The global crypto market and the leading cryptocurrency, Bitcoin (BTC), registered a slight decline as the U.S. Consumer Price Index (CPI) data exceeded expectations.

According to data from the CME Group, the CPI annual rate dropped from 3.4% to 3.1% while the expected rate was 2.9%. As the inflation rate outmatched the expectations, the Federal Open Market Committee (FOMC) did not change the interest rates — currently at 5.25% to 5.50%.

The next FOMC meeting is expected to take place on March 20 and data from the CME Group suggests that the probability of not changing the interest rates has risen to 89.5% while the remaining 10.5% believe the committee would ease the interest rates.

The crypto market showed bearish sentiment toward the unchanged interest rate. According to data provided by CoinGecko, the global crypto market capitalization declined by 0.3% in the past 24 hours and is currently standing at $1.95 trillion.

Moreover, Bitcoin also registered a 0.8% fall over the past day and is trading at $49,600 at the time of writing. The daily trading volume of BTC plunged by 13%, currently hovering around $34 billion.

Notably, the flagship crypto asset recorded an intraday low of $48,470 a few hours after the CPI report was released.

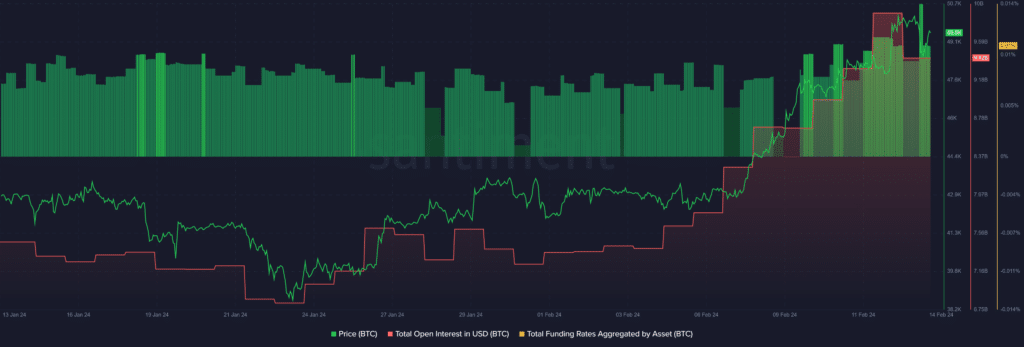

According to data provided by Santiment, Bitcoin’s total open interest (OI) declined from $9.9 billion to $9.4 billion, showing a roughly $500 million fall.

Data from the market intelligence platform shows that the total funding rate aggregated from all exchanges declined from 0.014% to 0.01% following the FOMC meeting. This shows that traders betting for a further price surge have slightly declined as the market sees bearish sentiment.

Per a crypto.news report on Feb. 13, Bitcoin option trades which will expire on March 29 expect the asset to reach new all-time highs — traders are hitting prices of $60,000, $65,000 and even $75,000.