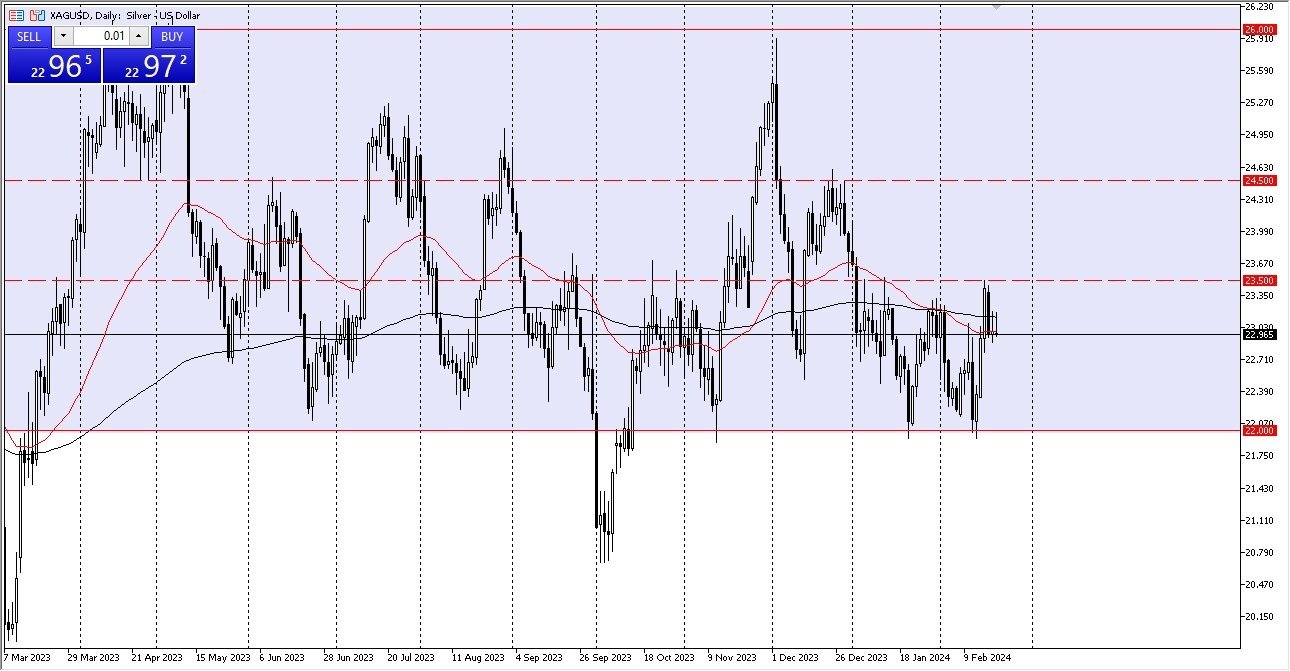

Potential Signal: With the FOMC Meeting Minutes being released late in the session, I suspect that we could see action. A move above $23.50 has me buying the breakout. At that point, I am aiming for $24.35, with a stop at $23.20 below.

- During Wednesday’s trading session, the silver market slightly recovered in order to once more test the pivotal 200-Day EMA.

- As is customary with silver, this market has been extremely loud and should stay that way. Keep in mind that silver is extremely risky, thus during this kind of volatility, maintain a sensible stake size.

We are circling the 200-day EMA in the silver market, which is presently providing some resistance. However, bear in mind that the 200-day EMA is practically flat. That implies that more than anything else, we are heading in the wrong direction. The barrier at $23.50, which has been in place for about two months, has been active on various occasions during the past few years. We can try to target the $24.50 level if we are able to break over the $23.50 mark.

Forex Brokers We Recommend in Your Region

As far as I can tell, short-term pullbacks will be buying opportunities, and the $22 level underneath is a big support level that has shown itself numerous times. In that location, we have formed something of a double bottom. Thus, I believe it is important. In the end, you will need to include US interest rates, the US currency itself, and industrial demand—which is, naturally, a little harder to estimate because silver is used in certain industries. Of course, there are also global central bank actions.

As of right now, it appears that several central banks will be loosening their monetary policies in 2019. Furthermore, precious metals should perform reasonably well overall if that is the case. Because silver can occasionally be an extremely dangerous market to trade in, keep the size of your position moderate. You must therefore use extreme caution when making a big wager all at once. As a result, I would expect to see more buying in this market’s dip area moving forward, which, to be honest, has been the case for the past six weeks or so. I do anticipate seeing increased momentum following a break above $23.50, which would make the next dollar a much easier target for market players to reach.

Ready to trade our Forex daily analysis and predictions? Here’s a list of regulated forex brokers to choose from.