Long-term Bitcoin (BTC) holders seem to be doubling down on their bullish sentiment for the crypto king, according to blockchain analytics platform Glassnode.

In a new analysis, Glassnode reports that Long-Term Holders (LTH), or addresses that hold coins for at least 155 days, do not appear phased by the recent market volatility and are adding more Bitcoin to their wallets.

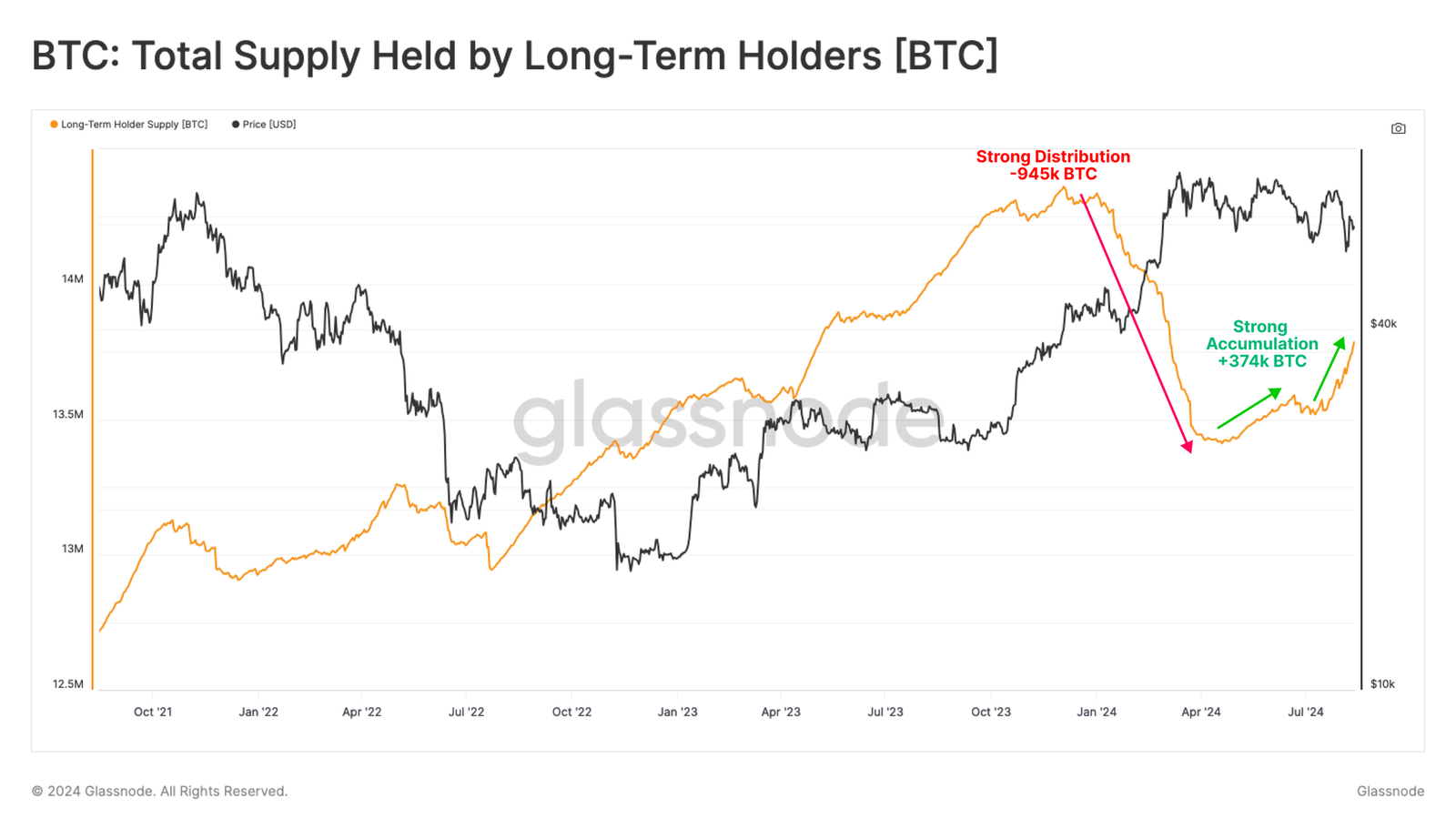

“Despite challenging and choppy market conditions, Long-term Bitcoin holders remain remarkably steadfast in their conviction, with evidence they are ramping up accumulation behavior.”

Glassnode says that the unwillingness of long-term holders to sell their coins despite Bitcoin’s recent drop to $48,000 earlier this month is a sign that investors are weathering the storm and expecting new all-time highs for BTC.

“An elevated percentage of Bitcoin network wealth is held by this investor cohort relative to previous cycle ATH breaks, which suggests there is a degree of investor patience on display, and waiting for higher prices. Additionally, the lack of panic selling amongst this cohort in lieu of the largest price contraction of the cycle highlights a resilience of their aggregate conviction.”

Glassnode also says that since June, more than $22.176 billion worth of BTC has moved into the hands of long-term holders.

“This cohort has now returned to a preference for HODLing (holding on for dear life), with a total volume of +374,000 BTC migrating into LTH status over the last three months.”

Bitcoin is trading for $59,336 at time of writing, down 2.55% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3