Two of the world’s largest social media platforms will allow companies to advertise spot Bitcoin ETFs (exchange-traded funds). This represents a significant stride toward the increasing mainstream acceptance of cryptocurrencies.

Facebook and Instagram are in the process of updating advertising policies to allow the promotion of Bitcoin ETF in the US.

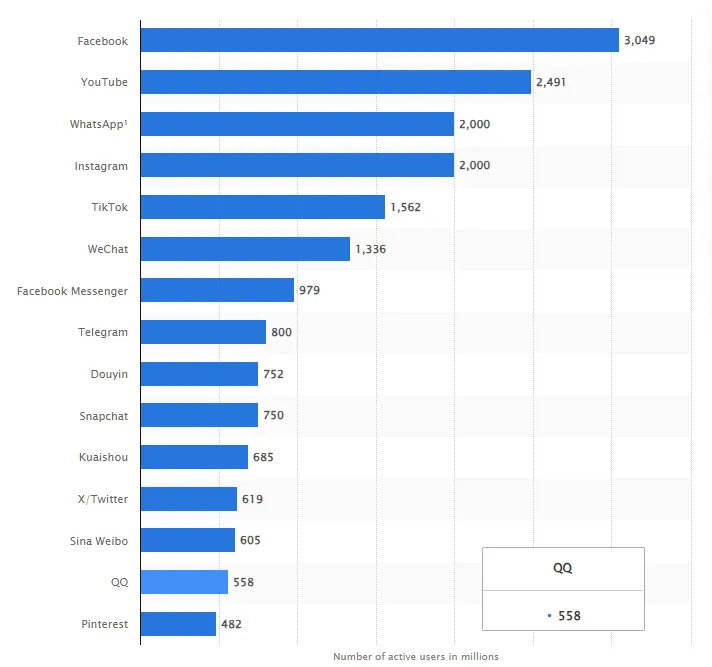

The new policies could pave the way for Bitcoin ETF ads to be featured on Facebook and Instagram. These companies have a colossal user base of over 2 billion monthly active users each,

Nate Geraci, President of ETF Store, emphasized the significance of Facebook’s older demographics. According to him, opening these platforms to spot Bitcoin ETF ads could notably broaden their reach, capturing the attention of baby boomers who are unfamiliar with cryptocurrency investments.

“Facebook and Instagram may soon allow spot Bitcoin ETF ads… No bigger boomer honeypot than Facebook,” Geraci added.

Likewise, Google recently allowed the promotion of certain cryptocurrency products, including spot Bitcoin ETFs. The crypto community praised this decision, anticipating that it would enhance the visibility of these products to a broader audience.

Succesful Bitcoin ETFs Launch

The introduction of spot Bitcoin ETFs has witnessed a remarkable surge in popularity within the investment community. Their success has prompted increased demands for additional crypto-based spot ETFs.

This rising popularity has, in turn, attracted substantial investments, with January alone seeing two spot Bitcoin ETFs — BlackRock’s IBIT and Fidelity’s FBTC — ranking among the top 10 for total inflows. These Bitcoin ETFs recorded net flows of $2.6 billion and $2.2 billion, respectively.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

| TICKER | NAME | MARKET CAP | TOTAL ASSETS |

| GBTC | Grayscale Bitcoin Trust | $20,526,473,034 | $20,537,180,963 |

| IBIT | iShares Bitcoin Trust | $3,009,176,768 | $2,984,840,606 |

| FBTC | Fidelity Wise Origin Bitcoin Fund | $2,586,300,500 | $2,585,613,855 |

| ARKB | ARK 21Shares Bitcoin ETF | $682,475,500 | $684,223,422 |

| BITB | Bitwise Bitcoin ETF | $660,350,000 | $658,793,183 |

| BTCO | Invesco Galaxy Bitcoin ETF | $304,515,500 | $305,011,803 |

| BTCW | Wisdomtree Bitcoin Fund | $11,189,150 | null |

| HODL | Vaneck Bitcoin Trust | $129,002,000 | $128,940,549 |

| BRRR | Valkyrie Bitcoin Fund | $113,728,650 | $113,528,663 |

| EZBC | Franklin Bitcoin ETF | $61,134,561 | $60,889,533 |

| DEFI | Hashdex Bitcoin ETF | $17,350,744 | null |

Moreover, BlackRock’s IBIT and Fidelity’s FBTC have secured positions in the top five list of the fastest ETFs to reach $1 billion in assets under management. This underlines the rapid growth and acceptance of spot Bitcoin ETFs in the financial markets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.