Shenyang Blue Silver Industry Automation Equipment Co., Ltd (SZSE:300293) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking back a bit further, it’s encouraging to see the stock is up 36% in the last year.

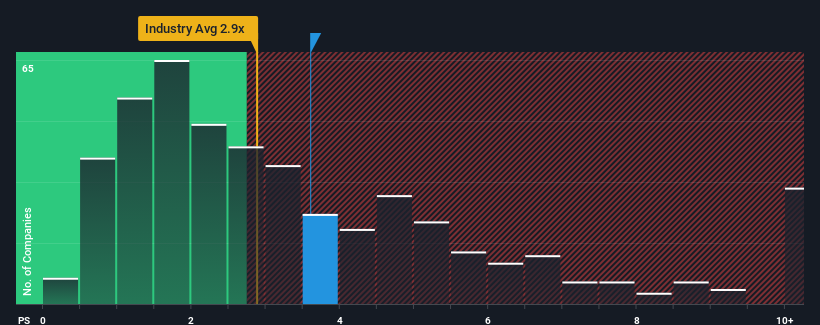

Since its price has surged higher, given close to half the companies operating in China’s Machinery industry have price-to-sales ratios (or “P/S”) below 2.9x, you may consider Shenyang Blue Silver Industry Automation Equipment as a stock to potentially avoid with its 3.6x P/S ratio. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Shenyang Blue Silver Industry Automation Equipment

What Does Shenyang Blue Silver Industry Automation Equipment’s P/S Mean For Shareholders?

Recent times have been quite advantageous for Shenyang Blue Silver Industry Automation Equipment as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don’t have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenyang Blue Silver Industry Automation Equipment’s earnings, revenue and cash flow.

Is There Enough Revenue Growth Forecasted For Shenyang Blue Silver Industry Automation Equipment?

In order to justify its P/S ratio, Shenyang Blue Silver Industry Automation Equipment would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 40%. The latest three year period has also seen an excellent 46% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 27% over the next year, materially higher than the company’s recent medium-term annualised growth rates.

In light of this, it’s alarming that Shenyang Blue Silver Industry Automation Equipment’s P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren’t willing to let go of their stock at any price. There’s a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Shenyang Blue Silver Industry Automation Equipment’s P/S

The large bounce in Shenyang Blue Silver Industry Automation Equipment’s shares has lifted the company’s P/S handsomely. It’s argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shenyang Blue Silver Industry Automation Equipment revealed its poor three-year revenue trends aren’t detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren’t comfortable with the high P/S as this revenue performance isn’t likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders’ investments at significant risk and potential investors in danger of paying an excessive premium.

Don’t forget that there may be other risks. For instance, we’ve identified 2 warning signs for Shenyang Blue Silver Industry Automation Equipment that you should be aware of.

If you’re unsure about the strength of Shenyang Blue Silver Industry Automation Equipment’s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we’re helping make it simple.

Find out whether Shenyang Blue Silver Industry Automation Equipment is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.