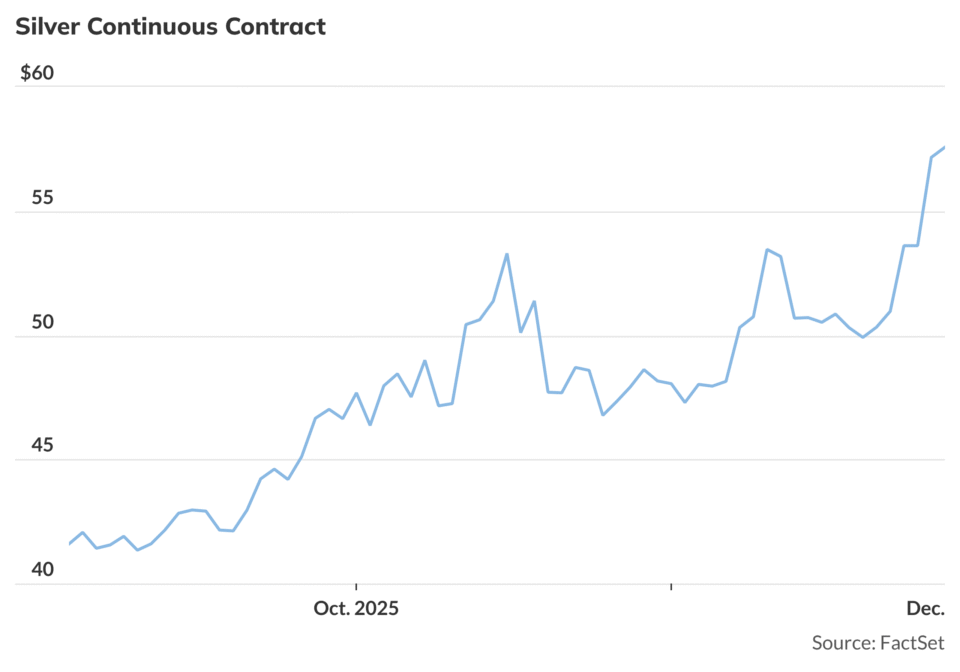

Silver futures ended their six-day rally Tuesday after a widely-regarded technical indicator – the relative strength index – touched 70, signalling overbought conditoins for many traders. Having traded north of $59 on Monday, futures were 2.57% lower Tuesday morning at $57.61.

Having delivered a 95% return for 2025 so far, comfortably outpacing gold and platinum, silver ran into some profit-taking but sentiment towards precious metals remains upbeat nonetheless.

Drivers behind the strength in silver include the supply deficit that is forecast for 2026, the safe-haven appeal that inflation fears have engendered, the expectations of another Fed rate cut next week, robust demand from electrification trends and electric vehicles and a physical shortage of inventories in its global trading hubs.