- Bitcoin miners might sell as decreased mining rewards and transaction fees lower revenues.

- A potential sell-off by miners could dramatically impact the cryptocurrency market.

Bitcoin [BTC] continues to hold significant value, trading above $60,000 despite a 2.3% decrease over the past day.

This resilience in price comes amid a challenging period for Bitcoin miners, whose revenues have plummeted following the most recent halving event, according to data from Kaiko.

Pressures on Bitcoin miners intensify

Bitcoin miners are facing increasing pressure to sell their holdings as a result of diminishing revenues.

The recent halving, which reduced mining rewards from 6.25 BTC to 3.125 BTC, has significantly impacted their income.

This drop in revenue is compounded by falling transaction fees, which have not recovered since the initial surge following the halving.

Kaiko’s report highlights that miners’ dual income streams—mining rewards and transaction fees—are yielding lower returns.

This is forcing miners to consider offloading their BTC to cover operational costs. Kaiko analysts noted,

“The halving has typically been a selling event for Bitcoin miners as the process of creating new blocks incurs significant costs, forcing miners to sell to cover costs.”

The potential for a Bitcoin sell-off by miners could have profound effects on the cryptocurrency market, especially given the current low liquidity.

Mining giants like Marathon Digital, which holds over $1.1 billion in Bitcoin, could trigger significant market movements if they decide to sell even a small portion of their holdings.

Kaiko’s report explains.

“Bitcoin miners typically classify their BTC holdings as current assets due to their ability to liquidate these holdings to fund operating expenses.”

With major players like Marathon Digital and Riot Platforms holding substantial amounts of Bitcoin, any forced sales could lead to notable market impacts.

Bitcoin’s network activity declines

Meanwhile, Bitcoin’s network activity is showing signs of slowing down.

Glassnode’s data reveals that the number of active Bitcoin addresses (7d EMA) has fallen from over 800,000 to below 700,000 in recent weeks.

Similarly, the number of new addresses (7d EMA) has decreased from around 388,158 to 267,925, indicating a possible decline in user engagement and interest.

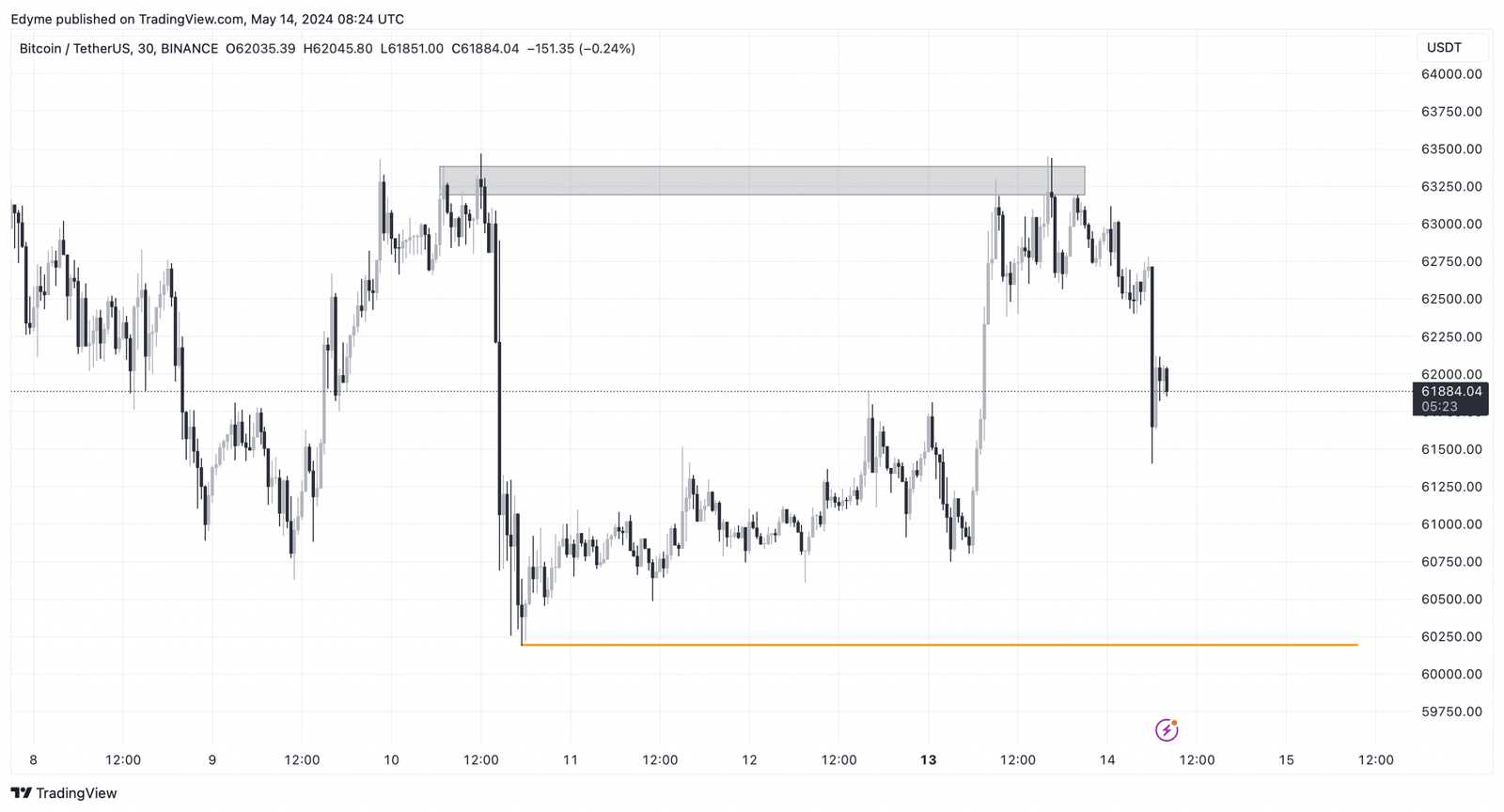

Short-term technical analysis suggested that Bitcoin took out liquidity on the 30-minute chart on the 14th of May.

This suggested that the asset might continue to retract towards the $60,000 range—a swing low—before any significant upward movement occurs.

Is your portfolio green? Check the Bitcoin Profit Calculator

The potential decline, coupled with pressures on miners, could set the stage for a volatile period in the Bitcoin market.

Meanwhile, AMBCrytpo has recently reported that crypto analyst Ali Martinez has projected that if Bitcoin can reclaim $64,290 as a support level, there could be a pathway to a bullish rise toward $76,610.