One reason why reverse repos are not yet on many treasurers’ radar is the administrative work that goes along with investing in these instruments. “Negotiating master agreements with banks, contracts with providers such as Clearstream or Euroclear, onboarding every single counterparty and adhering to regulatory reporting requirements are complex tasks,” says Mayer.

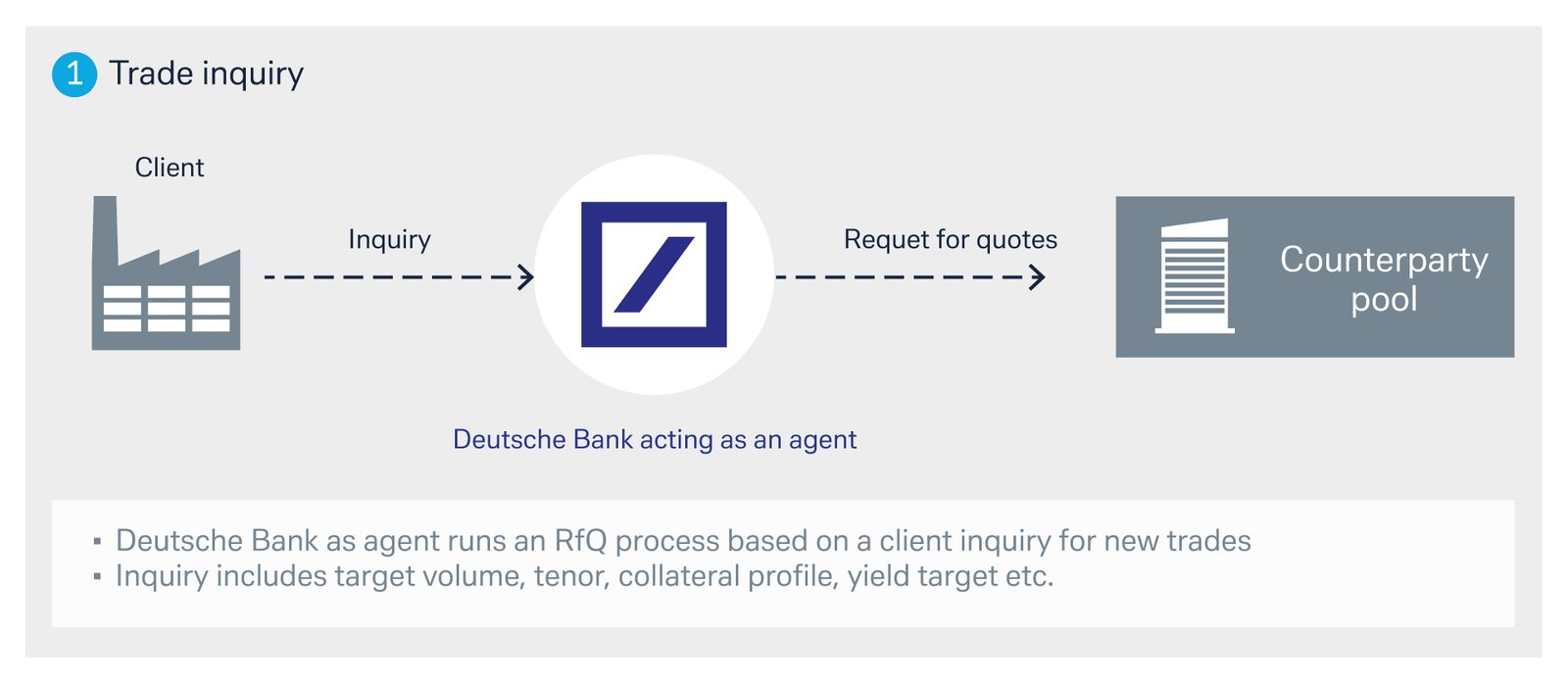

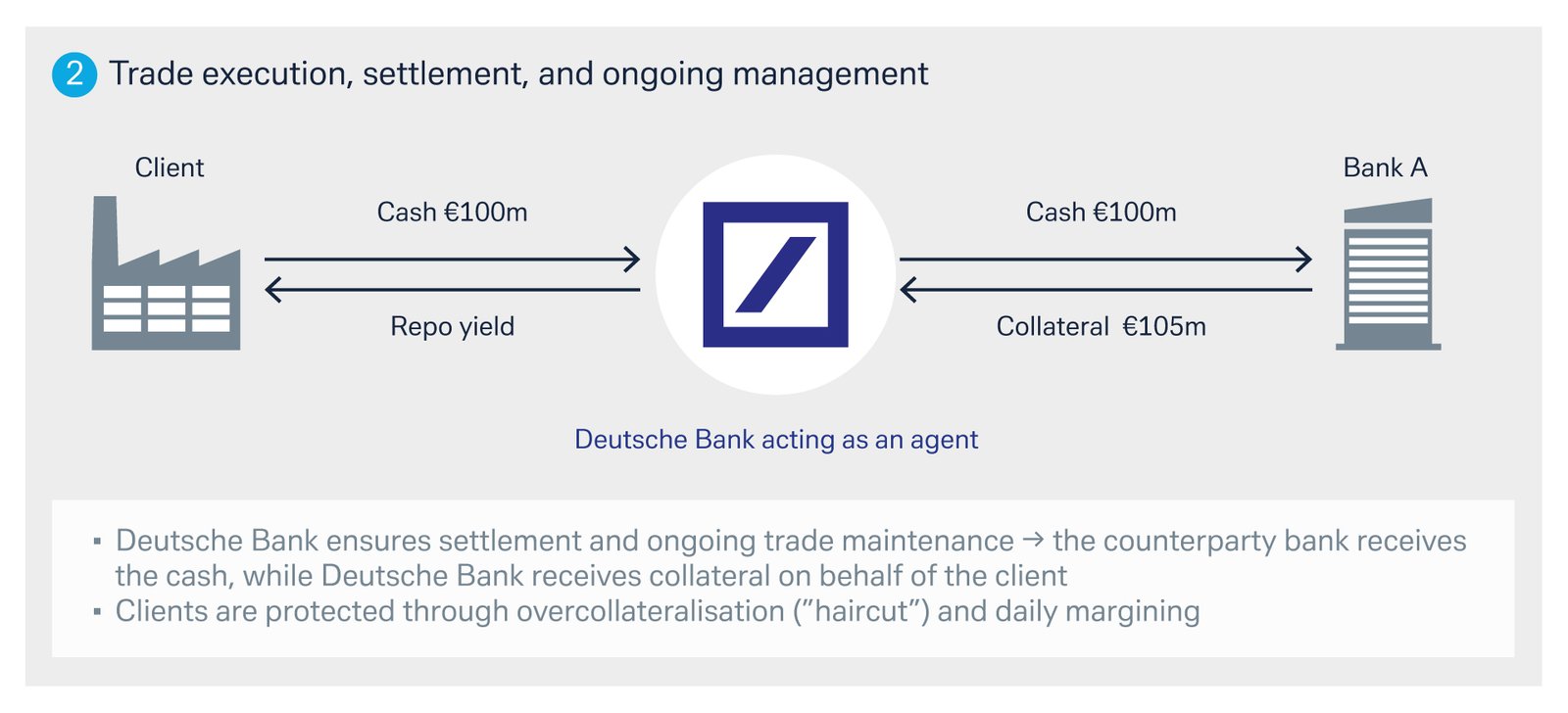

To address this, Deutsche Bank has created its Cash Investment Service (CIS). “The service allows treasurers to access investment alternatives to bank deposits in a time- and cost-efficient way”, says Mayer. Through the bank’s agency trading desk and, according to investment rules stipulated by the client themselves, clients can “invest excess cash securely via reverse repos against various bank counterparties,” Mayer adds. Clients can further invest into MMFs from leading providers with different underlying holdings and fund characteristics.

Figure 2: Exemplary trade execution in agency repo

One of the companies that uses CIS is the global container liner shipping Company Hapag-Lloyd. During the Covid-19 pandemic, freight rates surged dramatically, which drove cash levels of the Hamburg-based company to record-breaking heights in 2021 and 2022, explains Michael Kastl, Managing Director Treasury & Finance at Hapag-Lloyd: “This led to the situation where it was no longer possible to only use overnight and time deposits within our existing counterparty management.”9

“Reverse repos are like a mixing desk”

The company responded by seeking alternative investments that still allowed liquidity to be treated as cash or cash equivalent according to IFRS accounting standards, while not increasing counterparty credit risk. MMFs and reverse repos turned out to be a perfect fit. “Reverse repos are like a mixing desk. We can adapt the collateral basket, for example by including high-yield securities to increase yield. In turn, we may increase the collaterisation ratio to lower risk,” Kastl explains.

“For us, the platform is the ideal solution to access different counterparties with one contract,” he continues, admitting that ideally even more counterparties joining the platform would allow Hapag-Lloyd to further diversify its investments.

The onboarding of more counterparties is on the bank’s agenda, Mayer confirms. “Platforms allow for a much faster and efficient process which helps treasurers in their daily operations.” He believes that Cash Investment Service offers a good opportunity for all companies that want to streamline their cash investments processes – no matter what the current interest rate environment looks like.