- Less efficient miners are beginning to leave the network.

- On-chain metrics flash a buy signal.

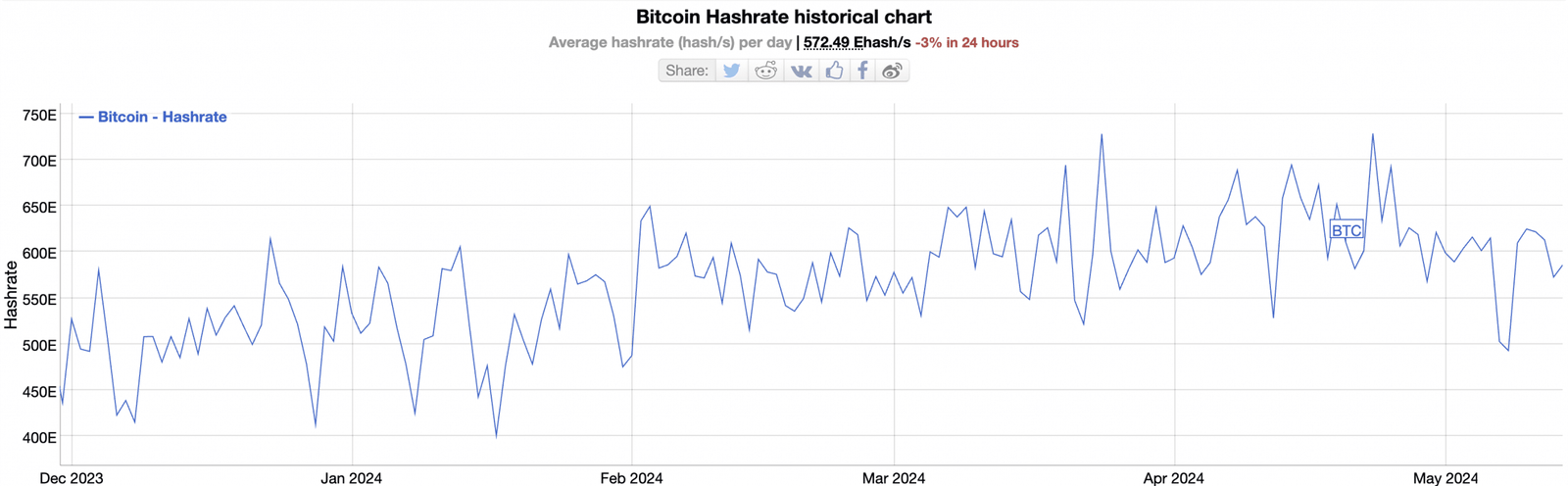

The decline in Bitcoin’s [BTC] hashrate post-halving hinted at a potential miner capitulation, pseudonymous CryptoQuant analyst Maartunn noted in a new report.

The 2024 halving event reduced mining rewards from 6.25 BTC to 3.125 BTC, Bitcoin’s hashrate.

After this, the total combined computational power used to mine and process transactions on the network, rallied to a year-to-date high of 728.27E on the 23rd of April.

Consequently, it initiated a decline. At 585.7E at press time, the network’s hashrate has since dropped by 20%, according to data from BitInfoCharts.

According to Maartuun.

“Although this decline is still modest and brief, it stands out because the hashrate typically rises. This trend shifted after the halving.”

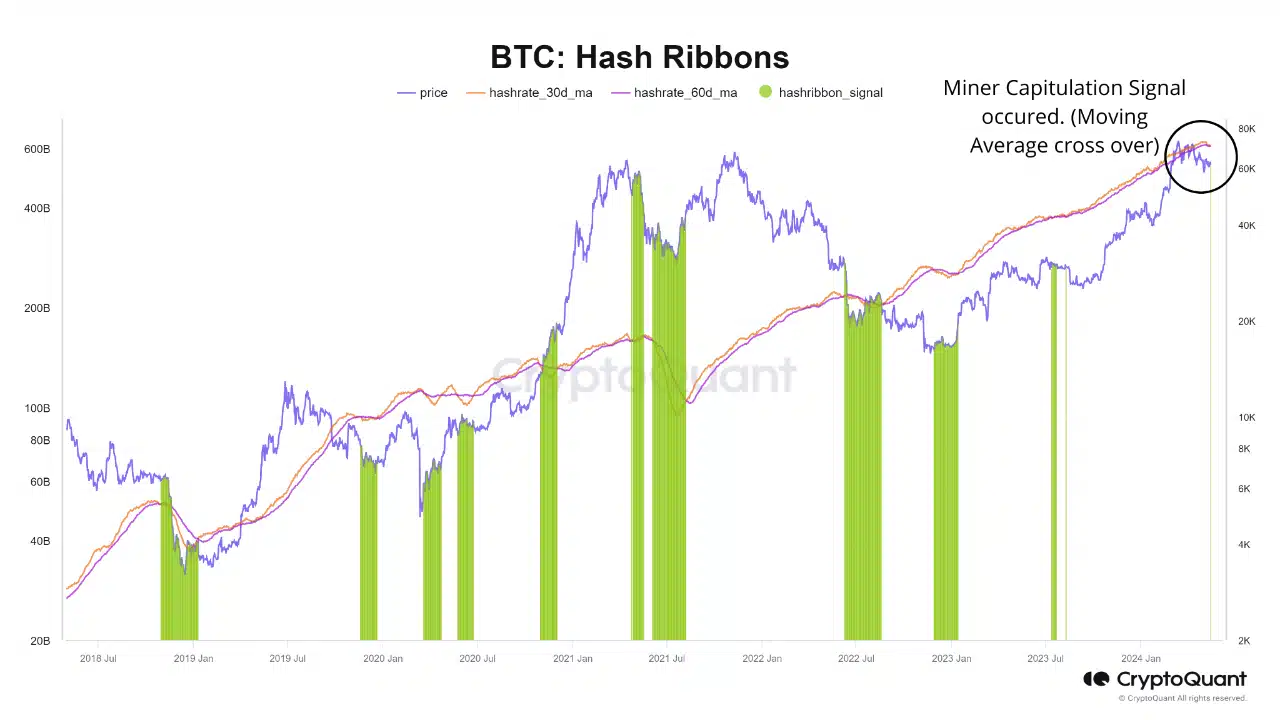

When Bitcoin’s hashrate declines, it triggers an uptick in Hash Ribbons. The network’s Hash Ribbons track the relationship between short-term and long-term moving averages of Bitcoin’s hashrate.

When it spikes, it suggests reduced mining activity on the Bitcoin network, which signals the exit of less efficient miners from the market due to decreased profitability.

The recent decline in Bitcoin’s hashrate has led to a spike in the network’s Hash Ribbons, hence the likelihood of miner capitulation. Maartun noted,

“Periods of rapid declines in the hashrate are marked in green on the bitcoin price chart below, often indicating “miner capitulation.”

Mining activity on the Bitcoin network

Since the halving event, BTC’s Miner Reserve has declined. This metric measures the amount of coins held in affiliated miners’ wallets. When its value declines, it suggests that miners are offloading their coins.

The network’s Miner Reserve, at 1.8 million BTC at press time, has decreased by 1.1% since the 19th of April, according to CryptoQuant’s data.

Further, due to the decline in miner revenue caused by the low transaction count on the Bitcoin network after the halving, the share of BTC’s volume contributed by the miners on its network has fallen.

Good time to buy?

According to Maartun, Bitcoin’s hiked Hash Ribbons offer a good buying opportunity for market participants who may be willing to take advantage of the coin’s low price action. The analyst said,

“Hash Ribbons operates under the assumption that such circumstances often coincide with significant price lows for BTC, eventually offering an opportune moment to capitalize on price dips.”

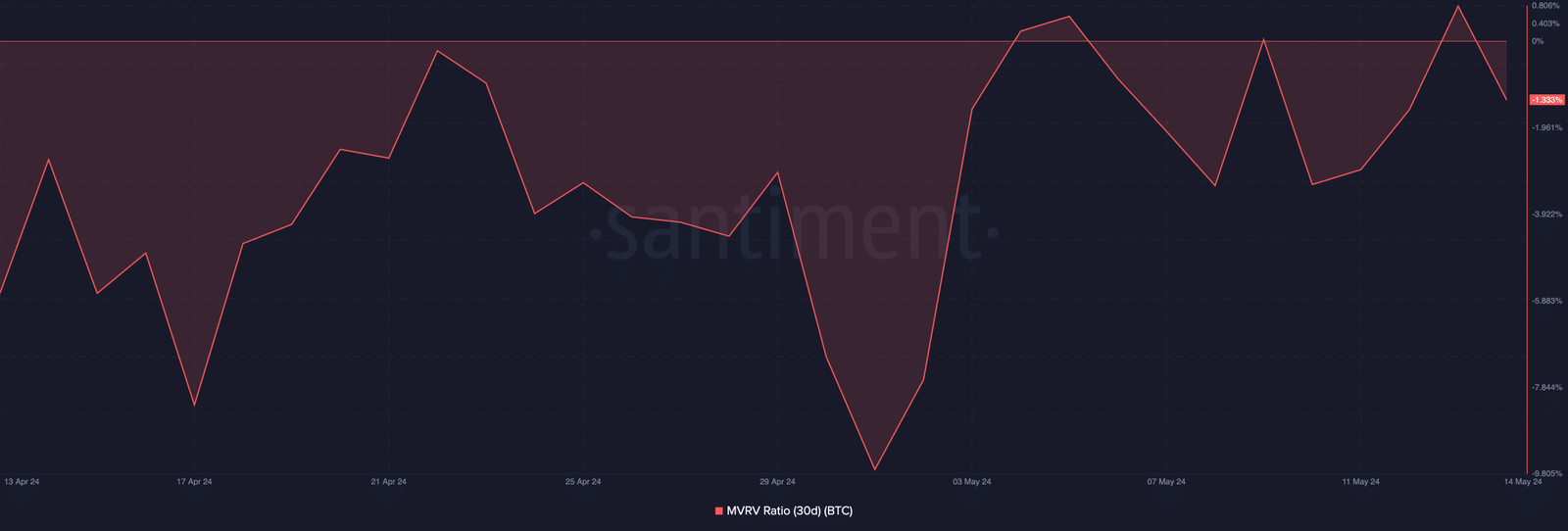

This position was confirmed by BTC’s Market Value to Realized Value (MVRV) ratio, which returned a negative value of -1.33% at press time.

This metric tracks the ratio between BTC’s current market price and the average price of every coin or token acquired for that asset.

Read Bitcoin’s [BTC] Price Prediction 2024-25

When its value is negative, the coin is said to be undervalued, as its market value is below the average purchase price of all its coins in circulation.

A negative MVRV ratio is considered a buy signal because it means that the asset in question now trades at a discount relative to its historical cost basis.