- Bitcoin survived the 13th largest capitulation across the financial market

- Tether treasury drove $1.3B USDT into exchanges too

This week’s Bitcoin [BTC] market crash, at the time of writing, ranked as the 13th largest capitulation event in global financial history. This is an important milestone regardless of how you look at it because as cryptocurrencies evolve within the broader financial system, more significant downturns are likely.

To its credit though, the crypto sector rebounded strongly. After hitting new monthly lows lows, the market bounced back, with top digital assets like Bitcoin and Ethereum climbing by over 20% on the charts.

In fact, entity-adjusted realized loss data indicated that Bitcoin recovered from the crash, with its current value now exceeding $1.3 billion.

USDT $1.3B onto exchanges

The recent Bitcoin crash on 5 August prompted Tether’s Treasury to transfer $1.3 billion USDT to exchanges. This influx likely fueled the strong recovery in the crypto market.

The same was highlighted by market analyst Pro Blockchain in a breakdown of how Tether’s actions increased USDT supply on exchanges. As a result of the same, the growing USDT supply is expected to influence future cryptocurrency prices, potentially driving them higher on the charts.

Historical data projections for USDT dominance v other cryptos

When USDT dominance rises, cryptocurrency prices typically fall, and the opposite happens when USDT dominance declines.

On the 3-day chart, both USDT and other cryptocurrencies have followed this trend closely. A key moment on 13 October 2023, for instance, highlighted a drop in USDT dominance, leading to a rise in other crypto prices.

If the upward trend in USDT breaks down, the reverse should happen for cryptocurrencies, indicating potential price hikes. Simply put, the recent rejection from the top of the USDT dominance chart may be a sign that crypto prices might rise soon.

Bitcoin retail inter at 20%

At the time of writing, BTC was trading close to $60,000. However, retail interest fell to around 20% of its previous levels. And yet, Bitcoin has weathered the most recent market crash and could see further price hikes this year.

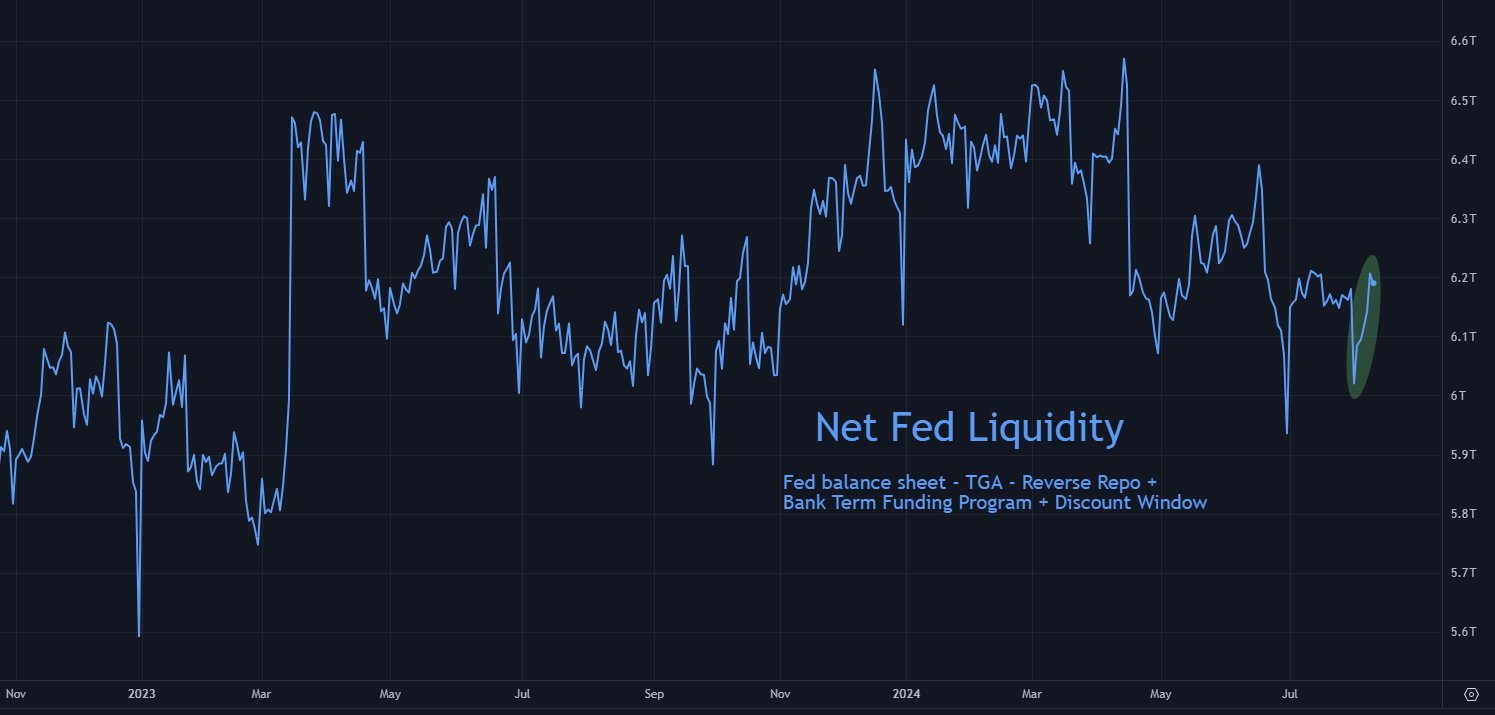

Fed Liquidity rebounds strongly

Finally, while the Net Fed Liquidity dropped by $160 billion last week, it quickly recovered by $170 billion.

Both the S&P 500 and Bitcoin experienced significant declines, with the S&P 500 down 3% and Bitcoin down 30%.

However, this week they have both rebounded, with the S&P 500 up 4% and Bitcoin up 22%. The increase in USDT on exchanges can potentially sustain a rise in crypto assets across the board.