- Whale accumulation of BTC surges as over 1.9M BTC moves to mega wallets since the start of 2024.

- More metrics show why BTC is a good bet for long-term investors.

A huge amount of Bitcoins [BTC] has recently been transferred to new, large wallets, indicating significant activity by major investors, often called whales.

This movement follows a market crash earlier this week, which some analysts believed marked the cycle’s lowest point before the start of the next bull run.

According to CryptoQuant, the total Bitcoins held in new wallets containing over 1,000 BTC, including spot ETFs and custodial wallets, but excluding exchanges, has risen to over 1.9 million BTC in the year 2024.

This coupled with the following analysis suggests growing confidence in Bitcoin’s long-term potential.

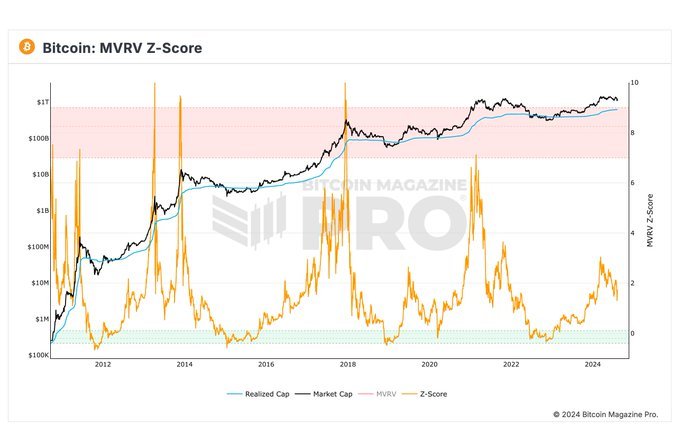

The MVRV Z-Score hasn’t peaked yet

The MVRV Z-Score, a key tool for spotting market highs and lows, is currently reading below 2. This indicated that Bitcoin is in the undervalued zone.

This suggests that Bitcoin hasn’t yet reached its peak. Those claiming the peak is in might miss out as investors and traders are poised for significant gains in the fourth quarter of 2024.

The Bitcoin dominance continues to rally

Additionally, Bitcoin dominance surged to a new short-term high last week, a strong signal for the imminent rally.

While the exact timing is uncertain, this growing momentum suggests that Bitcoin is poised for a significant upward move.

The bull run is gradually building, and when it fully takes off, Bitcoin is expected to experience a parabolic rise.

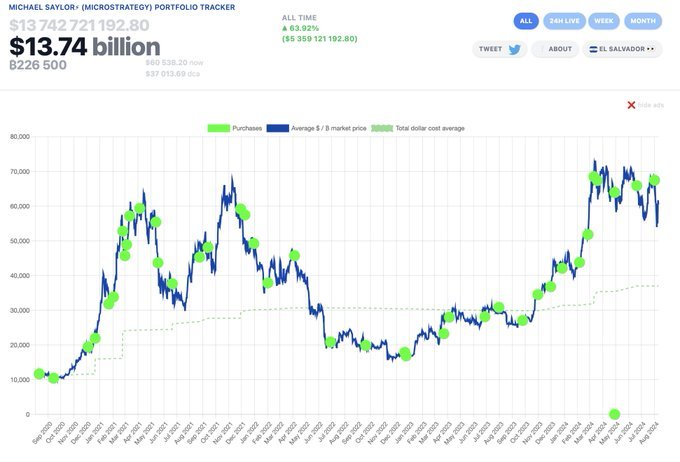

MicroStrategy BTC holdings at $13.74B

Moreover, MicroStrategy’s BTC holdings at the time of writing this article being valued at $13.74 billion, shows strong commitment to the future of BTC.

Is your portfolio green? Check out the BTC Profit Calculator

They’ve gone all in, making a significant bet on Bitcoin’s long-term potential as their stock-growth of 995% in the past four years indicates.

This investment strategy highlights why Bitcoin could be a great option for long-term gains. Watching their bold move is like witnessing a financial drama unfold in real-time.