Published: 30 Oct. 2024, 18:19

Updated: 30 Oct. 2024, 18:29

-

- SHIN HA-NEE

- shin.hanee@joongang.co.kr

Audio report: written by reporters, read by AI

![Tom Graham, head of private markets equity specialists at Aviva Investors, speaks during an interview with the Korea JoongAng Daily on Oct. 16 in western Seoul. [SHIN HA-NEE]](https://piglobalinvestments.com/wp-content/uploads/2024/10/6464a67e-408c-4e9f-8934-e5423003b232.jpg)

Tom Graham, head of private markets equity specialists at Aviva Investors, speaks during an interview with the Korea JoongAng Daily on Oct. 16 in western Seoul. [SHIN HA-NEE]

[Interview]

Last year was a slower one for alternative investments — that is, financial asset classes other than stocks, bonds or cash — which underperformed in a financial climate marred by high interest rates. Now, however, central banks are cutting rates — presenting a turning point for investors.

Tom Graham, head of private markets equity specialists at $300 billion asset manager Aviva Investors, suggests that private debt and private equity both offer new opportunities in the face of macroeconomic shifts worldwide.

“It’s an interesting point of inflection,” noted Graham during an interview with the Korea JoongAng Daily in western Seoul.

“The discussion and debate we’re having very regularly with our clients globally is that today, you can make the case to invest in [private] equity or in debt. The forecast returns from both on a risk-adjusted basis, we believe, are very compelling.”

Private debt, or debt instrument typically extended directly to private companies by non-bank lenders, saw strong growth during the period of post-pandemic monetary tightening, while private equity, wherein funds invest in private companies or public companies with the intention of delisting them, is rebounding after last year’s contraction.

Graham, who visited Seoul to deliver a presentation at the ASK Global Conference, leads a team of real assets investment specialists at the London-based Aviva Investors, which managed around $304 billion in assets as of June.

The firm — which is the investment arm of British insurer Aviva — is one of Europe’s largest private asset managers with assets worth approximately $52 million under management in the private market.

Graham expects global alternative investments to continue at least a high-single-digit growth in the longer term, albeit at a mild pace compared to the past decade or so, after a slower 2023.

Such asset classes have grown steeply over the past 10 years as investors sought to diversify portfolios following the 2008 financial crisis, but they underperformed in 2023 after a surge of inflation following the Covid-19 pandemic drove central banks across the globe to rapidly hike interest rates.

But Graham suggested the disappointing returns some alternative investors reported last year are “a result of short-termism in what is, we believe, a long-term asset class.

“To see the true benefits of investing in private markets, you have to have a long-term outlook,” the director said.

He emphasized that the inflow of cash to alternative asset giants remains relatively resilient despite the headwinds of the past few years.

“What the change in macroeconomic conditions has prompted is for investors to look at their own diversification within private markets,” said Graham. “The trend remains an upward trajectory of further allocations to private markets.”

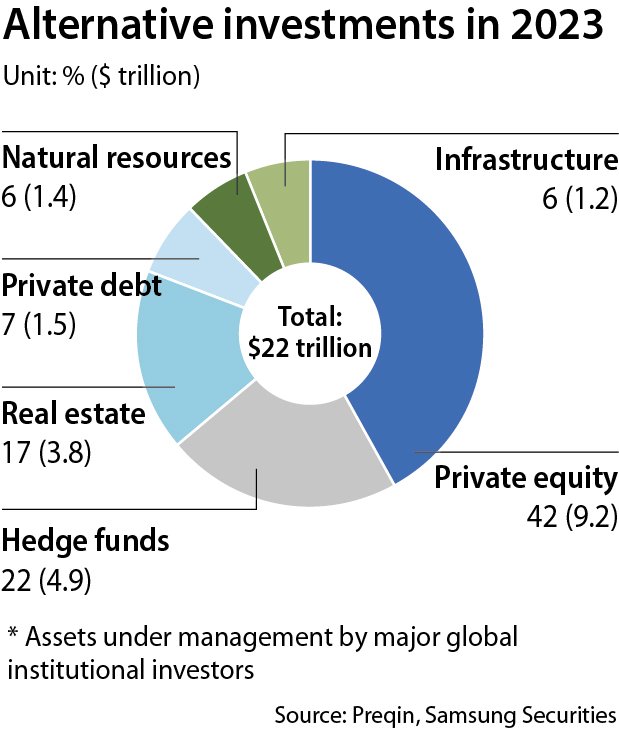

With rate-cut cycles coming in full swing, global stocks have begun to rebound. Samsung Securities estimated that assets allocated to alternative investments would reach $27 trillion by 2027 worldwide; they totaled $22 trillion in 2023.

Graham identified Korea as one of the key regions for Aviva Investors as the firm seeks to expand its presence in the country, as well as the Asia-Pacific region. He sees additional opportunities in the Pan-European market, particularly in real estate with low vacancy rates driving growing demand for limited supply.

“We think the United Kingdom reached the bottom at the end of last year and that in Europe, we’ve reached the bottom in the summer in most sectors with some residual risk in the office sector,” said Graham.

With the right assets, “you’re going to be a beneficiary when the market does turn and recover, which will likely have a correlation with interest rate cuts going through,” he added.

Graham also sees Britain’s current political environment as a favorable one for both equity and debt investments in renewables and social infrastructure.

He highlighted “conviction in scale” as the cornerstone of Aviva Investors’ investment philosophy.

“Our [assets under management] has grown, but the actual number of underlying assets has reduced, so that means we’re doing larger transactions,” Graham said.

Aviva Investors has identified five trends driving growth in private markets: technology, responsible investment, environment, new global order and demographics — which, together, constitute the acronym “Trend.”

Graham put an emphasis on “R” and “E,” in particular, as prevailing megatrends.

“It’s incumbent on us, as an asset manager and an asset owner, alongside our investors, to contribute to society,” he said.

BY SHIN HA-NEE [shin.hanee@joongang.co.kr]