9h41 ▪

3

min of reading ▪ by

While the price of Bitcoin has been stagnating for several weeks, technical analysts see the possibility of a bullish reversal. However, the upcoming macroeconomic indicators could significantly influence BTC’s short-term trajectory.

Is Bitcoin about to break its downtrend?

On the 4-hour chart, BTC has formed an inverted head and shoulders pattern, a classic chart pattern suggesting a trend reversal, according to investor Quinten Francois. A close above the neckline of this pattern would validate this bullish signal.

In addition, several technical indicators support the hypothesis of a rebound. The MACD, which measures price momentum, is about to make a bullish crossover. The daily RSI has regained a neutral level at 49, compared to 33 at the beginning of May, indicating a more balanced valuation of BTC.

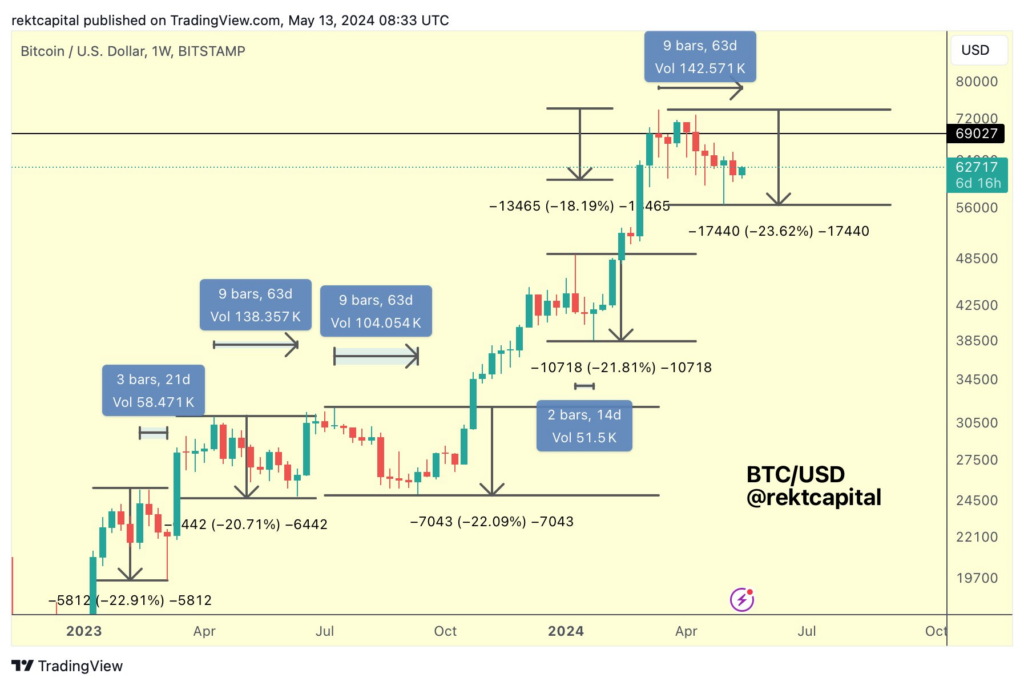

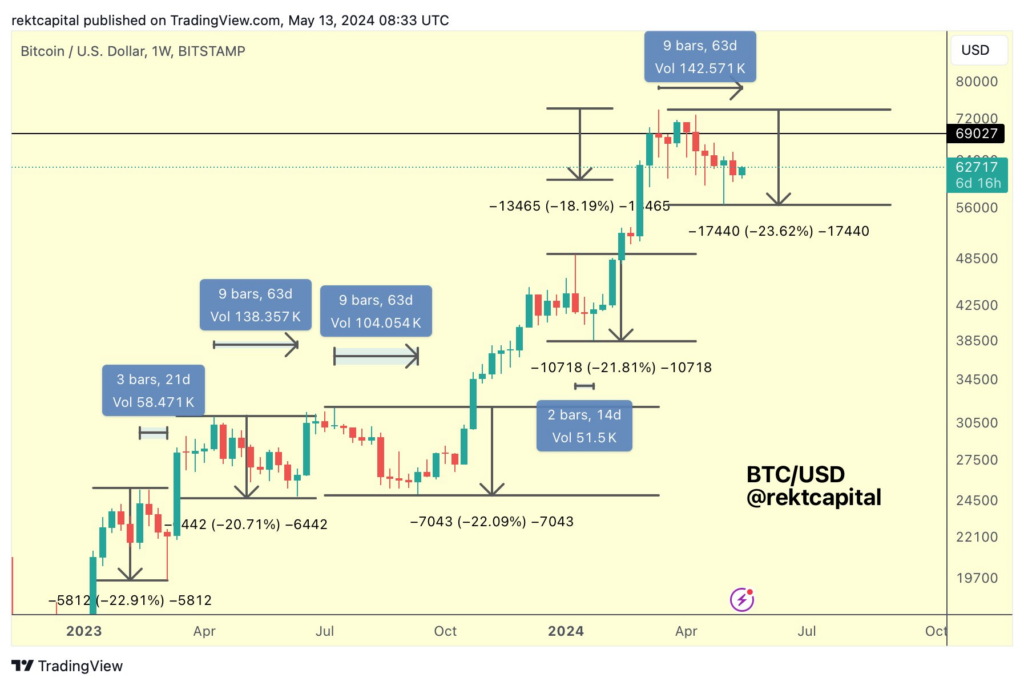

Analyst Rekt Capital notes that the current correction has ended at $56,000, likely marking a local bottom. Moreover, Bitcoin has recently left its “danger zone” of distribution. It still faces strong resistance between $63,500 and $63,700, breaking which would liquidate over $516 million of short positions.

Key macro statistics this week

Despite these encouraging technical signals, sentiment around Bitcoin remains fragile. The US inflation figures expected on May 14 and the comments from Fed Chairman Jerome Powell “could generate a new wave of volatility in cryptos,” warns Matt Bell, CEO of Turbofish.

The market’s reaction to these macroeconomic data will be crucial to confirm or deny the emerging bullish trend. Given Bitcoin’s strong correlation with risk assets, a more aggressive monetary tightening than anticipated could dampen hopes for a sustainable rally.

While the stars seem technically aligned for a Bitcoin surge, caution is still advised. The evolution of macroeconomic fundamentals, especially interest rates, will be closely watched by investors. A breakout above $65,000 would be a strong signal to fuel the bullish momentum.

Maximize your Cointribune experience with our ‘Read to Earn’ program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Click here to join ‘Read to Earn’ and turn your passion for crypto into rewards!

Passionné par le Bitcoin, j’aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l’outil qui peut rendre cela possible.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.