As the economy continues to stagger, a growing number of people are considering alternative investments.

Among these alternatives, cryptocurrency and real estate have gained particular attention for their potential to offer significant returns.

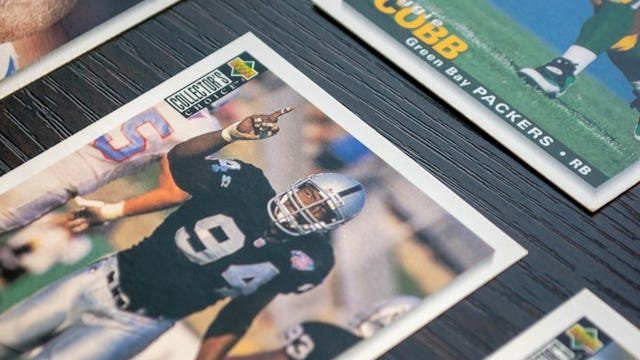

However, that’s just the tip of the iceberg. Another investment — one that gained serious popularity during the COVID-19 pandemic — is sports card investing.

Don’t Miss:

February Grading Increased Year Over Year

In February, the top four trading card grading companies — Professional Sports Authenticator (PSA), Certified Guaranty Co. (CGC), SGC Grading and Beckett Collectibles — authenticated more than 1.6 million cards, a slight decrease from January but representing a 25% increase from the same period last year.

While 55.5% of these were sports cards, the remainder fit into another category: trading card games (TCGs). That’s another example of an alternative investment worth considering.

At the current pace, you can expect there to be roughly 16 million cards graded this year. That’s a massive number.

But Is It A Viable Path To Wealth?

Just like any investment, there’s no guarantee of making money with sports cards. Many variables are at play, ranging from economic factors to player performance to market conditions.

However, there’s no shortage of collectors and investors who’ve achieved massive returns.

For example, the 2009 Bowman Chrome Draft Mike Trout Autograph card, particularly in a PSA 10 (Gem Mint condition), has recorded impressive sales numbers.

One of the cards sold for around $3.93 million at auction in August 2020, setting a record for the highest price ever paid for a modern baseball card at that time.

How To Invest In Sports Cards

Diving into sports card investing offers a range of strategies for potential returns.

One approach is “breaking boxes,” where investors purchase sealed boxes of cards in hopes of finding rare, high-value cards to sell individually. This method can yield significant profits, especially when a box contains a sought-after rookie card or limited edition insert.

Another strategy is “flipping,” which involves buying cards or collections at a lower price and quickly selling them for a profit.

This requires a keen eye for undervalued cards and an understanding of market trends to predict which cards are likely to appreciate quickly.

Long-term investing in “blue-chip” cards of legendary athletes is another method. These cards, like those of historical sports figures or hall of famers, tend to increase in value over time and offer more stability than newer players who haven’t proven their lasting impact on the sport.

Lastly, “speculative investing” targets up-and-coming players who show great potential.

Buying their cards early in their careers could lead to substantial gains if they become stars. This strategy carries higher risk but also the potential for high rewards.

Each of these strategies requires research, patience and a bit of luck. However, with the right approach, sports card investing can be a viable path to wealth while having fun along the way.

Read Next:

-

With returns as high as 300%, it’s no wonder this asset is the investment choice of many billionaires. Uncover the secret.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Sports Card Grading Remains Hot — Proof That Alt Investing Is A Viable Path To Wealth originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.