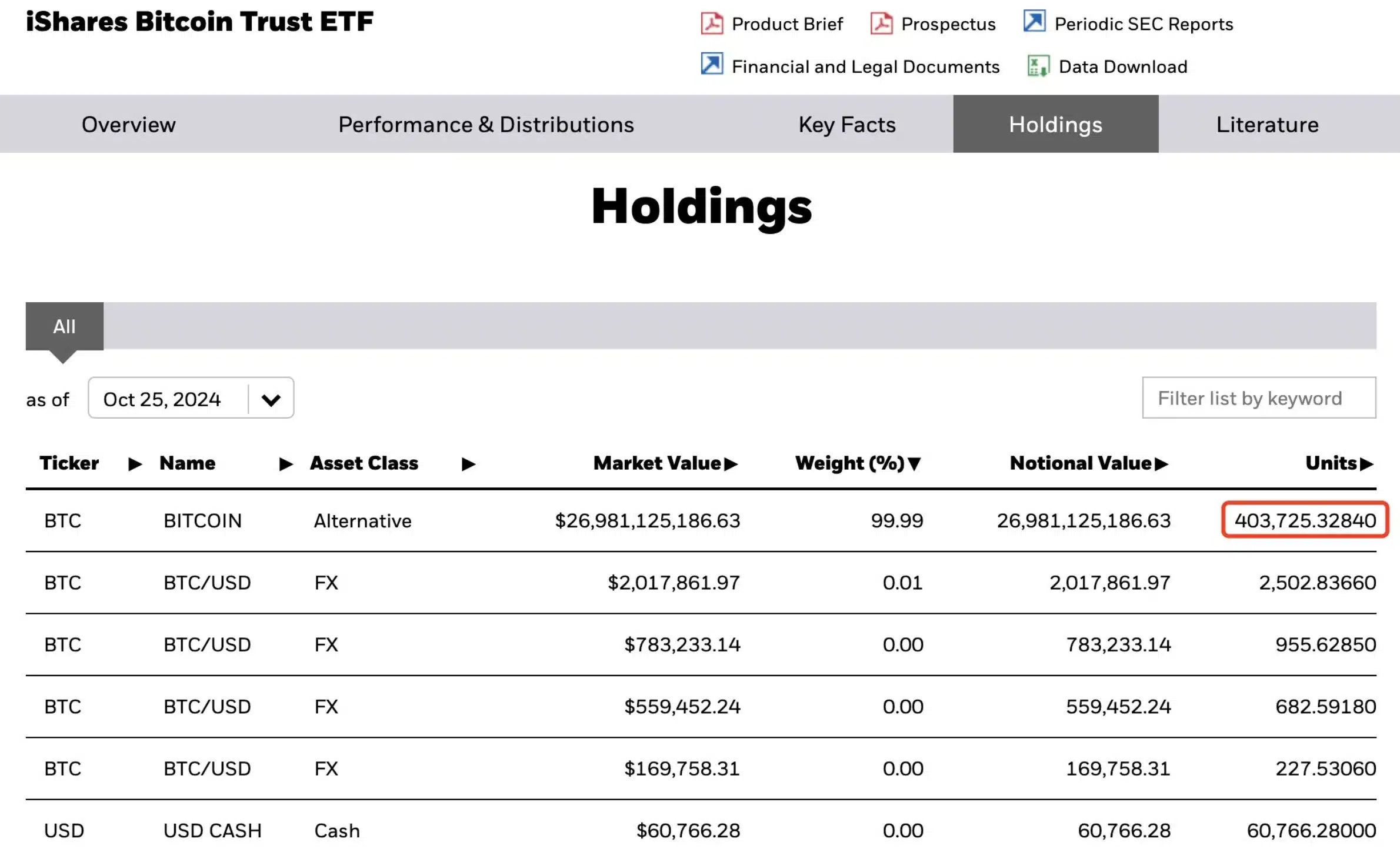

- BlackRock’s Bitcoin holdings exceed 400,000 BTC, valued at $26.98 billion.

- BlackRock’s Bitcoin ETF sees consistent inflows, surpassing $23 billion in total value.

Amid growing speculation that Bitcoin [BTC] ETFs may soon surpass the holdings of Satoshi Nakamoto, BlackRock has hit a significant milestone in its BTC accumulation.

Blackrock’s Bitcoin accumulation

According to a recent update from Lookonchain, the asset management giant now holds over 400,000 Bitcoin. At press time, it was valued at approximately $26.98 billion.

Over the past two weeks alone, BlackRock has added 34,085 BTC to its portfolio, worth roughly $2.3 billion. This latest acquisition highlighted BlackRock’s dominance in the cryptocurrency space as it continues to expand its Bitcoin holdings.

On the flip side, BlackRock’s BTC ETF (IBIT) has seen remarkable growth, surpassing the $23 billion mark, according to Farside Investors. Notably, IBIT has been on a consistent inflow streak since the 14th of October.

Between the 14th and 25th October, IBIT recorded inflows nearing $400 million on some days, reflecting strong investor interest and confidence in BlackRock’s BTC strategy. This underscored BlackRock’s strategic approach to Bitcoin amid its growing adoption.

Community reaction and impact on Bitcoin

Seeing this the crypto community has responded with optimism.

As of the latest update, Bitcoin was trading at $67,773.35, marking a rise of over 1% within the past 24 hours as per CoinMarketCap.

Additioanlly, the Relative Strength Index (RSI) was also lying above the neutral threshold, signaling that bullish momentum was overtaking bearish forces.

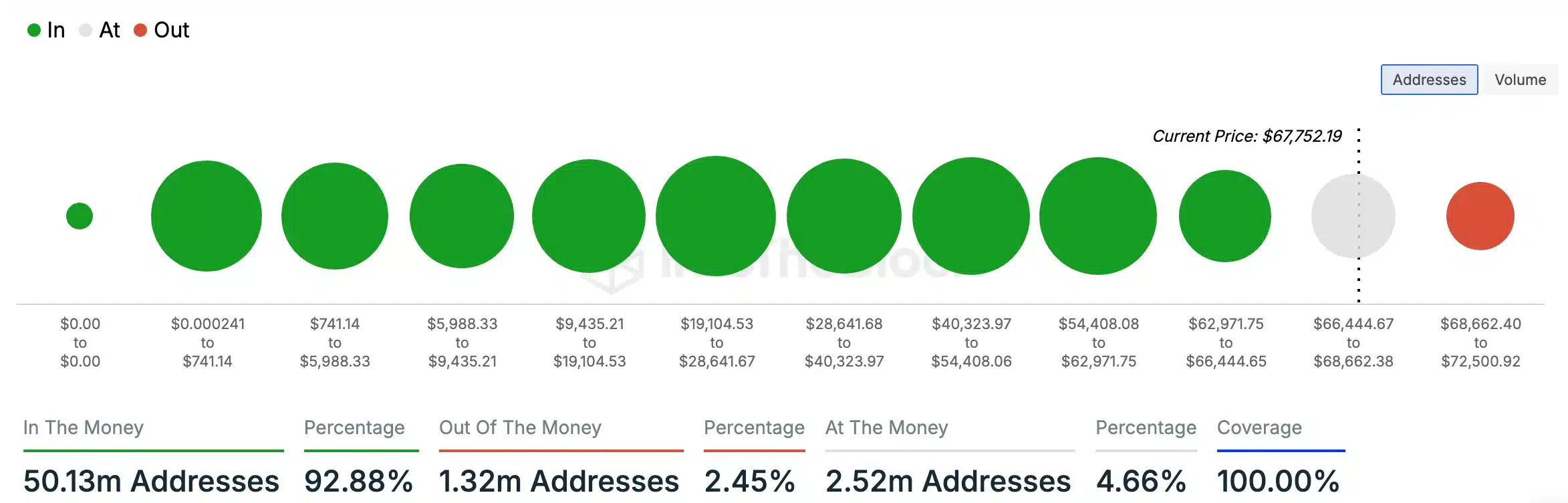

For Bitcoin’s roadmap ahead, an analysis by IntoTheBlock, cited by AMBCrypto, revealed that approximately 92.88% of BTC holders were “in the money,” meaning their holdings were valued higher than their initial purchase price.

Meanwhile, only 2.45% of holders were “out of the money,” reflecting a robust market sentiment and suggesting potential for further price gains.

Is this the start of the “Bitcoin war”?

Speculation about future “Bitcoin wars” is already circulating, with some predicting that giants like BlackRock could eventually seek to fork the original Bitcoin chain and promote their own version as the legitimate one.

While such a scenario may currently seem like a conspiracy theory, the rapid accumulation of BTC by BlackRock has raised concerns about its growing influence over the market.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, they are not alone—other major players such as MicroStrategy, led by Michael Saylor, as well as Tesla, Binance, and SpaceX, have also been steadily amassing Bitcoin.

Therefore, whether MicroStrategy and other institutions will be able to challenge BlackRock’s dominance remains an open question.