produce high-grade concentrates demonstrates the project’s efficiency in extracting significant value from the ground,” comments Ian Harris, President and CEO. “This significantly de-risks the Santa Ana project and is very promising as we continue our drilling operations to potentially expand the existing resources dramatically.”

Sample Preparation and Previous tests

Outcrop Silver commenced its metallurgical test program by preparing four core sample composites using coarse laboratory rejects (see news release dated February 23, 2022). Two samples for each vein as follow: samples POR-01 and POR-02 for the La Porfia vein and samples PAR-01 and PAR-02 for Paraiso vein. Each composite weighted approximately 50 kilograms, and represented two metallurgical domains: high-grade and low-grade. The high-grade composites represent the average grade in the ore-shoot, while the low-grade represents Outcrop Silver’s “significant result” threshold. The final locked cycle flotation metallurgical balance results for sample PAR-02 demonstrated an exceptional recovery rate, achieving 97.14% for gold and 92.85% for silver; this process produced a high-grade concentrate grading of 128.74 grams per tonne of gold and 9,488 grams per tonne of silver (see News Release dated August 23, 2023).

Gravimetric Concentration Tests

The gravimetric concentration tests on the PAR-02 sample from Paraiso vein were performed at SGS Metallurgical Services Peru utilizing a Falcon Gravity Concentrator, resulting in recovery rates of 30.52% for gold and 7.3% for silver (see News Release dated April 22, 2024).

Sequential Gravimetric and Flotation Concentration Tests

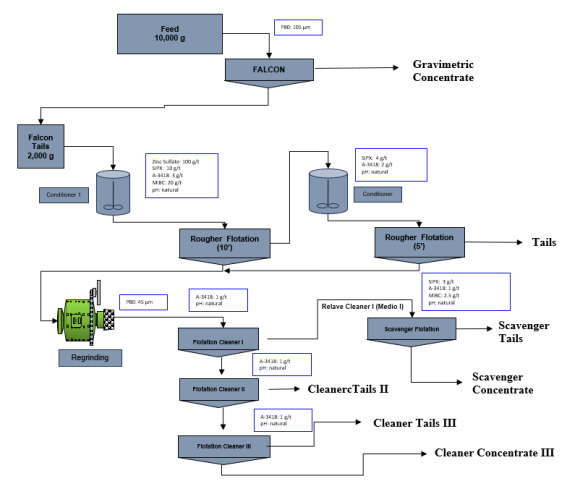

The conventional open cycle flotation was applied to the general tails from the gravimetric concentration test following the conditions from the previous flotation tests (see News Release dated August 23, 2023) as main guidelines (Figure 1). SGS Metallurgical Services Peru executed this program with all analyses performed at SGS Geochemical Services Laboratory in Lima, Peru.

The Rougher flotation concentrate returned grades of 4,357 grams per tonne of silver and 37.47 grams per tonne of gold for 88.64% and 62.74% recoveries, respectively (Table 2). Together with the gravimetric concentration results, the current test work achieved a remarkable global recovery of 96.28% for silver and 98.52% for gold (Table 1), confirming Outcrop Silver’s goal of maximizing metallurgical recoveries by combining physical methods on the mineralized material from Santa Ana project.

|

|

|

|

Grades |

Recoveries |

||||||

|

Product |

Mass % |

Ag g/t |

Au g/t |

Fe % |

S % |

Ag % |

Au % |

Fe % |

S % |

|

|

Gravimetric Conc. |

1.31 |

2,883 |

164.12 |

16.66 |

17.60 |

7.64 |

35.79 |

3.26 |

6.30 |

|

|

Rougher Conc. |

10.04 |

4,357 |

37.47 |

26.48 |

31.69 |

88.64 |

62.74 |

39.80 |

87.14 |

|

|

Global |

11.35 |

4,187 |

52.07 |

25.35 |

30.07 |

96.28 |

98.52 |

43.06 |

93.45 |

|

|

Tails |

88.65 |

21 |

0.10 |

4.29 |

0.27 |

3.72 |

1.48 |

56.94 |

6.55 |

|

|

Calculated Head |

100.00 |

494 |

6.00 |

6.68 |

3.65 |

100.00 |

100.00 |

100.00 |

100.00 |

|

|

Assayed Head |

|

539 |

6.67 |

6.94 |

3.52 |

|

|

|

|

|

Table 1. Summary of Global Metallurgical Balance.

Figure 1. Sequential Gravimetric and Flotation Metallurgical Testing flow chart.

|

Product |

Mass % |

Grades |

Recoveries |

||||||

|

Ag g/t |

Au g/t |

Fe % |

S % |

Ag % |

Au % |

Fe % |

S % |

||

|

Gravimetric Concentrate |

1.31 |

2883 |

164.12 |

16.66 |

17.60 |

7.64 |

35.79 |

3.26 |

6.30 |

|

Gravimetric tails |

98.69 |

486 |

4.41 |

6.72 |

3.39 |

92.36 |

64.21 |

96.74 |

93.70 |

|

Rougher Concentrate |

10.04 |

4357 |

37.47 |

26.48 |

31.69 |

88.64 |

62.74 |

39.80 |

87.14 |

|

Cleaner Concentrate III |

3.49 |

8590 |

82.54 |

37.98 |

50.04 |

60.75 |

48.03 |

19.84 |

47.83 |

|

Medium III |

1.81 |

5139 |

40.03 |

35.72 |

47.89 |

18.86 |

12.08 |

9.68 |

23.75 |

|

Medium II |

0.89 |

1427 |

5.97 |

19.59 |

20.04 |

2.58 |

0.89 |

2.62 |

4.90 |

|

Scavenger Concentrate |

0.77 |

2465 |

6.60 |

26.19 |

28.67 |

3.83 |

0.84 |

3.00 |

6.02 |

|

Scavenger tails |

3.08 |

421 |

1.73 |

10.10 |

5.51 |

2.63 |

0.89 |

4.66 |

4.65 |

|

General Tails |

88.65 |

21 |

0.10 |

4.29 |

0.27 |

3.72 |

1.48 |

56.94 |

6.55 |

|

Calculated Head |

100.00 |

494 |

6.00 |

6.68 |

3.65 |

100.00 |

100.00 |

100.00 |

100.00 |

|

Assayed Head |

|

539 |

6.67 |

6.94 |

3.52 |

|

|

|

|

Table 2. Summary of Global Metallurgical Balance.

Qualified Person

Edwin Naranjo Sierra is the designated Qualified Person for this news release within the meaning of the National Instrument 43-101 (NI 43-101) and has reviewed and verified the technical information in this news release. Mr. Naranjo holds a MSc. in Earth Sciences, and is a Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM) and the Society of Economic Geologist.

About Santa Ana

The 100% owned Santa Ana project covers 27,000 hectares within the Mariquita District, known as the largest and highest-grade primary silver district in Colombia with mining records dating back to 1585.

Santa Ana’s maiden resource estimate, detailed in the NI 43-101 Technical Report titled “Santa Ana Property Mineral Resource Estimate,” dated June 8, 2023, prepared by AMC Mining Consultants, indicates an estimated indicated resource of 24.2 million ounces silver equivalent at a grade of 614 grams per tonne and an inferred resource of 13.5 million ounces at a grade of 435 grams per tonne. The identified resources span seven major vein systems that include multiple parallel veins and ore shoots: Santa Ana (San Antonio, Roberto Tovar, San Juan shoots); La Porfia (La Ivana); El Dorado (El Dorado, La Abeja shoots); Paraiso (Megapozo); Las Maras; Los Naranjos, and La Isabela.

The 2024 drilling campaign aims to extend known mineralization and test new high-potential areas along the project’s extensive 30 kilometres of strike. These efforts underscore the scalability of Santa Ana and its potential for substantial resource growth, positioning the project to develop into a high-grade, economically viable, and environmentally responsible silver mine.

About Outcrop Silver

Outcrop Silver is a leading explorer and developer focused on advancing its flagship Santa Ana high-grade silver project in Colombia. Leveraging a disciplined and seasoned team of professionals with decades of experience in the region. Outcrop Silver is dedicated to expanding current mineral resources through strategic exploration initiatives.

At the core of our operations is a commitment to responsible mining practices and community engagement, underscoring our approach to sustainable development. Our expertise in navigating complex geological and market conditions enables us to consistently identify and capitalize on opportunities to enhance shareholder value. With a deep understanding of the Colombian mining landscape and a track record of successful exploration, Outcrop Silver is poised to transform the Santa Ana project into a significant silver producer, contributing positively to the local economy and setting new standards in the mining industry.

ON BEHALF OF THE BOARD OF DIRECTORS

Ian Harris

Chief Executive Officer

+1 604 638 2545

Kathy Li

Vice President of Investor Relations

+1 778 783 2818

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “potential,” “we believe,” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Outcrop to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including: the receipt of all necessary regulatory approvals, capital expenditures and other costs, financing and additional capital requirements, completion of due diligence, general economic, market and business conditions, new legislation, uncertainties resulting from potential delays or changes in plans, political uncertainties, and the state of the securities markets generally. Although management of Outcrop have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Outcrop will not update any forward-looking statements or forward-looking information that are incorporated by reference.