Southern Silver Exploration Corp. (TSXV: SSV) (“Southern Silver”) reports results from its Preliminary Economic Assessment(‘ PEA“) on its 100% owned Cerro Las Minitas project (“CLM”).

PEA Highlights (all figures in $US unless otherwise noted):

- Robust Project Economics – Base Case1: after-tax NPV5% of $501M (C$682M) and IRR of 21.2% with a 48-month payback;

- Excellent Silver and Zinc Price Leverage – Base-case + 20% Metal Prices2: after-tax NPV5% of $876M (C$1,193M) and IRR of 30.1% with a 37-month payback;

- Base Case Metal Prices: Ag- $23.00/oz, Au – $1850/oz, Cu – $4.00/lb, Pb – $1.00/lb and Zn – $1.25/lb

- Base Case +20% metal prices: Ag- $27.60/oz, Au – $2220/oz, Cu – $4.80/lb, Pb – $1.20/lb and Zn – $1.50/lb

The 2024 Preliminary Economic Assessment features:

- A Large-Scale Underground Mining Operation with a 17-year mine life and an annual average plant feed of 14.3 Mozs AgEq3 (inc. 5.8 Mozs Ag) and life-of-mine (LOM) feed totalling 243.2 Mozs AgEq3; (inc. 98.6 Mozs Ag). LOM product sales total 194.3Mozs AgEq3 at an AISC of $13.23/oz AgEq3 sold;

- A High-Revenue Project with gross revenues totalling $4.47B with silver and gold representing 45% of revenues, and zinc representing 35% of projected revenues. The project has an Initial CapEx of $388M, an NPV5%-to-CapEx ratio of 1.3X and a paydown of 48 months on a post-tax basis; and

- A Well-Located Project in a mining friendly jurisdiction with excellent infrastructure in southeast Durango state, Mexico;

- AgEq is calculated on a (contained metal x metal price)/ Ag price basis

In comparison to the earlier 2022 economic model, the updated PEA now:

- Increases the Life of Mine (LOM) production by 5Mt, representing an approximate 20% increase;

- Increases daily mine production capacity to 5300 tonnes per day (“tpd”), representing an approximate 18% increase;

- Extends the mine life by 2.6yrs;

- Increases the LOM Revenue by $765M, representing an approximate 17% increase in revenues.

- Increases the after-tax NPV5% by 45% to $501M; and

- Similarly, increases the post-tax IRR by 3.3% to 21.2%

Lawrence Page. K. C. President, said: “This latest economic update of Cerro Las Minitas represents a new milestone in the ongoing evolution and development of the project which is the culmination of a number of smaller technical improvements, developed over the last 18 months, which together result in a significant increase in the value of the Cerro Las Minitas asset. This includes the addition of new mineral resources from the North Felsite zone as first reported in March 2023; the standardization of the metallurgical recoveries and charges across each of the deposits, including the addition of gold revenues into the project cash-flow; improvements in the mine scheduling and optimization both the Operating and Capital costs of the project.”

“Since acquisition of the property in 2010 and subsequent identification of the mineral resources, a very profitable and valuable mine has been modelled in the results of the PEA disclosed today. Total acquisition, exploration and development costs are approximately US$28 million and significantly, the property is not burdened with royalties, presenting potential financing opportunities for additional drilling and development work on the property. This presentation of the results of the PEA marks a significant milestone in the development of the property and the best is yet to come.”

PEA SUMMARY:

Study support

- The study is based on an updated Mineral Resource (“Resource”) by KGL, as of March 20th 2024, using a $60NSR/t cut-off:

- Indicated – 13.3Mt averaging 102g/t Ag, 0.07g/t Au, 0.17% Cu 1.3% Pb, and 3.1% Zn totaling 43.4Moz Ag, 32Koz Au, 49Mlb Cu, 374Mlb Pb and 921Mlb Zn; and

- Inferred – 23.4Mt averaging 111g/t Ag, 0.14g/t Au, 0.21% Cu, 1.1% Pb and 2.1% Zn totaling 83.4Moz Ag, 104koz Au, 111Mlb Cu, 582Mlb Pb and 1,106Mlb Zn.

(see Appendices for Resource details, price and recovery assumptions)

- The PEA project team included Kirkham Geosciences Ltd. (“KGL”), Ausenco Engineering USA South Inc and Ausenco Sustainability ULC. (“Ausenco”), Entech Mining Limited (“Entech”), and MPC Metallurgical Process Consultants Limited (“MPC”);

- PEA metal price assumptions: Ag = $23.00/oz, Au = $1850, Cu = $4.00/lb, Pb = $1.00/lb, Zn= $1.25/lb;

- Terms: Net Present Value at a 5% discount (“NPV5%”); Internal Rate of Return (“IRR”); Operating Costs (“OpEx”); and Capital Costs (“CapEx”), All-in Sustaining Costs (“AISC”)

Cautionary Statement

The PEA is preliminary in nature, it may include mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves have not demonstrated economic viability. The mineral resources may be affected by subsequent assessment of mining, environmental, processing, permitting, taxation, socio-economic, and other factors.

Project Economics

The CLM project demonstrates robust LOM revenues over 17 years of production and after-tax NPV5% of $501M. Total Capital Expenditure for the project is $565M which requires $388M of initial capital expenditure and $177M in sustaining and closure capital. The project payback is 48 months.

Table 1: CLM Project Economics

| Item | Units | Base Case |

| Revenue | US $M | $4,470 |

| EBITDA | US $M | $2,076 |

| LOM pre-tax cash flow | US $M | $1,512 |

| LOM after-tax cash flow | US $M | $923 |

| NPV pre-tax (5% Discount) | US $M | $887 |

| NPV pre-tax (8% Discount) | US $M | $648 |

| NPV pre-tax (10% Discount) | US $M | $525 |

| IRR pre-tax | % | 30.0% |

| NPV after-tax (5% Discount) | US $M | $501 |

| NPV after-tax (8% Discount) | US $M | $340 |

| NPV after-tax (10% Discount) | US $M | $258 |

| IRR After Tax | % | 21.2% |

| Initial Capital Expenditures | US $M | $388 |

| Payback (discounted, after-tax) | months | 48 |

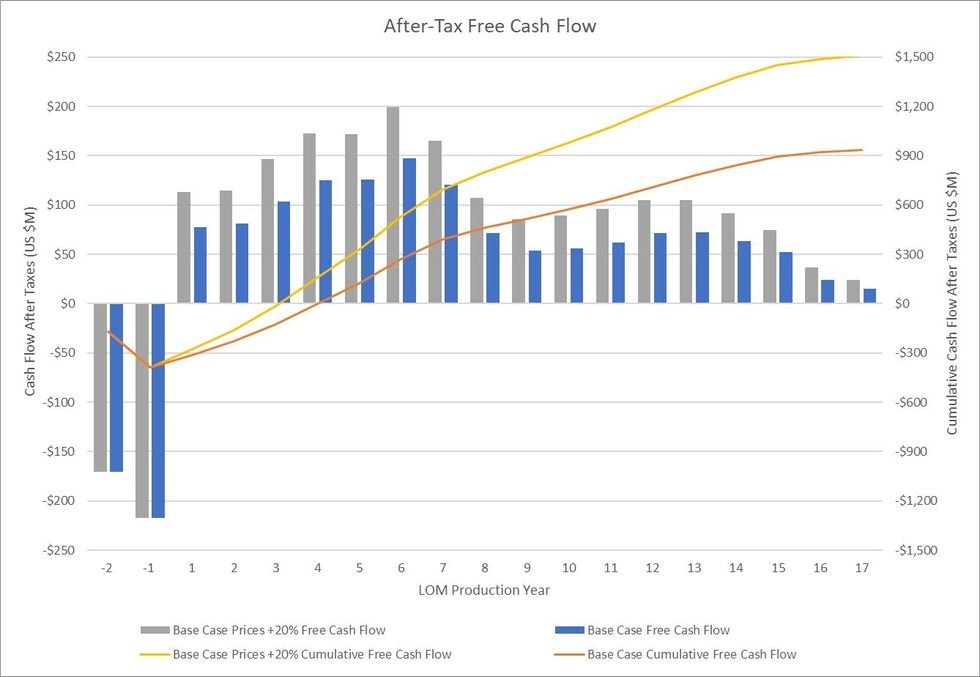

After-Tax, Free Cash Flow

Figure 1 illustrates the estimated annual and cumulative after-tax cash flow over the life-of-mine for both the Base Case (blue) and the Base Case +20% metal values (grey). Mine scheduling targets higher margin mineralization in the first eight years of production resulting in a more aggressive paydown of capital and improved economics with an annual average After-tax Free-cashflow of $107M in the first eight years of production and $78M over the life-of-Mine.

Figure 1: Annual and LOM cashflow

Figure 1: Annual and LOM cashflow

Economic Sensitivities

The Project’s gross revenues, NPV5% and IRR shows greatest sensitivity to metal prices.

Table 2: Gross Revenue, NPV5% and IRR sensitivity at base-case +/- 20% and current pricing

| All Metal Price (Ag, Au, Cu, Pb, Zn) Sensitivity | ||||

| Metal Price | Revenue (US$M) | NPV, after tax @ 0% (US$M) |

NPV, after tax @ 5% (US$M) |

IRR, after Tax |

| Spot | $5,493 | $1,583 | $931 | 31.4% |

| +20% | $5,364 | $1,501 | $876 | 30.1% |

| Base Case | $4,470 | $923 | $501 | 21.2% |

| -20% | $3,576 | $339 | $122 | 9.9% |

Note: Base Case price assumes Ag = $23.00/oz, Au = $1850/oz, Cu = $4.00/lb, Pb = $1.00/lb, Zn = $1.25/lb

“Spot” assumes May 29 2024 prices: Ag = $31.53/oz, Au = $2332/oz, Cu = $4.69/lb, Pb = $1.05/lb, Zn = $1.41/lb

Other factors that may impact the NPV sensitivity include changes in Operating Costs (“OpEx”) and Initial Capital. These relative impacts together with changes in silver and zinc prices are shown in Table 3 and Figure 2.

Table 3: NPV sensitivity as a function of select metals prices, recoveries, CapEx and OpEx:

| Sensitivity NPV @ 5%, after Tax (US$M) | ||||||

| Sensitivity | Silver Price | Zinc Price | Silver in Pb Recovery | Zinc Recovery | Initial Capital | OPEX |

| 20% | $665 | $628 | $427 | $351 | ||

| 15% | $624 | $596 | $446 | $388 | ||

| 10% | $583 | $565 | $570 | $533 | $464 | $426 |

| 5% | $542 | $533 | $535 | $523 | $483 | $464 |

| 0% | $501 | $501 | $501 | $501 | $501 | $501 |

| -5% | $460 | $469 | $467 | $479 | $520 | $539 |

| -10% | $419 | $437 | $433 | $457 | $538 | $576 |

| -15% | $378 | $405 | $398 | $435 | $556 | $613 |

| -20% | $337 | $373 | $364 | $413 | $575 | $650 |

Note: +15% and +20% Silver and Zn recoveries are not applicable

Figure 2: After-tax NPV5% sensitivities

Figure 2: After-tax NPV5% sensitivities

Production and Costs:

Annual mine production is estimated to deliver 14.3 Moz AgEq (includes 5.8 Mozs Ag) to the processing facility averaged over a 17-year period. Potential annual product of sales (net deductions, treatment and refining) averaging 11.4 Moz AgEq (includes 4.9 Mozs Ag).

Peak annual Plant Feed is achieved in Year 6 with 22.3 Mozs AgEq (includes 9.4 Moz Ag) being processed with peak annual product of sales of 18.0 Moz AgEq (includes 7.9 Moz Ag). Table 4 summarizes the estimated metal production from the CLM project.

Table 4: CLM LOM Production and Metal Sales

| Units | Y1-8 | LOM | |

| AgEq Plant Feed (Yearly Average) | (Moz) | 17.9 | 14.3 |

| AgEq Product of Sales (Yearly Average) | (Moz) | 14.4 | 11.4 |

| AgEq Plant Feed (Total) | (Moz) | 143.7 | 243.2 |

| AgEq Product of Sales (Total) | (Moz) | 115.4 | 194.3 |

| All-In Sustaining Cost (AISC) | (US$/AgEq oz) | $12.23 | $13.23 |

| Units | Y1-8 | LOM | |

| Ag Plant Feed (Yearly Average) | (Moz) | 7.6 | 5.8 |

| Ag Product of Sales (Yearly Average) | (Moz) | 6.5 | 4.9 |

| Ag Plant Feed (Total) | (Moz) | 60.8 | 98.6 |

| Ag Product of Sales (Total) | (Moz) | 51.9 | 83.9 |

Note: AgEq was determined assuming contained metal and pricing

Mine Schedule and All-In-Sustaining-Cost (AISC)

Mine scheduling targets higher value silver-lead production in the first 8 years of mine life with lower AgEq grading material (zinc-copper dominant) being targeted in the final 9 years. Total plant feed (mine production) is estimated to be 243.2 Mozs AgEq (includes 98.6 Mozs Ag) with 194.3 Moz AgEq (includes 83.9 Moz Ag) sold. Total all-in sustaining costs (“AISC”) are estimated to be $US 2.57B averaging $US13.23/oz AgEq sold. LOM production and AISC are illustrated in Figure 3.

Figure 3: LOM AgEq sales and AISC:

Figure 3: LOM AgEq sales and AISC:

.OPERATIONS:

Mining:

The mine plan was completed by Entech and incorporates longitudinal and transverse longhole stoping methods. Two separate portals are proposed to access the various deposits, with one portal accessing the Blind-El Sol and Skarn Front deposits, and a second portal accessing the La Bocona, South Skarn, and North Felsite deposits. The process in creating the mine plan is further described below:

- Datamine® Mineable Stope Optimizer (“MSO”) was used to produce shapes for mine planning purposes. The Resource model from March 22, 2023 by Kirkham Geosciences Ltd. was used for the evaluation and MSO analyses considered a preliminary cut-off value of $60/t NSR;

- The Resource Model is restated with standardized metal prices, metal recoveries and smelter terms in this current disclosure (see Appendices);

- MSOs considered a minimum mining width of 3.5 m (inclusive of 1.0 m width for unplanned dilution in rock), 25 m sub-levels, and 20 m strike lengths;

- A total of 29.5 Mt averaging $131/t NSR (104 g/t Ag, 0.11g/t Au, 0.19 % Cu, 1.06 % Pb, and 2.41 % Zn) was sent to the processing facility, representing a conversion of approximately 88.3% of the Resource value at a $60/t cut-off value;

- Depending on the width of the stope and the strike of continuous sections of wider zones, transverse stoping was selected and mined bottom-up. For predominately narrower zones (typically less than 18m) longitudinal stoping was selected and mined either top-down or bottom-up depending on location and timing of development. Overall, the average stope width by tonnage was 16.5 m;

- Detailed geotechnical analysis including hydrogeological modelling is to be completed in further studies of the deposit, however preliminary investigations have been completed. The preliminary investigations support the selection of longhole stoping as an appropriate method for this Preliminary Economic Assessment. An equivalent linear overbreak slough (ELOS) was assumed to be 1.0m (0.5m from each wall) and additional dilution for mining of backfill was considered. Backfill dilution was varied depending on exposure, with 0.5m considered from the backs (top-down), 0.25m from the floor (bottom-up), 0.5m from the far wall (longitudinal stoping), and 0.5m from one adjacent wall (transverse stoping mined centre-out);

- A stope recovery factor of 93% and development recovery factor of 97% was considered.

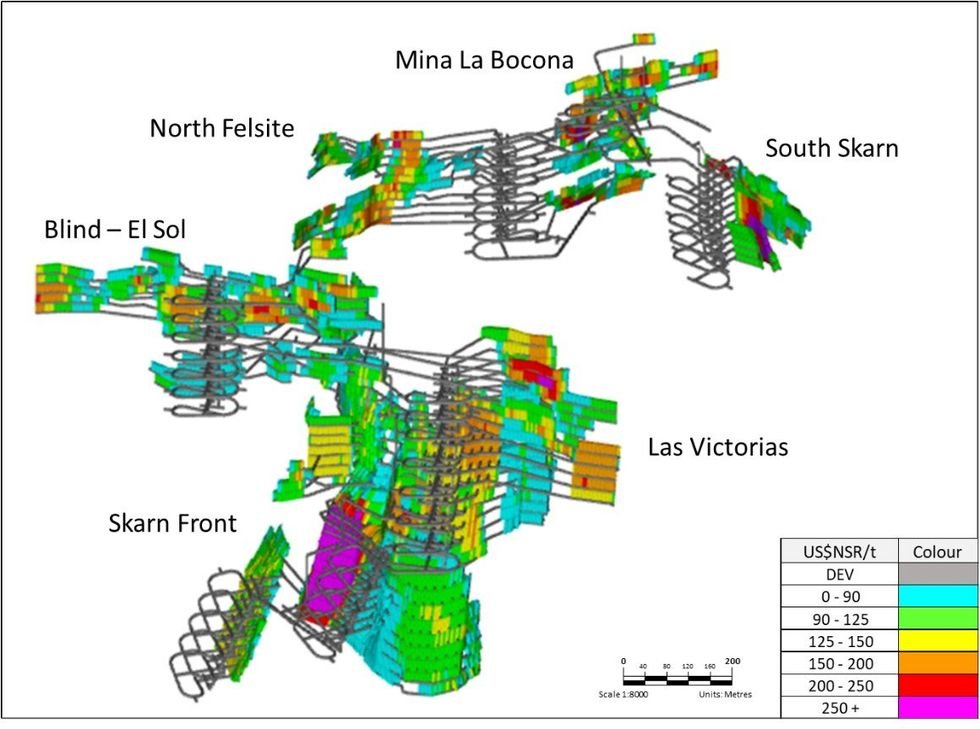

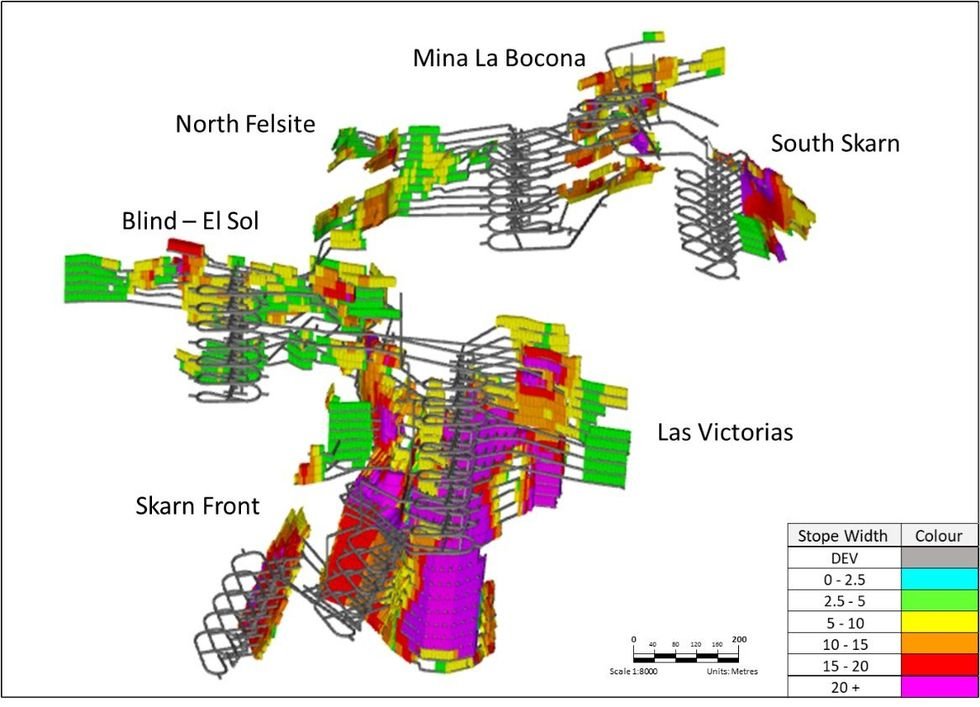

The grade and average stoping widths are illustrated in Figure 4 and Figure 5 respectively.

Figure 4: US$NSR/t grade distribution of the Cerro Las Minitas MSO model – looking northeast

Figure 4: US$NSR/t grade distribution of the Cerro Las Minitas MSO model – looking northeast

Figure 5: Average Stope Width of the Cerro Las Minitas MSO model – looking northeast

Figure 5: Average Stope Width of the Cerro Las Minitas MSO model – looking northeast

Processing:

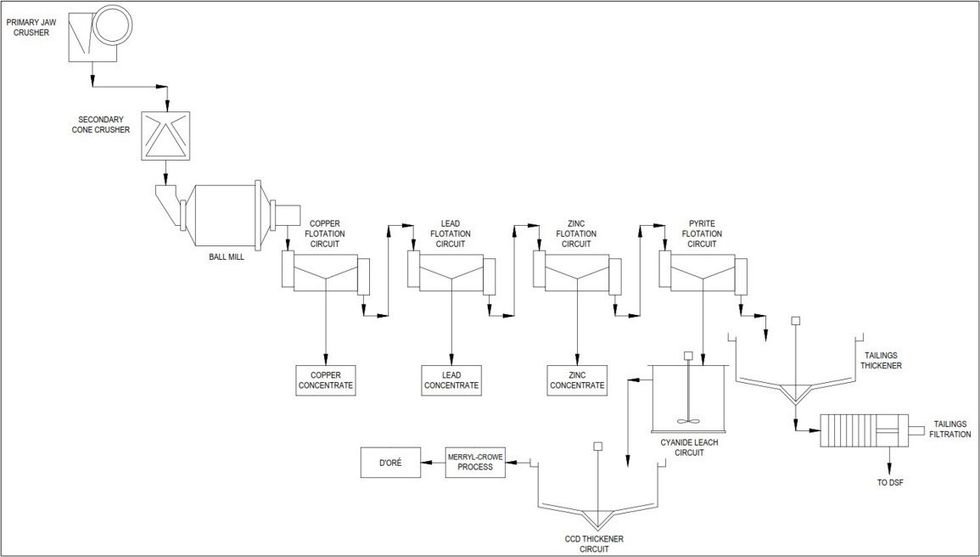

The process plant for the PEA study is a conventional sulphide flotation system consisting of:

- Primary jaw crushing to a 15,000 tonnes ROM stockpile, reclaim and secondary crushing, closed-circuit ball mill grinding and sequential Cu-Pb-Zn (each with rougher-regrind-cleaner stages) flotation circuit producing three filtered concentrates for sale and a gold-bearing pyrite concentrate for leaching.

- The pyrite leach incorporates ultra-fine grinding to improve conventional cyanidation and gold recovery by Merrill-Crowe precipitation and induction melting to produce Au-Ag doré bars.

- Barren tailings to Paste Plant for underground mine cement backfill with the surplus, dry-stacked to surface

- Design Annual Throughput of 1,935 kilo-tonnes based on nominal 5,300 tpd throughput.

Head grades:

MSO scheduling successfully prioritized higher grade material to the mill earlier in the mine life resulting in higher heads grades (and associated annual revenue) in the first eight years of production as compared to the final 10 years.

Table 5: Head grade over Yr1-8 and LOM

| HEAD GRADES | Units | Y1-8 Average | LOM |

| Avg. Annual Plant Feed | (kt) | 1,930 | 1,930 |

| Ag | (g/t) | 119 | 104 |

| Au | (g/t) | 0.14 | 0.11 |

| Cu | (%) | 0.15 | 0.19 |

| Pb | (%) | 1.37 | 1.06 |

| Zn | (%) | 2.45 | 2.41 |

| AgEq | (g/t) | 290 | 257 |

Recoveries and Tailings:

- A series of Batch/Locked cycle testwork/variability testwork programs conducted between 2018 and 2023 confirmed that the Cu-Pb-Zn sequential flotation flowsheet would be appropriate for processing all the sulphide mineralization from the deposit.

- Testwork conducted in 2023 indicated that gold in oxide was readily leachable at high (>80%) recoveries, while approximately 70% of the gold present in sulphide material could be concentrated in the pyrite-rich concentrate while 20% reported to the copper concentrate. Ultra-fine grinding of the pyrite to 80% passing 6 micron improved the extraction of Au by cyanidation from 17% to 40% while oxidative pre-treatment increased the gold extraction to 83% but with very high oxygen and cyanide consumption. An economic evaluation determined that the oxidation step could not be justified.

- Circuit design based on stainless grinding media and optimised reagent selection for sequential flotation which maximizes base metal grades and recoveries while minimizing misplacement of base metals to other concentrates.

- While mining progresses through various geo-metallurgical ore types, the plant is designed to handle wide variations in both grade and sulphide mass pull.

- Non-sulphide tailings surplus to the backfill requirements are dry stacked in a suitable area some 1000m NW of the process plant.

CONCENTRATE TERMS:

Metal Payables

The project is expected to produce four saleable concentrates of sufficient quality to be marketable to a variety of global smelters.

Approximately 93% of Ag is recovered with 77 % reporting to the Pb concentrate, 6% to the Cu concentrate, 7% to the Zn concentrate and 3% to the leach circuit.

Table 6: Metal Recoveries established for the PEA

| Item | Pb Conc. | Zn Conc. | Cu Conc. | Dore |

| Pb Recovery | 87% | |||

| Zn Recovery | 93% | |||

| Cu Recovery | 70% | |||

| Ag Recovery | 77% | 7% | 6% | 3% |

| Au Recovery | 20% | 28.6% | ||

| Concentrate Grade (Primary Base Metal) | 65% | 54% | 27% |

Refining and Treatment:

Treatment and refining charges were based on consultation with industry professionals and generated the terms indicated below:

Table 7: Refining and Treatment

| Ag | Au | Cu | Pb | Zn | |

| Cu Concentrate | |||||

| Average Concentrate Grade LOM | 1,266g/t | 4.3g/t | 27% | – | – |

| Payable Metal | 90% | 90% | 97% | – | – |

| Minimum Deduction | – | – | 1 unit | – | – |

| Pb Concentrate | |||||

| Average Concentrate Grade LOM | 5,641g/t | – | – | 65% | – |

| Payable Metal | 95% | – | – | 95% | – |

| Minimum Deduction | 50g/t | – | – | 3 Units | – |

| Zn Concentrate | |||||

| Average Concentrate Grade LOM | 180g/t | – | – | – | 53.50% |

| Payable Metal | 70% | – | – | – | 85% |

| Minimum Deduction | 3oz/t | – | – | – | 8 units |

| Dore | |||||

| Contained kozs | 2,927 | 28.9 | – | – | – |

| Payable Metal | 99% | 100% | – | – | – |

The high Ag grade in the Pb concentrate makes it attractive to smelters and could result in more favourable treatment terms, but these have not been considered at the PEA level. Penalty elements are low, with Cd (in solution with Zn) ($8.9/t conc.) being the major contributor to Zn penalties, and Sb (in solution with Pb) being the major source of Pb penalties ($27/t conc).

Concentrate Transportation:

Transportation costs assume trucking of the concentrate via containers to the international port at Manzanillo, Colima, and then shipping via ocean freight to Asia. Estimated transportation costs (trucking, port handling and ocean freight) are US$96/wmt (wet metric tonnes) for Pb concentrate and US$106/wmt for Zn concentrate. Moisture contents are assumed to be 8.5% based on the grind size of the final concentrates.

CAPITAL EXPENDITURES:

Total initial capital investment in the project is estimated to be $388 million and includes $50 million contingency, which represents the total direct and indirect cost for the development of the project, including associated infrastructure.

Table 8: Capital Expenditure break down.

| Item | Total ($M) |

| Process Plant and Infrastructure | |

| Project Directs including freight | $159.7 |

| Project Indirects | $38.9 |

| Owner Costs | $8.0 |

| Contingency | $50.1 |

| Sub-Total | $257 |

| Mining | |

| Pre-Production Capital Costs | $131 |

| Total Initial Capital Costs | $388 |

| Sustaining Capital and Closure Costs | $177 |

| Total Capital Costs | $565 |

Mining Development Costs:

Mining development costs were developed by Entech considering a mining contractor model. Total capital costs including sustaining capital allocated to mining are approximately $US291M comprising of the following:

Table 9: Mining Capital Breakdown

| Item | Total ($M) |

| Capitalised Operating Expense | 31 |

| Pre-Production Capital Development | 65 |

| Pre-Production Fixed and Mobile Plant | 6 |

| Pre-Production Capital Infrastructure | 28 |

| Pre-Production Surface Infrastructure | 2 |

| Total Pre-Production Mining Capital Costs | 131 |

| Sustaining Capital Development | 114 |

| Sustaining Fixed and Mobile Plant | 25 |

| Sustaining Capital Infrastructure | 22 |

| Total Mining Sustaining Capital Costs | 160 |

| Total Mining Capital Costs | 291 |

- Initial development costs are approximately $65M;

- Sustaining development are approximately $114M;

- Reallocated operating expense of $31M.

- Contractor mobilization, equipment purchases and half-life rebuilds (pumps, primary and auxiliary fans, compressors, and substations) are approximately $30M;

- Initial project capital expenses (portals, primary fans, initial pump stations, refuge chambers, etc. plus a 25% contingency) are approximately $50M; and,

- Total lateral capital development cost of $6,594 /m and includes a reallocation of operating expense to capital of $845 /m;

Direct costs of $4,211 /m and indirect costs of $1,538 /m.

OPERATING COSTS

Operating costs are broken down into Mining, Processing, G&A and Treatment and Refining costs, plus additional production charges including government royalty, employee profit sharing and closure expenses. Operating costs were developed by Ausenco and Entech (Mine Operating Cost).

Table 10: Operating cost breakdown on a per tonnage basis

| Area | $/t ore processed |

| Mine Operating Cost | $41.22 |

| Process Plant Operating Cost | $15.82 |

| G & A | $4.33 |

| Operating Cost | $61.37 |

| Treatment & Refining Charges | $19.88 |

| Sustaining Capital Costs | $5.43 |

| Closure Cost | $0.56 |

| Other Production Cost | $25.87 |

| Total | $87.24 |

Mining:

The operating costs reflect a contractor mining option which defers capital but utilizes the experience of a contractor for initial construction and development of the mine. Mining considers a modern and large operation using large 21-t loaders and 63-t capable trucks targeting an average daily plant feed of approximately 5,300 tpd and 6,900 tpd when including waste development (peak of 7,800 tpd in production Year 4) as both portals are in production. Mining costs are developed by Entech and are from Entech’s cost database which includes pricing from mining contractors.

Table 11: Production and Development Breakdown

| Item | Total ($M) | Total ($/t) |

| Development | $190 | $6.45 |

| Production | $1,024 | $34.77 |

| Total Production and Development Costs | $1,214 | $41.22 |

Operating costs are summarized as follows and are appropriate for a Preliminary Economic Assessment:

- Total underground mining operating costs are approximately $1,214M at an average of $41.22/t;

- Operating development (including non-capital waste development) of $3,087 /m (direct costs of $2,720 /m) and averages on a per tonne basis of $6.45 /t;

- Production costs of $34.77 /t of which $29.54 /t are direct costs and $5.23 /t are indirect costs which includes labour (mine management/technical services), maintenance, power, and other costs.

Processing and General & Administration costs (“G+A”):

The process plant is a conventional sulphide flotation system consisting of both primary and secondary crushing, a closed-circuit ball mill grinding and sequential Cu-Pb-Zn flotation circuit producing three filtered concentrates for sale. A fourth pyrite concentrate is produced for leaching.

Operating costs are as follows:

Table 12: Breakdown of Process Plant Operating cost

| Operating & Maintenance | $/t ore processed |

| Labor | $1.40 |

| Electrical Power | $4.64 |

| Reagents | $5.04 |

| Liners/Grinding Media | $1.94 |

| Maintenance Parts | $0.95 |

| Supplies and Services | $1.65 |

| Fresh Water Supply | $0.19 |

| Total (US$) | $15.82 |

G&A costs reflect a well-located project in an area of excellent infrastructure and immediately adjacent to the town of Guadalupe Victoria (population: ~35,000).

OPPORTUNITIES:

Mine life extension: Mineralization on the eastern and northern sides of the Cerro remains relatively under-drilled and several gaps occur in the current resource model both at relatively shallow depths and down dip of several of the main higher-grade zones. Identification of further mineralization at relatively shallow depths would potentially add more value in the earliest parts of the mine schedule.

Infill Drilling: Infill drilling, specifically on the portions of the deposit that fall within the Inferred category of classification will increase confidence in the Mineral Resource estimate, will further de-risk the project and potentially increase the value of the project.

Metallurgical Upside: XRT-based preconcentration testwork showed excellent discrimination between sulphide and oxide material enabling a 3-4x upgrade of run-of-mine rock crushed to 80% passing 75mm with the sub-15 mm fines removed. Pay metal retention in the sulphidic fraction exceeded 98%. This option provides an excellent opportunity for further reductions in project Capex and Opex should the need arise.

TECHNICAL DISCLOSURE

- All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum (CIM) definitions, as required under NI43-101.

- Mineral resources reported demonstrate reasonable prospect of eventual economic extraction, as required under NI43-101.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. The mineral resources may be materially affected by environmental, permitting, legal, marketing, and other relevant issues.

- The PEA is preliminary in nature, it may include mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

- An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. It is reasonably expected that most of the inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

- AISC is calculated as: Operating costs (mining, processing and G&A) + Incremental PTUs + Concentrate Transportation + Treatment & Refining Charges + Penalties + Sustaining Capital + Closure Costs +Silver Revenue Royalty and is reported on using a per tonne mined, AgEq plant feed and AgEq payable basis

- A full technical report will be prepared in accordance with NI 43-101 and will be filed on SEDAR within 45 days of this press release.

APPENDICES

Appendices with the following supporting information is found at the back of this release.

Appendix A: Sulphide Mineral Resource Estimate

Appendix B: Project location and Infrastructure

Appendix C: Simplified Process Flow Sheet

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is an exploration and development company with a focus on the discovery of world-class mineral deposits either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our specific emphasis is the 100% owned Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, Los Gatos, San Martin, Naica and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. Our property portfolio also includes the Oro porphyry copper-gold project and the Hermanas gold-silver vein project where permitting applications for the conduct of a drill program is underway, both located in southern New Mexico, USA.

On behalf of the Board of Directors

“Lawrence Page”

Lawrence Page, K.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver’s website at https://www.southernsilverexploration.com or contact us 604.641.2759 by email at corpdev@mnxltd.com.

Qualified Person

The PEA for the Cerro Las Minitas project as summarized in this release was completed by Kirkham Geosystems Ltd. (“KGL”), Ausenco Engineering USA South Inc. and Ausenco Sustainability ULC. (“Ausenco”), Entech Mining Limited (“Entech”), and MPC Metallurgical Process Consultants Limited (“MPC”). A full technical report will be prepared in accordance with NI43-101 and will be filed on SEDAR within 45 days of this press release.

The scientific and technical content of this news release was reviewed and approved by Robert Macdonald, MSc. P.Geo, VP. Exploration, who is a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Southern Silver Exploration Corp. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.

Appendix A: Sulphide Mineral Resource Estimate as of March 20, 2024

| Indicated Resources | Average Grade | |||||||

| Zone | Tonnes | Ag | Au | Pb | Zn | Cu | AgEq | NSR |

| (Kt) | (g/t) | (g/t) | (%) | (%) | (%) | (g/t) | (US$/t) | |

| Blind Zone | 2,614 | 92 | 0.04 | 1.8 | 2.0 | 0.10 | 227 | 113 |

| El Sol Zone | 1,252 | 77 | 0.04 | 2.1 | 1.9 | 0.08 | 214 | 106 |

| Skarn Front Zone | 7,626 | 104 | 0.06 | 0.8 | 4.1 | 0.19 | 298 | 143 |

| La Bocona/North Felsite Zone | 1,807 | 121 | 0.19 | 2.1 | 1.5 | 0.23 | 262 | 135 |

| Total | 13,299 | 102 | 0.07 | 1.3 | 3.1 | 0.17 | 272 | 132 |

| Inferred Resources | Average Grade | |||||||

| Zone | Tonnes | Ag | Au | Pb | Zn | Cu | AgEq | NSR |

| (Kt) | (g/t) | (g/t) | (%) | (%) | (%) | (g/t) | (US$/t) | |

| Blind Zone | 1,697 | 74 | 0.20 | 1.2 | 1.8 | 0.08 | 192 | 95 |

| Las Victorias Zone | 1,417 | 124 | 0.65 | 1.9 | 2.2 | 0.12 | 307 | 155 |

| El Sol Zone | 1,168 | 57 | 0.03 | 1.7 | 2.1 | 0.06 | 185 | 90 |

| Skarn Front Zone | 12,444 | 110 | 0.05 | 0.7 | 2.6 | 0.32 | 254 | 126 |

| La Bocona/North Felsite Zone | 2,666 | 120 | 0.22 | 1.4 | 1.6 | 0.13 | 243 | 124 |

| South Skarn Zone | 4,036 | 134 | 0.19 | 1.9 | 1.3 | 0.08 | 250 | 129 |

| Total | 23,428 | 111 | 0.14 | 1.1 | 2.1 | 0.21 | 247 | 124 |

| Indicated Resources | Contained Metal | ||||||

| Zone | Tonnes | Ag TrOz | Au TrOz | Pb | Zn | Cu Lbs | AgEq TrOz |

| (Kt) | (000’s) | (000’s) | (Mlbs) | (Mlbs) | (Mlbs) | (000’s) | |

| Blind Zone | 2,614 | 7,751 | 4 | 106 | 116 | 6 | 19,094 |

| El Sol Zone | 1,252 | 3,102 | 2 | 57 | 54 | 2 | 8,592 |

| Skarn Front Zone | 7,626 | 25,557 | 15 | 128 | 692 | 32 | 73,100 |

| La Bocona/North Felsite Zone | 1,807 | 7,039 | 11 | 82 | 59 | 9 | 15,236 |

| Total | 13,299 | 43,449 | 32 | 374 | 921 | 49 | 116,023 |

| Inferred Resources | Contained Metal | ||||||

| Zone | Tonnes | Ag TrOz | Au TrOz | Pb | Zn | Cu Lbs | AgEq TrOz |

| (Kt) | (000’s) | (000’s) | (Mlbs) | (Mlbs) | (Mlbs) | (000’s) | |

| Blind Zone | 1,697 | 4,029 | 11 | 46 | 66 | 3 | 10,448 |

| El Sol Zone | 1,417 | 5,629 | 30 | 58 | 69 | 4 | 13,993 |

| Las Victorias Zone | 1,168 | 2,150 | 1 | 43 | 53 | 1 | 6,956 |

| Skarn Front Zone | 12,444 | 43,834 | 20 | 180 | 711 | 88 | 101,537 |

| South Skarn Zone | 2,666 | 10,327 | 19 | 85 | 95 | 7 | 21,040 |

| La Bocona/North Felsite Zone | 4,036 | 17,393 | 24 | 170 | 112 | 7 | 32,468 |

| Total | 23,428 | 83,362 | 104 | 582 | 1,106 | 111 | 186,442 |

- The current Resource Estimate was prepared by Garth Kirkham, P.Geo., of Kirkham Geosystems Ltd.

- All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum (“CIM”) definitions, as required under National Instrument 43-101 (“NI43-101”).

- Mineral resources were constrained using continuous mining units demonstrating reasonable prospects of eventual economic extraction.

- Silver Equivalents were calculated from the interpolated block values using relative recoveries and prices between the component metals and silver to determine a final AgEq value. Metal recoveries: 95%. silver, 75% gold, 70% copper, 87% lead and 93.2% zinc.

- Silver Equivalents and NSR$/t values were calculated using average long-term prices of $22.5/oz. silver, $1,850/oz. gold, $3.78/lb. copper, $0.94/lb. lead and $1.25/lb. zinc. All prices are stated in US$.

- The formula used for NSR$/t calculations was as follows – $NSR = (Ag g/t x 0.55) + (Au g/t x 34.45) + (Cu% x 48.68) + (Pb% x 13.41) + (Zn% x 15.59)

- Mineral resources are not mineral reserves until they have demonstrated economic viability. Mineral resource estimates do not account for a resource’s mineability, selectivity, mining loss, or dilution.

- An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

Model Parameters for the Blind, El Sol, Skarn, South Skarn, Bocona, and North Felsite Zones

- The mineralized zones were initially defined by Southern personnel and subsequently adjusted and redefined, validated and verified by KGL. The mineralized wire frames were defined using a combination of geological constraints and grade boundaries in addition to consideration of potential reasonable mining thickness. Intervals that were not sampled were assigned a zero grade.

- The estimates were carried out using a separate block models constrained by 3D wireframes of the individual mineralized zones. The chosen block size was 10 m by 10 m by 2 m, roughly reflecting the drill hole spacing (i.e., 4-6 blocks between drill holes) which is spaced at approximately 50 m centres. Note: MineSightTM uses the centroid of the blocks as the origin. It should be noted that the South Skarn employs sub-blocking as opposed to partial percentage for the coding of the block models. In this case the parent block size is 10 m X 10 m X 3 m while the sub-block size is 0.5 m X 0.5 m X 0.3 m. Grades for Ag, Au, Cu, Pb and Zn are interpolated using Ordinary Kriging within the Bocona/North Felsite zone and Inverse Distance to the second power (ID2) weighting for the South Skarn and North Felsite Hangingwall zones. The Skarn zone is interpolated using inverse distance to the third power (ID3) with a form of dynamic anisotropy. NSR/t, silver equivalent and zinc equivalent values were subsequently calculated from the interpolated block grades.

- The interpolation was carried out in two passes using progressively larger search radii along strike and down dip of 60m x 60m to a maximum of 100m x 100m. Composites were restricted to a minimum of 3 and a maximum of 9 composites, with a maximum of 3 composites from any one drill hole.

- Bulk densities were based on a total of 3,146 individual measurements taken by Southern Silver field personnel from key mineralized zones. Density values ranged from 1.04 t/m3 to 5.33 t/m3 and average to 2.89 t/m3. Specific gravities were calculated on a block-by-block basis by interpolating the SG measurements using inverse distance to the second power and limited within the individual mineralized zone solids. A default density of 2.85 t/m3 was assigned to any blocks that were not assigned a calculated value.

- Silver composite values have been capped in order to remove the effects of potential overestimation due to statistical outliers. The threshold chosen was 700 g/t silver for the Bocona/North Felsite and North Felsite HW zones. In addition, outlier values for the co-product metals were capped at the threshold levels of 1.5 g/t gold, 2% copper, 18% lead and 10% zinc at Bocona/North Felsite and 2 g/t gold, 0.2% copper, 3% lead and 5% zinc for the North Felsite HW zones, respectively.

- The high-grade outlier thresholds were chosen by domain and are based on an analysis of the breaks in the cumulative probability plots for each of the mineralized domains for each of the zones.

- Mineral resources for the Cerro Las Minitas deposit were classified according to the CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) by Garth Kirkham, P.Geo., an “independent qualified person” as defined by National Instrument 43-101. Drill hole spacing in the Cerro Las Minitas deposit is sufficient for preliminary geostatistical analysis and evaluating spatial grade variability. Kirkham Geosystems is, therefore, of the opinion that the amount of sample data is adequate to demonstrate very good confidence in the grade estimates for the deposit. The estimated blocks were classified according to the following:

- confidence in interpretation of the mineralized zones;

- number of data used to estimate a block;

- number of composites allowed per drill hole; and

- distance to nearest composite used to estimate a block.

- Blocks were classified as indicated if they were within approximately 50 m of a composite and were interpolated with a minimum of two drill holes. Note: There were no blocks classified as Measured resources. Blocks were classified as Inferred if the nearest composite was less than 100 m from the block being estimated. Furthermore, an interpreted boundary was created for the indicated and inferred threshold in order to exclude orphans and reduce “spotted dog” effect. The remaining blocks were unclassified and may be considered as geologic potential for further exploration. Furthermore, in consideration for the requirement for resources to possess a “reasonable prospect of eventual economic extraction” (RP3E), underground mineable shapes were created that displayed continuity based on cut-off grades and classification. Additionally, these RP3E shapes also took into account must-take material that may fall below cut-off grade but will be extracted by mining in the event that adjacent economic material is extracted making below cut-off material by virtue of the mining costs being paid for.

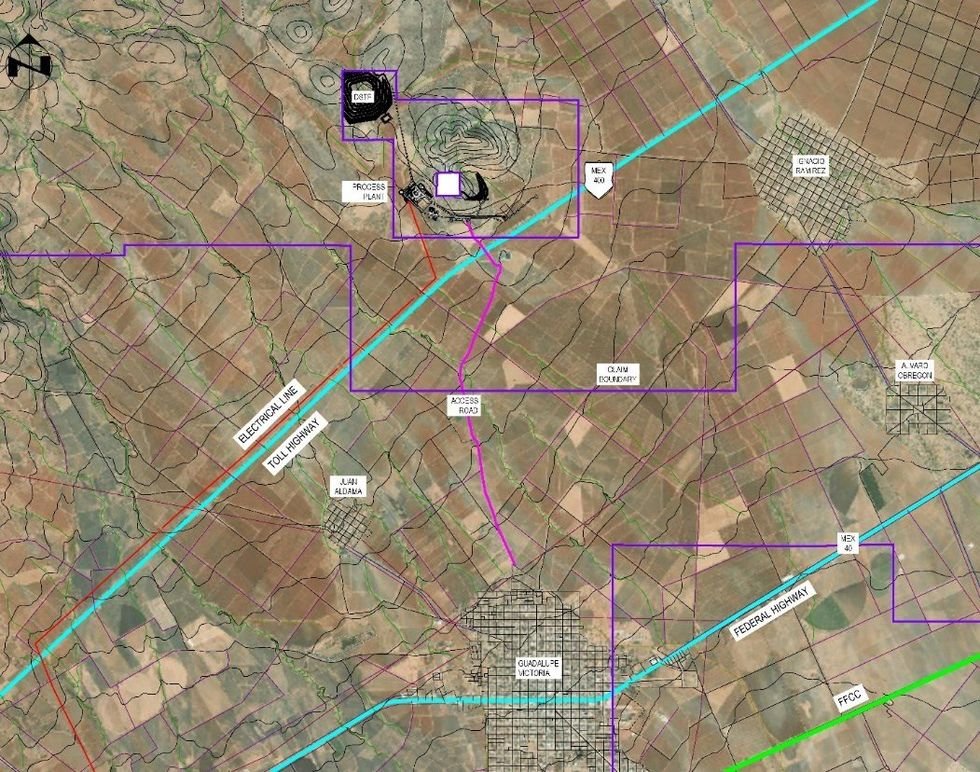

Appendix B: Project Location and Site Infrastructure

Appendix B: Project Location and Site Infrastructure

The process plant for the PEA study is a conventional sulphide flotation system consisting of both Primary and secondary crushing, a closed-circuit ball mill grinding and sequential Cu-Pb-Zn flotation circuit producing three filtered concentrates for sale. A fourth pyrite concentrate will be produced and leached.

Appendix C: Simplified Process Flow Sheet

Appendix C: Simplified Process Flow Sheet